Marknadsnyheter

Continued outperformance, trading now above Pre-COVID levels, Prime grows by 50% in 3 months to 1.5m members

Barcelona, 1st September, 2021 – eDreams ODIGEO (www.edreamsodigeo.com), Europe’s largest online travel company, No 2 in flights globally and one of the largest European e-commerce businesses, today reports its results for the first quarter ended June 30th 2021.

RESULTS HIGHLIGHTS

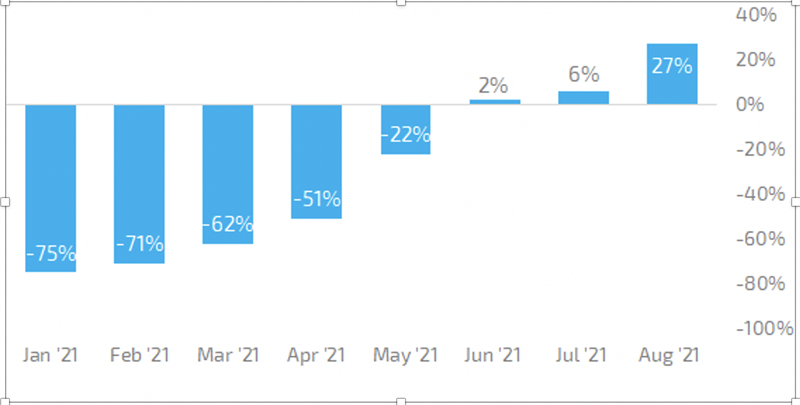

In the first quarter, we have experienced a sharp increase in trading, despite uncertainty and some travel restrictions remaining, as more people are vaccinated and COVID restrictions are eased. After a difficult year in 2020/2021, as predicted, the travel market is rapidly returning. eDreams ODIGEO, with its unique customer proposition and over 1.5 million Prime subscribers reached in August, is positioned to take advantage in a post-COVID era to attract more customers and capture further market share. eDreams ODIGEO continues to outperform its peers with Bookings in the month of June surpassing pre-COVID levels and accelerating even further during July and August (July +6% vs FY19; and August +27% vs FY19).

Bookings ahead of Pre-COVID levels

- In June 2021, Bookings improved to even surpass pre-COVID-19 levels.

- In July and August, trading continued to improve and year-on-year growth rates for Bookings vs pre-COVID-19 levels accelerated (July +6% vs FY19; and August +27% vs FY19).

Bookings growth vs 2019

Results are encouraging

Prime continues to reinvent travel and travel proposition

Evolution of Prime Members and share of total flight Bookings

eDo will be a clear winner post-COVID world

Dana Dunne, CEO of eDreams ODIGEO commented: “We have continued to see a rapid and strong turnaround in trading, despite some travel restrictions still being in place. We have surpassed pre-COVID booking levels for the last 3 months, with August being at an impressive +27% vs Pre-Covid-19 levels. We have extended the outperformance from last year and taken further market share after a very strong start in the first quarter of the current year.

And that is because we have successfully positioned ourselves to thrive in a post-COVID-19 world through our scale, by being an online leisure-focused business that is the leader in mobile and innovation, our market leading member subscription product Prime, which has grown 50% in the last 3 months to 1.5 million members. It is exciting that we will reach our self-imposed forecast of two million Prime members at least a year early.

Despite anticipating some continuing volatility over the next few months we are in great shape, excited and confident of making further progress for the rest of the year. We continue to succeed through our superior strategy, product proposition and operational excellence.”

BUSINESS REVIEW

In the first quarter of fiscal year 2022, we have experienced a sharp increase in demand, despite uncertainty and some travel restrictions remaining, as more people are vaccinated and COVID restrictions are eased. After a difficult year in 2020/2021, as predicted, the travel market is rapidly returning. eDreams ODIGEO, with its unique customer proposition and over 1.5 million Prime subscribers in August, is positioned to take advantage in a post-COVID era to attract more customers and capture further market share. eDreams ODIGEO continues to outperform its peers with the month of June surpassing pre-COVID levels and July and August strengthening further compared to 2019.

Despite COVID-19 impact, the first quarter of fiscal year 2022 has shown encouraging signs of market recovery. Revenue Margin in the first quarter increased 313% vs the same period last year, due to Bookings being up 491% and a reduction in Revenue Margin/Booking driven by lower average basket value of Bookings due to COVID-19, which results in lower classic and diversification revenue from customers and lower revenue from providers. However, COVID-19 induced restrictions still resulted in Revenue Margin being 52% below pre-COVID-19 levels (48% for Cash Revenue Margin, which includes the full contribution from Prime).

In the fiscal years 2021 and 2022 our focus has been on what we can control, which is to continually build and further enhance a high quality and adaptable business model. This is demonstrated by our Marginal Profit in the first quarter of fiscal year 2022 (Revenue Margin minus Variable Cost), being €13.4 million positive despite us investing in our call centre to help our customers. Cash EBITDA was €3.1 million positive vs a loss of €1.9 million excluding the positive impact of €5.1 million due to the increase in Prime Deferred Revenue in fiscal year 2022.

Our revenue diversification initiatives continue to develop. Product Diversification Ratio and Revenue Diversification Ratio continue to grow and have increased to 89% and 63% in the the first quarter, up from 86% and 54% in the first quarter last year, rising 3 and 10 percentage points in just one year, and up from 25% and 27% in the fourth quarter of fiscal year 2015, which is when we started to implement and communicated our diversification strategy.

Unsurprisingly, leverage ratios have been temporarily impacted. As announced on the 30th of April, the Company has taken further steps with its lenders to give the Company additional financial flexibility, and renewed its arrangements with its lenders on its SSRCF who have agreed to relax the covenant tests put in place last year and extend them by a year to 30th of June 2022.

Prime, the first and highly successful subscription-based model in travel, is performing strongly in a weak market. Prime subscription rates and share of total Bookings continue to grow. The number of subscribers have increased to 1,216,000 members by the end of the first quarter of fiscal year 2022, 652,000 more than in the same quarter of the previous fiscal year, Prime share of flight Bookings reached 39%. We now operate Prime in flights and hotels in five of our largest markets Spain, Italy, Germany, France, UK, and in the US, Portugal and Australia, our most recent additions to our subscription program. Additionally, mobile bookings continue to grow and accounted for 52% of our total flight bookings in fiscal year 2022, rising 3 percentage points from last year.

Adjusted Net Income was a loss of €15.5 million in the first quarter of fiscal year 2022 (vs loss of €23.6 million in the first quarter of fiscal year 2021), we believe that Adjusted Net Income better reflects the real ongoing operational performance of the business.

In the first quarter of fiscal year 2022, despite continued travel restrictions, net cash from operating activities improved by €45.8 million and we end the quarter with a positive Cash Flow from Operations of €37.9 million, mainly due to a working capital inflow of €35.4 million in the first quarter of fiscal year 2022. The inflow was driven by the increase in demand for leisure travel which led to better volume in the last two weeks of June 2021 vs March 2021. The Group continues to have a strong balance sheet, at the end of the first quarter of fiscal year 2022 the company had a strong liquidity position of €137 million, including €91 million undrawn from our Super Senior Revolving Credit Facility (“SSRCF”), placing us in a position of strength as normal activity resumes. This liquidity position is a solid starting point for the low seasonality period in the coming months, as naturally the level of Bookings decreases from September to December.

Financial Information and Income Statement Summary

Source: condensed consolidated interim financial statements unaudited.(*) (**) See Glossary at the end of this document

Current Trading and Outlook

Trading continues to improve despite travel restrictions still in place

Our current trading demonstrates the strong and rapid turnaround experienced during the summer period.

The Company’s booking levels over the past quarter have shown continuous improvement. Bookings in April were -51% compared to the same period of 2019, May showed strong improvement with trading levels reaching -22%. In June, Bookings improved further to surpass pre-COVID-19 levels with positive single-digit average growth rate and in July and August, trading has accelerated further with the Company now seeing strong growth levels.

In Summary

Our business is strong, and we are positioned to be a winner from the COVID pandemic. The travel industry is a €1 trillion market, one of the largest industries in the world. We are emerging from COVID stronger than ever. We have strong growth prospects with the proven desire of consumers to travel, which is the heart of what we do. We continue to take market share through our superior strategy, product proposition and operational excellence.

Moreover, we are reinventing travel through our Prime subscription program which continues to grow. We already have over 1.5 million subscribers in August, adding 500k subscribers in the last 3 months. And 39% of flight Bookings are now from Prime members.

We continue to expand our share of wallet of our customers via Prime and expand our geographic base. And we continue to deepen our customer loyalty and repeat business and we pioneer and reinvent travel and travel provision.

-ENDS-

Glossary

(*) Cash Revenue Margin means the IFRS revenue less cost of supplies, plus the variation of the Prime deferred revenue corresponding to the Prime fees that have been collected and that are pending to be accrued. The Prime fees pending to be accrued are non-refundable and will be booked as revenue based on usage, which refers to each instance the customer uses Prime to make a Booking with a discount, or when the Prime contracted period expires. Cash Revenue Margin provides a measure of the sum of the Revenue Margin and the full Prime fees generated in the period.

(**) Cash EBITDA means Adjusted EBITDA, plus the variation of the Prime deferred revenue corresponding to the Prime fees that have been collected and that are pending to be accrued. The Prime fees pending to be accrued are non-refundable and will be booked as revenue based on usage, which refers to each instance the customer uses Prime to make a Booking with a discount, or when the Prime contracted period expires. Cash EBITDA provides to the reader a view of the sum of the ongoing EBITDA and the full Prime fees generated in the period.

About eDreams ODIGEO

eDreams ODIGEO is one of the world’s largest online travel companies and one of the largest e-commerce businesses in Europe. Under its four leading online travel agency brands – eDreams, GO Voyages, Opodo, Travellink, and the metasearch engine Liligo – it serves more than 17 million customers per year across 45 markets. Listed on the Spanish Stock Market, eDreams ODIGEO works with over 650 airlines and has partnerships with 130. The brand offers the best deals in regular flights, low-cost airlines, hotels, cruises, car rental, dynamic packages, holiday packages and travel insurance to make travel easier, more accessible, and better value for consumers across the globe.

Marknadsnyheter

Svensk bioplast får amerikanskt certifikat för komposterbarhet

Kritabaserade bioplastmaterialet Biodolomer från GAIA Biomaterials i Helsingborg har nyligen certifierats för komposterbarhet av BPI i USA. Sedan tidigare hade Biodolomer en liknande europeisk certifiering från TÜV Austria.

– Nu kan vi visa varumärken och kunder att Biodolomer är certifierat av de två mest respekterade myndigheterna i världen, säger VD Peter Stenström

BPI (Biodegradable Products Institute) är USA:s ledande kontrollorgan för komposterbara produkter och förpackningar sedan mer än 20 år. Genom tredjepartsverifiering säkerställer man att alla påståenden om komposterbarhet stöds av vetenskapliga bevis, som amerikanska myndigheter kräver. Certifikatet avser industriell kompostering.

Gaia Biomaterials certfikat gäller för Biodolomer i olika filmapplikationer – till exempel matkassar. Men fler certifieringar är på gång.

– Vi har tillverkat Biodolomer i nio år, säger vd, Peter Stenström.

– Till skillnad från i många andra bioplaster används inget material som odlas på åkermark. Det är baserat på krita som är ett av världens vanligaste material.

– Biodoloner ger inga mikroplaster och orsakar upp till 80 % mindre CO2 än fossila plaster om det förbränns.

Biodolomer används för en mängd olika filmapplikationer, som matkassar, soppåsar, förkläden och olika jordbruksändamål.

Granulat av Biodolomer kan användas för nästan alla produktionsmetoder som används för fossil plast. Det gör det möjligt att använda det för ett stort antal engångsprodukter från sugrör och bestick till ölglas, flaskor och matförpackningar.

En allt tydligare uppfattning i förpackningsindustrin är återvinning inte kan lösa alla problem med plastavfall. Komposterbara material är en viktig del av lösningen – speciellt när det gäller matförpackningar – och de kräver inte ny infrastruktur.

– Ett stort problem är förpackningsmaterial som hamnar i matavfall och kontaminerar detta så att det inte kan komposteras. Med BPI-certifierade material som Biodolomer är det inte ett problem.

Gaia Biomaterials är baserade i Helsingborg och bland ägarna finns Investment AB Latour och den svenska statliga investeringsfonden Almi Invest Greentech.

Peter Stenström

CEO

peter.stenstrom@gaiabiomaterials.com

+46 70-885 34 37

GAIA Biomaterials AB är ett svenskt företag som utvecklat ett material vid namn Biodolomer. Biodolomer är ett komposterbart och helt nedbrytningsbart material som kan användas till de flesta användningsområden där plast idag är det vanligaste alternativet. Till exempel bärkassar, engångsbestick/tallrikar/muggar, förkläden, flaskor och mycket annat. GAIA Biomaterials har huvudkontor och produktion i Helsingborg,

Marknadsnyheter

Mobile Phone Takes Streaming Video to the Next Level

Sound Dimension Creates a New Home Movie Experience

Sound Dimension, a leader in innovative AI-based sound solutions, makes it possible to enjoy multispeaker movie sound without a soundbar or surround sound system. The technology, called AiFi Together Video, integrates directly into streaming service apps and delivers a significantly enhanced audio experience when mobile phone speakers are synchronized with TV sound.

”We recently introduced AiFi Together Video for streaming services. This means that providers can now offer their users a powerful audio experience from an ordinary TV, or even from an iPad. The movie experience is taken to a new level when we, in a way that is completely intuitive for the user, synchronize ordinary mobile phones and turn them into surround speakers,” says Sound Dimension’s CEO Rickard Riblom.

For streaming services, AiFi Together Video not only means an improved experience for users, the technology also creates opportunities for increased revenue. The streaming video market is worth USD 96 billion per year according to Statista.com, and is growing rapidly. However, one of the industry’s biggest challenges is getting new users to their apps and keeping users engaged. Streaming services that offer AiFi Together Video can get many more active users as multiple mobile phones are active at the same time when users watch a movie or TV series.

”We can simply multiply the number of daily users for a streaming service. Once inside the streaming service’s app, new users can also discover other movies or series and increase their use of the service,” says Rickard Riblom. For Sound Dimension, this means that we can offer the streaming service to pay us only when they receive increased revenue – a classic win-win situation.

A link to a demo app for AiFi Together Video is available on the AppStore: https://apps.apple.com/se/app/aifitogether-video/id6479789063

For more information about Sound Dimension AB, please contact:

Rickard Riblom, CEO Sound Dimension AB Phone: +46 704442479 Email: rr@sounddimension.se https://sounddimension.se/

About Sound Dimension

Sound Dimension has developed patented and award-winning technical solutions that combine audio technology and artificial intelligence (AI). The company develops, sells and licenses its AiFi technology (short for Artificial Intelligence Fidelity) to enable all available speakers to connect – regardless of brand or type – to a unified audio experience, optimized by AI. The goal is for AiFi to establish a new de facto standard for sound. Sound Dimension has developed AiFi Streaming, which is marketed to streaming service providers, and AiFi Inside, which is aimed at manufacturers of Bluetooth speakers. Sound Dimension was founded in 2013 and is headquartered in Karlstad. The company was listed on the Spotlight Stock Market in October 2021 (Ticker: SOUND).

Marknadsnyheter

Intresseanmälan öppen för nyproducerade bostadsrätter i Horns Strand, Västervik

I vacker skärgårdsnatur, i Horns Strand strax utanför Västervik, planerar Enkla Hem att uppföra ca 130 klimatsmarta bostadsrätter, med hållbara energilösningar, egna uteplatser samt gemensamhetsytor för umgänge och lek. Husen kommer att byggas i fyra etapper de första 52 par- och radhusen har planerad byggstart under 2024/2025, och kommer att byggas av Svensk Husproduktion.

Horns Strand ligger strax utanför Västervik – Vacker mellan skog och hav. Det är en typisk skärgårdsnatur med tallar, blåbärsris och ljung i en sluttning ned mot havet. På gångavstånd finns vackra strövområden av olika karaktär. Naturen i området har klassats som mycket vacker med många bevaransvärda arter och miljöer. Bad, havsklippor, strandängar, skärgårdsskog och klapperstensfält. Örserumsviken som ligger i närheten till området ligger inom Tjust Skärgård vilken anses vara en av de vackraste i Sverige. Längs Hornsvägen finns upplyst cykelbana in till centrum och bra bussförbindelse.

De 52 bostäderna som nu uppförs, är första etappen av fyra planerade. ”Vi ser ett stort behov av boenden i Västervik, och vi satsar både på mindre och större lägenheter”, säger Emanuel Vardi, VD på Enkla Hem. ”Många önskar att bo i lite mer lantlig omgivning, bara kommunikationer fungerar för skola och arbete, och det gör det ute i Horn. Där ska vi ge köparna det de vill ha, för en gemensam och hållbar framtid.”

Välkommen med din intresseanmälan via webben på enklahem.se där du även kan se bostädernas planritningar.

Kontaktinformation:

Emanuel Vardi, VD

emanuel.vardi@enklahem.se

073-504 08 85

Enkla Hem är ett fastighetsbolag som projekterar, förvärvar, producerar och förvaltar bostäder och samhällsnyttiga fastigheter i växande kommuner. För Enkla Hem är det långsiktiga och hållbara fastighetsägandet viktigt. Enkla Hem planerar förvaltning, byggnationer och renoveringar till minsta detalj för att kunna erbjuda energieffektiva, välplanerade och yteffektiva bostäder. Ett bättre hem som bidrar till en genuin hemkänsla länge.

Enkla Hem är ett onoterat bolag med huvudkontor i Linköping. Läs mer på www.enklahem.se.

Taggar:

-

Analys från DailyFX8 år ago

EUR/USD Flirts with Monthly Close Under 30 Year Trendline

-

Marknadsnyheter1 år ago

Marknadsnyheter1 år agoUpptäck de bästa verktygen för att analysera Bitcoin!

-

Marknadsnyheter4 år ago

BrainCool AB (publ): erhåller bidrag (grant) om 0,9 MSEK från Vinnova för bolagets projekt inom behandling av covid-19 patienter med hög feber

-

Analys från DailyFX11 år ago

Japanese Yen Breakout or Fakeout? ZAR/JPY May Provide the Answer

-

Analys från DailyFX11 år ago

Price & Time: Key Levels to Watch in the Aftermath of NFP

-

Analys från DailyFX7 år ago

Gold Prices Falter at Resistance: Is the Bullish Run Finished?

-

Nyheter5 år ago

Nyheter5 år agoTeknisk analys med Martin Hallström och Nils Brobacke

-

Marknadsnyheter6 år ago

Tudorza reduces exacerbations and demonstrates cardiovascular safety in COPD patients