Marknadsnyheter

Arcus: Listing application approved for the temporary secondary listing of Anora Group Plc on the Oslo Stock Exchange

THIS STOCK EXCHANGE RELEASE MAY NOT BE PUBLISHED OR DISTRIBUTED, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO AUSTRALIA, CANADA, HONG KONG, JAPAN, SOUTH AFRICA OR ANY OTHER JURISDICTION WHERE SUCH PUBLICATION OR DISTRIBUTION WOULD VIOLATE APPLICABLE LAWS OR RULES OR WOULD REQUIRE ADDITIONAL DOCUMENTS TO BE COMPLETED OR REGISTERED OR REQUIRE ANY MEASURE TO BE UNDERTAKEN IN ADDITION TO THE REQUIREMENTS UNDER FINNISH LAW. FOR FURTHER INFORMATION, SEE “IMPORTANT NOTICE” BELOW.

Arcus: Listing application approved for the temporary secondary listing of Anora Group Plc on the Oslo Stock Exchange

Altia Plc (“Altia”) and Arcus ASA (“Arcus”) announced on 29 September 2020 the merger of Altia’s and Arcus’ business operations through a statutory cross-border absorption merger of Arcus into Altia (the “Merger”). In accordance with the merger plan, the companies’ intent has been to seek a temporary secondary listing of the shares of the combined company on Oslo Børs (the “Oslo Stock Exchange”) in addition to the current listing of Altia on the official list of Nasdaq Helsinki Ltd in connection with the completion of the Merger. The companies announced on 25 August 2021 that all conditions for the Merger have been fulfilled and that the Merger will be completed.

Altia has submitted an application for a temporary secondary listing of the combined company’s shares on the Oslo Stock Exchange in connection with the completion of the Merger, for a transitional period of four (4) months from the first day of the secondary listing on the Oslo Stock Exchange. The Oslo Stock Exchange has today approved the listing application. The shares of the combined company will be listed through a depository interest arrangement in the Norwegian Verdipapirsentralen (the “VPS”) and will be trading on the Oslo Stock Exchange under the ticker code ANORA. Trading on the Oslo Stock Exchange is expected to commence after the Merger is completed on 1 September 2021. After the transitional period the combined company will apply for the shares in the combined company to be delisted from the Oslo Stock Exchange.

ARCUS ASA

Contacts:

For questions, please contact Per Bjørkum, interim Group Director Communications and IR. Mobile.: +47 92255777, email: per.bjorkum@arcus.no.

Information on Arcus and Altia in brief

Arcus is a leading Nordic branded consumer goods company within wine and spirits. Arcus is the world’s largest producer of aquavit, and holds strong market positions for wine and spirits across the Nordics. Vectura, a wholly owned company, supplies complete logistics solutions for the beverage industry in Norway. Arcus was spun off from the Norwegian state monopoly, Vinmonopolet, in 1996 and since then has grown from a local company to an international group with the Nordic region and Germany as its home market. The Group also exports a significant volume of spirits to other countries. Arcus is listed on Oslo Børs.

Altia is a leading Nordic alcoholic beverage brand company operating in the wine and spirits markets in the Nordic and Baltic countries. Altia wants to support a development of a modern, responsible Nordic drinking culture. Altia’s key exports brands are Koskenkorva, O.P. Anderson and Larsen. Other iconic Nordic brands are Chill Out, Blossa, Xanté, Jaloviina, Leijona, Explorer and Grönstedts.

Altia’s current strategy is built on two core strengths: Altia is the Nordic distillery that masters the sustainable production of high-quality grain-based spirits, and provides the best route-to-market through distribution and channel execution for its brands and partners.

Important notice

The distribution of this release may be restricted by law and persons into whose possession any document or other information referred to herein comes should inform themselves about and observe any such restrictions. The information contained herein is not for publication or distribution, in whole or in part, directly or indirectly, in or into Australia, Canada, Hong Kong, Japan, South Africa or any other jurisdiction where such publication or distribution would violate applicable laws or rules or would require additional documents to be completed or registered or require any measure to be undertaken in addition to the requirements under Finnish law. Any failure to comply with these restrictions may constitute a violation of the securities laws of any such jurisdiction. This release is not directed to, and is not intended for distribution to or use by, any person or entity that is a citizen or resident or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would require any registration or licensing within such jurisdiction.

Altia is a Finnish company and Arcus is a Norwegian company. The transaction, including the information distributed in connection with the merger and the related shareholder votes, is subject to disclosure, timing and procedural requirements of a non-U.S. country, which are different from those of the United States.

It may be difficult for U.S. shareholders of Arcus to enforce their rights and any claim they may have arising under U.S. federal or state securities laws, since Altia and Arcus are not located in the United States, and all or some of their officers and directors are residents of non-U.S. jurisdictions. It may be difficult to compel a foreign company and its affiliates to subject themselves to a U.S. court’s judgment. U.S. shareholders of Arcus may not be able to sue Altia or Arcus or their respective officers and directors in a non-U.S. court for violations of U.S. laws, including federal securities laws, or at the least it may prove to be difficult to evidence such claims. Further, it may be difficult to compel Altia or Arcus and their affiliates to subject themselves to the jurisdiction of a U.S. court. In addition, there is substantial doubt as to the enforceability in a foreign country in original actions, or in actions for the enforcement of judgments of U.S. courts, based on the civil liability provisions of the U.S. federal securities laws.

Arcus’ shareholders should be aware that Altia is prohibited from purchasing Arcus’ shares otherwise than under the Merger, such as in open market or privately negotiated purchases, at any time during the pendency of the Merger under the Merger Plan.

This release does not constitute a notice to an EGM or a merger prospectus and as such, does not constitute or form part of and should not be construed as, an offer to sell, or the solicitation or invitation of any offer to buy, acquire or subscribe for, any securities or an inducement to enter into investment activity. Any decision with respect to the proposed merger of Arcus into Altia should be made solely on the basis of information to be contained in the actual notices to the EGM of Arcus and Altia, as applicable, and the merger prospectus related to the merger as well as on an independent analysis of the information contained therein. You should consult the merger prospectus for more complete information about Altia, Arcus, their respective subsidiaries, their respective securities and the merger. No part of this release, nor the fact of its distribution, should form the basis of, or be relied on in connection with, any contract or commitment or investment decision whatsoever. The information contained in this release has not been independently verified. No representation, warranty or undertaking, expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of the information or the opinions contained herein. Neither Altia nor Arcus, nor any of their respective affiliates, advisors or representatives or any other person, shall have any liability whatsoever (in negligence or otherwise) for any loss however arising from any use of this release or its contents or otherwise arising in connection with this release. Each person must rely on their own examination and analysis of Altia, Arcus, their respective securities and the merger, including the merits and risks involved. The transaction may have tax consequences for Arcus shareholders, who should seek their own tax advice.

This release includes “forward-looking statements.” These statements may not be based on historical facts, but are statements about future expectations. When used in this release, the words “aims,” “anticipates,” “assumes,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “should,” “will,” “would” and similar expressions as they relate to Altia, Arcus or the merger identify certain of these forward-looking statements. Other forward-looking statements can be identified in the context in which the statements are made. Forward-looking statements are set forth in a number of places in this release, including wherever this release includes information on the future results, plans and expectations with regard to the Combined Company’s business, including its strategic plans and plans on growth and profitability, and the general economic conditions. These forward-looking statements are based on present plans, estimates, projections and expectations and are not guarantees of future performance. They are based on certain expectations, which may turn out to be incorrect. Such forward-looking statements are based on assumptions and are subject to various risks and uncertainties. Shareholders should not rely on these forward-looking statements. Numerous factors may cause the actual results of operations or financial condition of the Combined Company to differ materially from those expressed or implied in the forward-looking statements. Neither Altia nor Arcus, nor any of their respective affiliates, advisors or representatives or any other person undertakes any obligation to review or confirm or to release publicly any revisions to any forward-looking statements to reflect events that occur or circumstances that arise after the date of this release. Further, there can be no certainty that the merger will be completed in the manner and timeframe described in this release, or at all.

The securities referred to in this release have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or the securities laws of any state of the United States (as such term is defined in Regulation S under the U.S. Securities Act) and may not be offered, sold or delivered, directly or indirectly, in or into the United States absent registration, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the U.S. Securities Act and in compliance with any applicable state and other securities laws of the United States. This release does not constitute an offer to sell or solicitation of an offer to buy any of the shares in the United States. Any offer or sale of new Altia shares made in the United States in connection with the merger may be made pursuant to the exemption from the registration requirements of the U.S. Securities Act provided by Rule 802 thereunder.

The new shares in Altia have not been and will not be listed on a U.S. securities exchange or quoted on any inter-dealer quotation system in the United States. Neither Altia nor Arcus intends to take any action to facilitate a market in the new shares in Altia in the United States.

The new shares in Altia have not been approved or disapproved by the U.S. Securities and Exchange Commission, any state securities commission in the United States or any other regulatory authority in the United States, nor have any of the foregoing authorities passed comment upon, or endorsed the merit of, the merger or the accuracy or the adequacy of this release. Any representation to the contrary is a criminal offence in the United States.

Marknadsnyheter

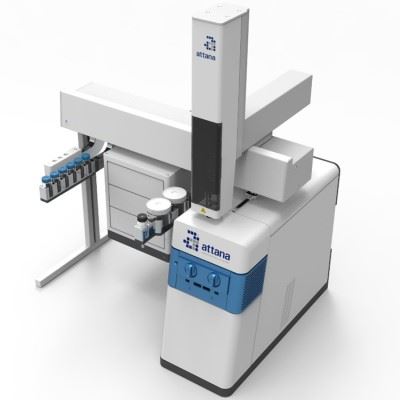

Attana påbörjar det tredje året av ett femårigt service och supportkontrakt från ett ledande hälsoinstitut i USA

Kontraktet går nu in på sitt tredje år och det är en viktig del i bolagets plan på att etablera starka referenskunder i USA. Det gångna året har flera användare tränats i Attanas teknik och förnärvarande pågår studier av T-cellers interaktioner med animala cancerceller. Förhoppningen är att data från experimenten kommer kunna publiceras under hösten och att projektet därefter även utförs på cancerbiopsier.

Värdet på serviceavtalet är drygt 200kkr per år och till det tillkommer försäljning av sensorchip och tillhörande förbrukningsvaror.

Kunden är en viktig del i att etablera starka referenskunder i USA. Projektens karaktär är valda så att de vid slutförandet tydligt kommer att belysa Attana teknikens fördelar och värdeskapande jämfört med traditionella metoder. Eftersom experimenten hos den aktuella kunden går hand i hand med kliniska studier och djurförsök löper projektet totalt över fem år och är nu ungefär halvvägs.

För ytterligare information, kontakta:

Teodor Aastrup

VD Attana AB

ir@attana.com

+46 708862300

Styrelsen för Attana AB bedömer att informationen i detta pressmeddelande ej är av kurspåverkande karaktär men att det alltjämt är av betydande vikt att enhetligt via offentliggörandet kommunicera informationen till bolagets intressenter.

Om Attana

Attana AB grundades 2002 med idén att effektivisera forskning och utveckling av nya läkemedel genom biologisk interaktionskarakterisering i realtid. Baserat på sina patenterade teknologier säljer bolaget uppdragsforskning och egenproducerade analysinstrument samt ett in vitro diagnostiskt (IVD) verktyg, Attana Virus Analytics (AVA), till läkemedelsbolag, bioteknikföretag och akademiska institutioner. Mer information om Attanas forskningstjänster och produkter finns på www.attana.com eller kontakta sales@attana.com

Marknadsnyheter

Stockholm tar över stafettpinnen för Yrkes-SM

Nu står det klart att Yrkes-SM för första gången kommer till Stockholm. Den 4 – 6 maj 2026 på Stockholmsmässan i Älvsjö ska hundratals yrkesskickliga ungdomar tävla mot varandra.

Yrkes-SM har sedan 2004 vartannat år samlat tusentals besökare på olika platser runt om i Sverige. Under tre dagar tävlar hundratals yrkesskickliga ungdomar om titeln svensk mästare. Det finns totalt cirka 50 yrken att bli svensk mästare i, exempelvis: målare, träarbetare, plattsättare, it-tekniker, webbutvecklare, automationstekniker, svetsare, frisör, kock, undersköterska eller fordonslackerare.

– Vi i Region Stockholm är glada och förväntansfulla att tillsammans med World Skills Sweden, Stockholms stad och övriga 25 kommuner i vårt län få arrangera Yrkes-SM 2026. Vi arbetar redan intensivt med att stärka yrkesutbildningens roll och status, detta går helt i linje med det, säger Aida Hadžialić (S), finansregionråd, Region Stockholm.

Evenemanget skapar intresse för yrkesutbildningar, främjar samverkan mellan skola och arbetsliv och visar utbildningens betydelse för Stockholms utveckling som helhet. Region Värmland och Karlstad var värdar för Yrkes-SM 2024. Vid en avslutningsceremoni under torsdagen lämnades den symboliska stafettpinnen över till Region Stockholm och Stockholm Stad.

– Det känns oerhört roligt att Stockholm 2026 kan stå värd för Yrkes-SM, och att unga från hela Sverige kan komma hit och visa upp alla färdigheter de har. Förhoppningsvis kan evenemanget också inspirera fler unga stockholmare att framöver välja yrkesgymnasium. Vi har en arbetsmarknad som skriker efter yrkesutbildad arbetskraft, och i dessa yrken finns så mycket att hämta, säger Emilia Bjuggren (S), skol-, arbetsmarknads-, och personalborgarråd i Stockholms stad.

Under Yrkes-SM möts mellanstadie- högstadie- och gymnasieelever, jobbsökande, yrkesväxlare och allmänt intresserade. Inträdet är fritt och besökare kan titta på tävlingarna, ställa frågor och själva prova på olika yrken.

FAKTA

- Yrkes-SM har arrangerats vartannat år sedan 2004 på olika platser runt om i Sverige. Evenemanget lockar tusentals besökare och är öppet för alla med är fritt inträde. Publikrekordet är från Växjö 2022 med 22 403 besökare.

- På plats kan man följa när Sveriges yrkesskickligaste ungdomar gör upp om SM-titlarna inom en mängd olika yrken. Besökare har möjlighet att upptäcka, utforska och prova på yrken och yrkesmoment.

- Exempel på medverkande yrken är målare, träarbetare, plattsättare, it-tekniker, webbutvecklare, automationstekniker, svetsare, frisör, kock, undersköterska, fordonslackerare med flera.

- Under Yrkes-SM utses Sveriges yrkesskickligaste ungdomar som sedan har möjligheten att ta en plats i Sveriges viktigaste landslag – Yrkeslandslaget.

- Syftet med Yrkes-SM är att öka kunskapen och kännedomen om vilka olika karriärvägar som finns inom yrkesutbildningsområdet samt att höja dess status

Presskontakt

Naomi Grossman

076 122 92 53

naomi.grossman@stockholm.se

Marknadsnyheter

Dedicare uppdaterar lönsamhetsmålet inför 2024

Dedicare har haft ett finansiellt lönsamhetsmål om att rörelsemarginalen (EBIT-marginal) ska överstiga 7,0 procent. Styrelsen i Dedicare har beslutat att ändra lönsamhetsmålet till en EBITA-marginal om 7,0 procent över tid.

Dedicares strategi är tillväxt genom förvärv. Anledningen till förändringen är att kunna följa lönsamhetsutvecklingen utan påverkan av förvärvsrelaterade tillgångar. Övergången till ett EBITA-baserat mått är också i linje med hur andra större bemannings- och konsultbolag följer upp sina lönsamhetsmål, vilket därmed ökar jämförbarheten mot andra bolag på den europeiska marknaden.

Denna information är sådan information som Dedicare AB (publ) är skyldigt att offentliggöra enligt EU:s marknadsmissbruksförordning och lagen om värdepappersmarknaden. Informationen lämnades, genom ovanstående kontaktpersons försorg, för offentliggörande den 25 april 2025 kl 15:00.

Krister Widström, Koncernchef och VD, 070-526 79 91

Anette Sandsjö, CFO, 073-343 44 68

Ringvägen 100, uppgång E, 10 tr

118 60 Stockholm

Tel: 08-555 656 00

www.dedicaregroup.com

Org.nr: 556516–1501

Kort om Dedicare

På Dedicare brinner vi för att tillföra kompetens till vård, life science och socialt arbete. Vår drivkraft är att på ett ansvarsfullt och hållbart sätt bidra till människors hälsa, utveckling och livskvalitet. Dedicare grundades 1996 och är Nordens största rekryterings- och bemanningsföretag inom vår sektor. Vi har verksamhet i Sverige, Norge, Danmark och Finland, och sedan hösten 2022 finns vi även i Storbritannien och på Irland. Dedicare är noterade på Nasdaq Stockholm och omsatte 1,7 miljarder 2022. På en daglig basis har vi över 2 000 anställda ute på uppdrag. Vi ser Europa som vår framtida marknad med en vision att på sikt växa till ett av Europas ledande rekryterings- och bemanningsföretag inom vård, life science och socialt arbete.

Läs mer om Dedicare på dedicaregroup.com

-

Analys från DailyFX8 år ago

EUR/USD Flirts with Monthly Close Under 30 Year Trendline

-

Marknadsnyheter1 år ago

Marknadsnyheter1 år agoUpptäck de bästa verktygen för att analysera Bitcoin!

-

Marknadsnyheter4 år ago

BrainCool AB (publ): erhåller bidrag (grant) om 0,9 MSEK från Vinnova för bolagets projekt inom behandling av covid-19 patienter med hög feber

-

Analys från DailyFX11 år ago

Japanese Yen Breakout or Fakeout? ZAR/JPY May Provide the Answer

-

Analys från DailyFX11 år ago

Price & Time: Key Levels to Watch in the Aftermath of NFP

-

Analys från DailyFX7 år ago

Gold Prices Falter at Resistance: Is the Bullish Run Finished?

-

Nyheter5 år ago

Nyheter5 år agoTeknisk analys med Martin Hallström och Nils Brobacke

-

Marknadsnyheter6 år ago

Tudorza reduces exacerbations and demonstrates cardiovascular safety in COPD patients