Marknadsnyheter

Audited Financial Results for the year ended 31 December 2022

The information contained within this announcement is deemed to constitute inside information as stipulated under the Market Abuse Regulation (”MAR”) (EU) No. 596/2014, as incorporated into UK law by the European Union (Withdrawal) Act 2018. Upon the publication of this announcement, this inside information is now considered to be in the public domain.

02 June 2023

Beowulf Mining plc

(”Beowulf” or the ”Company”)

Audited Financial Results for the year ended 31 December 2022

Beowulf (AIM: BEM; Spotlight: BEO), the mineral exploration and development company, announces its audited financial results for the year ended 31 December 2022. The Chairman’s statement, review of operations and activities, and financial information have been extracted from the Company’s Annual Report for the year ended 31 December 2022.

The Annual Report and Accounts will be tabled to shareholders at the Annual General Meeting (”AGM”) of the Company, the details of which will be announced in the coming days.

The 2022 Annual Report will shortly be posted to those shareholders who have requested a copy and will be available on the Company’s website today (https://beowulfmining.com/). The Notice of AGM and Form of Proxy will follow once further details have been announced.

Enquires

|

Beowulf Mining plc |

|

|

Daniel Lagerqvist |

Tel: +46 (079) 060 56 62 |

|

SP Angel (Nominated Adviser & Broker) |

|

|

Ewan Leggat / Stuart Gledhill / Adam Cowl |

Tel: +44 (0) 20 3470 0470 |

|

BlytheRay |

|

|

Tim Blythe / Megan Ray |

Tel: +44 (0) 20 7138 3204 |

Cautionary Statement

Statements and assumptions made in this document with respect to the Company’s current plans, estimates, strategies and beliefs, and other statements that are not historical facts, are forward-looking statements about the future performance of Beowulf. Forward-looking statements include, but are not limited to, those using words such as ”may”, ”might”, ”seeks”, ”expects”, ”anticipates”, ”estimates”, ”believes”, ”projects”, ”plans”, strategy”, ”forecast” and similar expressions. These statements reflect management’s expectations and assumptions in light of currently available information. They are subject to a number of risks and uncertainties, including, but not limited to , (i) changes in the economic, regulatory and political environments in the countries where Beowulf operates; (ii) changes relating to the geological information available in respect of the various projects undertaken; (iii) Beowulf’s continued ability to secure enough financing to carry on its operations as a going concern; (iv) the success of its potential joint ventures and alliances, if any; (v) metal prices, particularly as regards iron ore. In the light of the many risks and uncertainties surrounding any mineral project at an early stage of its development, the actual results could differ materially from those presented and forecast in this document. Beowulf assumes no unconditional obligation to immediately update any such statements and/or forecast.

CHAIRMAN STATEMENT

Dear Shareholders

Introduction

Beowulf has transformed itself in the last year, with the award of Exploitation Concession for the Kallak North Iron Ore Project and, post-period, positive economics results from the Kallak North ’Only’ Base Case.

The preliminary economic assessment for Kallak North is only part of the bigger Kallak story, and we have many levers to increase value, which will be investigated as we proceed with Pre-feasibility. These include resource expansion, a longer life mining operation, increased production capacity, and higher proportion of high-grade concentrate sales to decarbonising steelmakers in the Nordics and Europe, of which there are many.

We built new partnerships in Finland, firstly collaborating with Hensen, an established graphite and anode materials company, and then, post period, signing a new site agreement with the municipality of Korsholm for establishing an anode materials production facility in the GigaVaasa area.

Grafintec continued its efforts to expand its natural flake graphite resource inventory, with promising exploration findings for the Rääpysjärvi prospect, which in the future, could potentially add to the Company’s resources already defined at Aitolampi, offering sustainable and secure primary raw materials supply to a Finnish anode materials value chain.

In Kosovo, Vardar’s exploration drilling defined a large polymetallic epithermal system at Madjan Peak in the Mitrovica licence, with potential to host economic concentrations of base and precious metals. Furthermore, fieldwork at the Red Lead Prospect, also in Mitrovica, highlighted the potential for discovery of lead-zinc carbonate hosted mineralisation. As the prospect is located just 2km east of the world-class Stan Terg lead-zinc deposit with similar geology, it is considered a priority target for follow up drilling.

During the year, we made significant process in our ESG work, policy development and in practice with our project development work. Beowulf and its subsidiaries are focused on the role they play in society and contribution and are committed to working constructively – and in good faith – with all stakeholders and engaging in meaningful dialogue.

Kallak

The Company’s longstanding commitment to Kallak was finally recognised when, on 22 March 2022, the Company was awarded an Exploitation Concession for Kallak North. This permit provides exclusive mining rights in the defined areas for a period of 25 years.

The Kallak North deposit has an estimated Mineral Resource of 111 Mt, Measured and Indicated, with an average grade of 28 per cent iron content. In the Kallak area, the Company has additional defined mineral resources and exploration targets which could support a longer life mining operation beyond Kallak North.

Kallak is excellently positioned as a potential secure and sustainable supplier of market-leading high-grade iron concentrate to Europe’s decarbonising steel sector and fossil-free steel making projects in the Nordic region for decades to come.

During the year, the Company strengthened its leadership team in Sweden, with the appointment of Ulla Sandborgh as CEO of Jokkmokk Iron bringing extensive experience from trade and industry in Sweden and deep knowledge of environmental permitting, and initiated the Scoping Study for Kallak North.

On 24 January 2023, Beowulf announced positive economic results for Kallak North, forming part of the larger Kallak Iron Ore Project, from a Scoping Study prepared by independent consulting firm SRK Consulting (UK) Ltd. The study indicates a positive economic assessment for a mining operation producing up to 2.7 million tonnes per annum (”Mtpa”) of high-grade iron concentrate over a production life of 14 years.

Grafintec Oy (”Grafintec”)

Grafintec continued to focus on the creation of a Finnish anode materials value chain, with exploration for more natural flake graphite, contracting the Geological Survey of Finland (”GTK”) to carry out an electromagnetic (”EM”) survey over the Rääpysjärvi exploration permit. This yielded extensive EM anomalies, suggesting significant potential for a larger tonnage of high-grade graphite mineralisation than that defined at Aitolampi and for localised very high-grade mineralisation.

During the year, Grafintec entered into a MoU with GTK, providing Grafintec and GTK with a framework and platform to promote and foster cooperation in the fields of a circular economy, mineral processing and exploration of graphite as pertaining to anode materials for the lithium-ion battery market and other markets from different raw material sources.

During the year, Grafintec also entered into a new partnership with Hensen, a company that has been operating in the graphite industry for 37 years and has been producing graphite-based anode materials since 2003, as the Company continued to pursue its downstream ambitions.

Vardar Minerals (”Vardar”)

During 2022, the Company invested a further £1.2 million (2021: £300,000) to fund drilling taking the Company’s ownership of Vardar to approximately 59.5 per cent (2021: 49.4%). In 2023, Beowulf increased its ownership to 61.1 per cent.

From late summer onwards, the Company published a number of positive announcements, starting in August with the discovery of a large Polymetallic Epithermal System (copper, gold and lead-zinc) at Majdan Peak (”MP”), part of Mitrovica licence in Kosovo, with drilling results both supporting the potential for epithermal mineralisation of economic grades to be present and for comparisons to be drawn with the Chelopech copper-gold deposit in Bulgaria. This was soon followed up with new exploration targets at MP and then the identification, in December, of the Red Lead target, bearing striking similarities observed at the neighbouring world-class Stan Terg deposit, such as the same host rocks, trachyte heat source, hydrothermal breccias and hydrothermal alteration patterns.

Shareholder Base

At 31 December 2022, there were 632,863,876 (2021: 621,366,320) Swedish Depository Receipts representing 76.09 per cent (2021: 74.71 per cent) of the issued share capital of the Company. The remaining issued share capital of the Company is held in the UK.

Raising Finance

Maintaining sufficient funding to sustain the business is a significant challenge for an exploration and development company in the natural resources sector.

With the Kallak North Exploitation Concession awarded, and to fund work programmes, with the focus being on Kallak, on 4 July 2022, the Company announced bridging loan financing from a Nordic Institutional Investor of SEK 22 million (approximately £1.76 million) before expenses.

The Company announced on 20 December 2022 it had secured a preferential rights issue of Swedish Depository Receipts (“SDRs”) in Sweden (“Rights Issue”) and a PrimaryBid retail offer of ordinary shares in the UK (“PrimaryBid Offer”) which included a placing to certain UK investors (“Placing”). As part of this the Company received underwriting commitments to the value of a maximum of SEK 60 million, or approximately 70 per cent of the intended Rights Issue.

On 28 February 2023, Beowulf announced the outcome of the Rights Issue and the PrimaryBid offer. The Rights Issue raised approximately SEK 62.8 million (approximately £5 million) and the PrimaryBid Offer raised approximately £0.8 million. In addition to the PrimaryBid Offer, the Placing raised approximately £0.4 million. Members of the Board and executive management also subscribed to an agreed amount of £181,000.

Following the year end, it became apparent that due to the timing of the receipt of the funds from the Rights Issue the Company was not be in a position to pay back the bridging loan facility at its maturity. The outcome of this is that the holder of the loan enforced the penalty interest for entering another 30-day period, which was circa 1 million SEK (approximately £80,000). The loan principal and interest totalling £2.13m was repaid via a deduction to the gross proceeds from the Rights Issue.

The net funds raised after the loan repayment and share issue transaction costs were £3.72 million.

The Board continues to adopt the going concern basis to the preparation of the financial statements. The Group is dependent on further equity fundraising to operate as a going concern for at least twelve months from the date of approval of the financial statements, this conclusion has been reached following managements review of both cost and foreign exchange sensitivities and potential key hires required to advance projects. Although the Group has had past success in fundraising and continues to attract interest from investors, making the Board confident that such fundraising will be available to provide the required capital, there can be no guarantee that such fundraising will be available and as such this constitutes a material uncertainty over going concern.

2022 Financial Performance

For the year, the consolidated loss increased in the year before tax from £1,485,611 in 2021 to £2,041,452 in 2022. This increase is primarily due to finance costs in relation to the bridging loan of £304,529 (2021: £Nil) and share based payment expenses of £240,537 (2021: £Nil).

The underlying administration expenses of £1,806,582 were higher than the previous year of £1,503,049, due to share-based payment expenses of £240,537 (2021: £Nil).

Consolidated basic and diluted loss per share for the 12 months ended 31 December 2022 was 0.23 pence (2021: loss of 0.16 pence).

The Company received loan financing from a Nordic Institutional Investor of SEK 22 million, which generated £1,554,381 of net proceeds to fund working capital.

£1,776,556 in cash was held at the year-end (2021: £3,336,134).

Exploration assets increased to £13,002,465 at 31 December 2022 compared to £11,235,656 at 31 December 2021 primarily due to exploration activities in Mitrovica and Kallak.

The translation reserve losses attributable to the owners of the parent increased from £1,216,985 at 31 December 2021 to £1,289,415 at 31 December 2022. Much of the Company’s exploration costs are in Swedish Krona which has weakened against the pound since 31 December 2021.

Corporate

Post period end on 3 May 2023, Kurt Budge, the Company’s CEO, announced that he would step down from the Company to pursue other business interests. Kurt had been with the Beowulf for nine years and his presence was pivotal to the Company, especially in achieving the successful delivery of the Exploitation Concession for Kallak North. I should like to thank him for his many years of service and wish him all the best in his future endeavours.

The Company announced, on 8 July 2022, the implementation of a new Long-Term Incentive Plan (”LTIP”) available to eligible employees, an important element of the Company’s remuneration policies designed to retain and incentivise key employees. Moving forwards, the Company’s remuneration policies will be developed on a systematic basis and matched to performance metrics, such as achieving important business milestones and ESG objectives.

Staff and Employees

On behalf of the Board, I would like to express my sincere thanks to our staff, employees and consultants in Sweden and Finland, and also to the staff, employees and consultants of Vardar, for their significant efforts throughout the past 12 months to drive our Company forwards.

ESG

The Company believes in living its values of Respect, Partnership and Responsibility. Over the last year, our ESG work has identified, as material to the Company’s activities, specific Sustainable Development Goals which the Company will be focusing on as it develops its projects. These goals and our future compliance with The Equator Principles are being factored into our thinking, design, engineering, and planning of our operations and management systems. In 2022, Beowulf published its ESG Policy which can be viewed on the Company’s website following the link: https://beowulfmining.com/about-us/esg-policy/.

Outlook

Beowulf’s ambition is to become a trusted European supplier of metals needed for the Green Transition. The Company has an attractive strategic position, developing production assets, in magnetite iron ore and natural flake graphite, in stable jurisdictions and proximity to growing downstream markets, the decarbonising steel industry and the lithium-ion battery manufacturing sector.

With Jokkmokk Iron and Grafintec, we have distinct businesses positioned to benefit from the Green Transition and the demand for sustainable and secure supply of primary raw materials. The status of our iron ore and natural flake graphite resources can only be enhanced, as geopolitical uncertainties remain, and Europe seeks to be sustainable and self-sufficient.

With the aim of bringing Kallak into production, and opportunities with Grafintec to get into anode materials production, we are currently reassessing our timelines for advancing our projects and look forward to a busy schedule ahead progressing them.

J Röstin

Executive Chairman/Interim Chief Executive Officer

2 June 2023

REVIEW OF OPERATIONS AND ACTIVITIES

SWEDEN

Permits

Beowulf, via its subsidiaries, currently holds six exploration permits in Sweden, and one Exploitation Concession, as set out in the table below:

|

Exploration Permit Name |

Licence no. |

Area (hectares) |

Valid from |

Valid to |

|

|

|

|

|

|

|

Parkijaure nr 21 |

2008:20 |

285 |

18/01/2008 |

18/01/2025 |

|

Parkijaure nr 61 |

2019:81 |

999 |

10/10/2019 |

10/10/2024 |

|

Parkijaure nr 71 |

2021:47 |

2,212 |

16/06/2021 |

16/06/2024 |

|

Ågåsjiegge nr 31 |

2021:73 |

2,771 |

27/10/2021 |

27/10/2024 |

|

Åtvidaberg nr 12 |

2016:51 |

12,533 |

30/05/2016 |

30/05/2024 |

|

Exploitation Concession Name |

Licence no. |

Area (hectares) |

Valid from |

Valid to |

|

Kallak K nr 11 3 |

BK-2022:1 |

103 |

22/03/2013 |

22/03/2047 |

Notes:

(1) Held by the Company’s wholly owned subsidiary, Jokkmokk Iron Mines AB (“JIMAB”).

(2) Held by the Company’s wholly owned subsidiary, Beowulf Mining Sweden AB.

(3) An application for the Exploitation Concession was lodged on 25 April 2013 (Mines Inspector Official Diary nr 559/2013) and an updated, revised and expanded application was submitted in April 2014. On 21 September 2016, the Company submitted a letter to the Mining Inspectorate of Sweden, revising its application boundary to encompass both the Concession Area, delineated by the Kallak North orebody, and the activities necessary to support a modern and sustainable mining operation. On 22 March 2022, the Minister of Enterprise and Innovation, announced the award of the Concession for Kallak nr 1.

Kallak Introduction

The Company’s most advanced project is the Kallak iron ore deposit located approximately 40 kilometres (“km”) west of Jokkmokk in the County of Norrbotten, Northern Sweden, 80 km southwest of the major iron ore mining centre of Malmberget, and approximately 120 km to the southwest of LKAB’s Kiruna iron ore mine.

Kallak has the benefit of local infrastructure with all-weather gravel roads passing through the project and forestry tracks allowing for easy access throughout the licence. A major hydroelectric power station, with associated electric power-lines, is located only a few kilometres to the southeast. The nearest railway, the Inlandsbanan, passes approximately 40 km to the east. The Inlandsbanan meets the Malmbanan railway at Gällivare, which provides routes to the Atlantic harbour at Narvik in Norway or to the Bothnian Sea harbour at Luleå in Sweden.

Kallak is excellently positioned as a potential secure and sustainable supplier of market-leading high-grade iron concentrate to Europe’s decarbonising steel sector and fossil-free steel making projects in the Nordic region for decades to come.

Kallak Resource

Kallak was discovered by The Swedish Geological Survey (“SGU”) in the 1940s. The first exploration licence for Kallak was awarded by the Mining Inspectorate of Sweden in 2006. Drilling was conducted at Kallak North and South between 2010-2014, a total of 131 holes and 27,895 m.

On 25 May 2021, the Company published a ’Mineral Resource Estimate and Exploration Target Upgrade’, prepared by BGS. For Kallak North, a Measured and Indicated Resource of 111 Mt grading 28 per cent iron content was defined. With an additional Inferred Resource of 25 Mt grading 28.3 per cent iron.

For Kallak North and South combined, BGS derived a Measured and Indicated Mineral Resource of 132 Mt grading 27.8 per cent iron and an Inferred Mineral Resource of 39 Mt grading 27.1 per cent iron. In addition to the figures above, exploration targets were reported for Kallak South and the Company’s Parkijaure licences.

BGS prepared a Technical Report which serves as an independent report prepared by the Competent Person (“CP”) as defined by the Pan-European Reserves and Resources Reporting Committee (“PERC”) Standard for Reporting of Exploration Results, Mineral Resources and Mineral Reserves. PERC sets out minimum standards, recommendations and guidelines for Public Reporting of Exploration Results, Mineral Resources and Mineral Reserves in Europe. PERC is a member of CRIRSCO, the Committee for Mineral Reserves International Reporting Standards, and the PERC Reporting Standard is fully aligned with the CRIRSCO Reporting Template.

Below is a table showing the Mineral Resource Statement for the Kallak Project at a 0% Fe cut-off grade:

|

Deposit |

Classification |

Million Tonnes |

Density (g/cm3) |

Fe (%) |

FeO (%) |

SiO2 (%) |

Al2O3 (%) |

P (%) |

S (%) |

|

Kallak North |

Measured |

16 |

3.5 |

33.6 |

10.5 |

43.4 |

2.9 |

0.04 |

0.002 |

|

Indicated |

95 |

3.3 |

27.0 |

7.1 |

49.8 |

4.5 |

0.03 |

0.002 |

|

|

Sub-Total |

111 |

3.3 |

28.0 |

7.6 |

48.9 |

4.3 |

0.03 |

0.002 |

|

|

Inferred |

25 |

3.4 |

28.3 |

7.8 |

48.1 |

4.2 |

0.04 |

0.002 |

|

|

Kallak South North |

Measured |

|

|

|

|

|

|

|

|

|

Indicated |

21 |

3.3 |

26.9 |

7.2 |

49.3 |

4.9 |

0.04 |

0.003 |

|

|

Sub-Total |

21 |

3.3 |

26.9 |

7.2 |

49.3 |

4.9 |

0.04 |

0.003 |

|

|

Inferred |

6 |

3.2 |

23.4 |

6.5 |

50.1 |

6.6 |

0.05 |

0.004 |

|

|

Kallak South South |

Measured |

|

|

|

|

|

|

|

|

|

Indicated |

|

|

|

|

|

|

|

|

|

|

Sub-Total |

|

|

|

|

|

|

|

|

|

|

Inferred |

8 |

3.3 |

26.1 |

12.0 |

50.1 |

5.2 |

0.05 |

0.009 |

|

|

Total |

Measured |

16 |

3.5 |

33.6 |

10.5 |

43.4 |

2.9 |

0.04 |

0.002 |

|

Indicated |

116 |

3.3 |

27.0 |

7.1 |

49.7 |

4.6 |

0.03 |

0.002 |

|

|

Sub-Total |

132 |

3.3 |

27.8 |

7.5 |

48.9 |

4.4 |

0.03 |

0.002 |

|

|

Inferred |

39 |

3.3 |

27.1 |

8.5 |

48.8 |

4.8 |

0.04 |

0.004 |

Notes:

(1) Mineral Resources, which are not Mineral Reserves, have no demonstrated economic viability.

(2) The effective date of the Mineral Resource is 9 May 2021.

(3) The Open Pit Mineral Resource Estimate was constrained within lithological and grade-based solids and within an optimised pit shell defined by the following assumptions; base case metal price of USD130 / tonne for a 65% Fe concentrate; Fe recovery of 71% at Kallak North, 86% at Kallak South North and 94% at Kallak South South; Fe concentrate grades of 68% at Kallak North, 70% at Kallak South North and 69% at Kallak South South; Processing costs of USD6.8 / t wet; Selling cost of USD21.0 / t wet concentrate; Mining cost of Ore of USD3.3 / t, mining cost of waste of USD3.0 / t and an incremental mining cost per 10 m bench of USD0.05 / t; Wall angles of 30° within the overburden and 47.5° in the fresh rock.

(4) Mineral Resources have been classified according to the PERC Standards 2017, by Howard Baker (FAusIMM(CP)), an independent Competent Person as defined in the PERC Standard 2017.

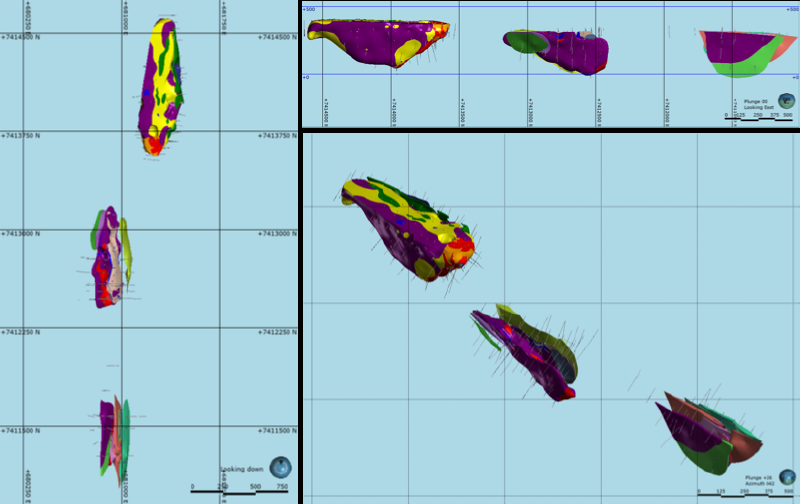

An overview of the interpreted mineralisation is shown in the diagram below, a) left – plan view, b) top right – looking east, c) bottom right – oblique view, looking northeast. Coloured by domain (Source: BGS).

BGS reported an Exploration Target in an untested gap between and Kallak South North and Kallak South South, of between 25 Mt and 75 Mt grading between 20% Fe to 30% Fe. In addition, an Exploration Target of between 45 Mt and 135 Mt grading between 20% Fe to 30% Fe at has been reported at Parkijaure. The potential quantity and grade are conceptual in nature as there has been insufficient exploration to estimate a Mineral Resource. It is uncertain if further exploration will result in the estimation of a Mineral Resource.

In September 2020, the Company published the findings of an investigation by Dr. Arvidson MSc Mining/Mineral Processing, PhD Mineral Processing (equivalent), Royal Institute of Technology, Stockholm, as Qualified Person, into the market potential of future products from Kallak, based on the results of laboratory and pilot plant testwork conducted to date, the highlights of which can be summarised as follows:

- Testwork on Kallak ore has produced an exceptionally high-grade magnetite concentrate at 71.5 per cent iron content with minimal detrimental components;

- This would make Kallak the market leading high-grade product among known current and planned future producers; and

- The next best magnetite product is LKAB’s (the state-owned Swedish iron ore company), which produces magnetite fines (“MAF”) with a target specification of 70.7 per cent iron and is regarded as unique, until now, due to its exceptionally high iron content.

2022 Update

On 22 March 2022, the Swedish Government awarded an Exploitation Concession for Kallak North; attached to the decision were 12 conditions for the Company to comply with. The Company’s legal advisers reviewed the Government’s decision and the conditions attached to it and, with respect to the conditions, were satisfied that these were matters the Company would naturally expect to address during project development and the Environmental Court process. The award of the Concession was a long-awaited milestone on the development timeline, and now the Company can focus its attention on project development and applying for the Environmental Permit.

The Government’s decision to grant the Exploitation Concession is subject to a review by the Supreme Administrative Court following an application by the Swedish Society for Nature Conservation, the Sirges Sami and the Jåhkågasska Sami. They argue that the government was not entitled to make the decision in question, on the grounds that it would be contrary to legal rules in support of mainly nature conservation and the national interest of reindeer husbandry. They argue that the Government’s decision lacks support in the legal order and that the Supreme Administrative Court should therefore declare the decision invalid. There is a risk that the Supreme Administrative Court will find that the Government has made the decision in violation of the law and therefore annul it. In such a case, the Government may reconsider the issue, but such a procedure risks delaying the start of mining production at Kallak North. There is also a risk that the Government will not take a new decision on the processing concession, which could prevent or at least delay the start of mining production. There is also a risk that the Government will attach additional conditions to a new decision, which may affect or delay the start of mining production at Kallak North. The Company assesses the probability of the described risks occurring to be low.

The Company strengthened its leadership team in Sweden with the appointment of Ulla Sandborgh as CEO of Jokkmokk Iron, Beowulf’s wholly owned Swedish subsidiary and the developer of the Kallak North. Before joining Jokkmokk Iron, Ulla held senior positions in private enterprise and public institutions, in sectors including infrastructure, electricity and water. Her most recent role was a Director General in the Ministry of Enterprise of The Government of Sweden, where she was responsible for issues affecting the limestone and cement industries and led the development of a strategy to promote the efficient and sustainable use of water. Ulla has extensive experience in managing permitting processes and, as part of this, engaging with stakeholders, to ensure interests are safeguarded, and benefits shared.

During the year, the Company contracted independent consulting firm SRK Consulting (UK) Ltd (”SRK”) Company to prepare a Scoping Study for Kallak North and engaged Vulcan Technologies Pty Ltd (“VulcanTech”), an Australian company specialising in the modelling of iron and steel making processes, to complete a Marketing Study to consider traditional and non-traditional market opportunities that might be served by Kallak concentrates. Workstreams associated with the Environmental Permit continued, including updating investigations regarding nature values, water management and options for transporting production from the mine.

2023 Update

On 24 January 2023, Beowulf announced the positive economic results of the Kallak North Scoping Study, forming part of the larger Kallak Iron Ore Project, prepared by independent consulting firm SRK Consulting (UK) Ltd. The Scoping Study presents a ‘Base Case’ solely focused on the Kallak North deposit, incorporating a Mineral Resource Estimate (“MRE”) with effective date of 9 May 2021 and an economic assessment for a mining operation producing up to 2.7 Mt per annum of high-grade iron concentrate over a production life of 14 years. The scoping study economic highlights include a Net Present Value (NPV8) of US$177 million, Internal Rate of Return of 14.5 per cent and a Payback Period of ~ 4.5 years from commencement of construction activity. The ’Base Case’ assumes 67 per cent of Kallak production is sold to the Blast furnace market and 33 per cent is sold to the Direct Reduction market, consistent over the 14 years production life.

A Pre-feasibility Study (PFS) is due to commence in Q2 2023, and the offers for the work was sent to the Company by the 11 May 2023. The offers are evaluated and compared before the assignment is given to one or several bidding companies. The PFS is an important part of the Environmental Permit. The Permitting workstreams are continuing with all the necessary investigations that must be included in the application for an Environmental Permit that will be handed in to the court. Like background measuring of noise, dust, waterflows and inventory of nature values.

FINLAND

Grafintec

Grafintec is recognised in Finland as one of the main companies in the anode space and continues to be supported by Business Finland, the Finnish governmental organisation for innovation funding and investments.

Finnish Exploration Permits

Grafintec’s exploration programme is targeted at securing long-term sustainably produced primary raw material supply to support a Finnish graphite anode value chain. The Company has a rolling programme of exploration permit and claim reservation applications and exploration permit renewals.

Tukes (the permitting authority) processes the Company’s applications, which if deemed satisfactory, are published as a ‘Hearing’ for one month, during which time appeals can be submitted.

|

Exploration Permit Name |

Licence no. |

Area (hectares) |

Notes |

|

Pitkäjärvi 1 |

ML2016:0040-02 |

407 |

27.4.2021: Extension permit granted by TUKES. 3.3.2022: The Administrative Court dismissed all the appellants’ claims and the litigation costs. 11.4.2022: Appeal application to the Supreme Administrative Court by Puhtaan Saimaan puolesta ry, Kansalaisten kaivosvaltuuskunta ry and Vesiluonnon puolesta ry. 3.11.2022: The Supreme Administrative Court dismissed the NGO’s application for leave to appeal the exploration permit. The permit is now legally valid until 26.4.2024. |

|

Rääpysjärvi 1 |

ML2017:0104 |

716 |

Exploration permit granted. The permit gained legal force 21.6.2021 and is valid to 20.6.2025. |

|

Karhunmäki 1 |

ML2019:0113 |

889 |

Granted by TUKES 29.9.2021. The decision has been appealed to the Vaasa Administrative Court by Lapua municipality and MiningWatch Finland ry. |

|

Luopioinen 1 |

ML2022:0004 |

218 |

Exploration permit application submitted 28.1.2022. The permit has not gained legal force yet. |

Aitolampi (Pitkäjärvi 1 Exploration Permit) – Graphite

Introduction

The Aitolampi graphite project sits within the Pitkäjärvi 1 licence and is located in eastern Finland, approximately 40 km southwest of the well-established mining town of Outokumpu, and an eastern extension of known old graphite workings from many years ago. Infrastructure in the area is excellent, with road access and good availability of high voltage power.

Discovered in 2016, the licence covers an area of graphitic schists on a fold limb, coincidental with an extensive electromagnetic (“EM”) anomaly. Many of the EM zones are obscured by glacial till, but graphite observations in road cuttings and outcrops are also associated with abundant EM anomalies.

The resource contains graphite of almost perfect crystallinity, and high proportion of fine and medium flake, which is an important prerequisite for high tech applications, such as lithium-ion batteries. Purification results indicate that concentrates meet the purity specification of 99.95 per cent C(t) for lithium-ion batteries.

Mineral Resource Estimate

In 2019, Grafintec delivered an upgraded MRE for Aitolampi, with an 81 per cent increase in contained graphite (compared to the 2018 MRE) for the higher-grade western zone with an Indicated and Inferred Mineral Resource of 17.2 Mt at 5.2 per cent Total Graphitic Carbon (“TGC”) containing 887,000 tonnes of contained graphite.

An unchanged Indicated and Inferred Mineral Resource of 9.5 Mt at 4.1 per cent TGC for 388,000 tonnes of contained graphite for the eastern lens.

In total, an Indicated and Inferred Mineral Resource of 26.7 Mt at 4.8 per cent TGC for 1,275,000 tonnes of contained graphite. All material is contained within two graphite mineralised zones, the eastern and western lenses, interpreted above a nominal three per cent TGC cut-off grade.

An augmented global Indicated and Inferred Mineral Resource of 11.1 Mt at 5.7 per cent TGC for 630,000 tonnes of contained graphite, reporting above a five per cent TGC cut-off, based on the grade-tonnage curve for the resource.

The Mineral Resource was estimated by CSA Global of Australia in accordance with the JORC Code, 2012 Edition. See table below:

|

Zone |

Classification |

Mt |

TGC % |

S % |

Density (t/m3) |

Contained graphite (kt) |

|

Western lens |

Indicated |

9.2 |

5.1 |

5.0 |

2.80 |

468 |

|

Inferred |

8.0 |

5.2 |

4.7 |

2.80 |

419 |

|

|

Indicated + Inferred |

17.2 |

5.2 |

4.8 |

2.80 |

887 |

|

|

Eastern lens |

Indicated |

1.8 |

4.1 |

4.4 |

2.82 |

74 |

|

Inferred |

7.7 |

4.1 |

4.5 |

2.82 |

314 |

|

|

Indicated + Inferred |

9.5 |

4.1 |

4.5 |

2.82 |

388 |

|

|

TOTAL |

Indicated + Inferred |

26.7 |

4.8 |

4.7 |

2.81 |

1,275 |

2022 Update

Grafintec continued to focus on the creation of a Finnish anode materials value chain, with exploration for more natural flake graphite, contracting Geological Survey of Finland (“GTK”) to carry out an EM survey over the Rääpysjärvi exploration permit.

Grafintec entered into a Memorandum of Understanding (“MoU”) with GTK, providing Grafintec and GTK with a framework and platform to promote and foster cooperation in the fields of circular economy, mineral processing and exploration of graphite as pertaining to anode materials for the lithium-ion battery market and other markets from different raw material sources.

Grafintec also entered into a new partnership with Hensen, a company that has been operating in the graphite industry for 37 years and has been producing graphite-based anode materials since 2003. The MoU includes an agreed framework and key terms on which both companies are collaborating to establish an anode materials hub in Finland.

Along with the MoU signed with Hensen, Grafintec also signed a MoU with Dominik Georg Luh Technografit GmbH (”Technografit”), establishing the basis for a commercial partnership for procuring sustainably produced natural flake graphite for Grafintec’s planned graphite anode materials plant. The MoU was signed with Technografit in May 2022 and sets the heads of terms for incorporating a formal sales agreement between Grafintec and Technografit, This follows the Company’s strategy to expand its resource footprint while its projects are still in development, in order to develop downstream anode capabilities. Samples received from Technografit will be tested by Hensen and other possible technology partners and processed to anode material. Also, the Company has testwork programmes on recycled graphite containing waste to assess whether it can be processed to suitable feedstock for anode materials production.

In the final quarter of the year, the Company announced the results from the EM survey and assays for the Rääpysjärvi flake graphite prospect.

The EM survey indicated extensive EM anomalies, significant potential for a larger tonnage of high-grade graphite mineralisation than that defined at Aitolampi and for localised very high-grade mineralisation.

Highlights included:

- 13 highly conductive EM zones were identified, with isolated zones extending for up to 850m strike length and 250m width.

- Analysis of eight grab samples from outcrops in the area range from 0.52 to >50 per cent TGC. The sample assaying more than 50 per cent TGC (limit of the analysing methodology) was taken from a historic graphite quarry situated close to the north-western limit of one of the largest EM conductive zones.

- Six holes drilled in the 1980s have also been re-sampled and re-assayed for TGC. Two of the drill holes intersected significant graphite mineralisation:

- TN/SM-2: 19.29m at 5.62 per cent TGC (from 177.11m); and

- TN/SM-3: 9.84m at 6.70 per cent TGC (from 226.16m) and 35.55m at 4.98 per cent TGC (from 266.45m).

- Previous metallurgical testwork on a 10kg composite grab sample has produced a concentrate grade of 97.4 per cent TGC.

- The encouraging exploration data set indicates significant potential for natural flake graphite mineralisation suitable for graphite anodes across Rääpysjärvi.

Samples were taken from four trenches in different locations within the identified EM conductive Zone 1, with assays confirming the existence of significant flake graphite mineralisation grade and intersected width.

Flake graphite mineralisation was discovered in all four trenches sampled, including:

- RAA-TR1-22: 10.6 m at 4.33 per cent TGC and 3.8m at 5.77 per cent TGC;

- RAA-TR2-22: 9.96 per cent TGC from grab sample;

- RAA-TR3-22: 5.8m at 7.25 per cent TGC and 7.1 m at 7.43 per cent TGC; and

- RAA-TR4-22: 1.0m at 26.00 per cent TGC.

2023 Update

Grafintec announced, on 9 January 2023, that it had awarded a Pre-feasibility Study (“PFS”) contract to RB Plant to assess the technical, economic, statutory, regulatory and commercial options for a natural flake graphite micronisation, spheronisation, purification, and coating plant in Finland.

The study will investigate the Best Available Technology (”BAT”) with consideration for environmental, operational and financial factors and performance, for transforming a high-grade natural flake graphite concentrate to graphite anode material suitable for the European lithium-ion battery market opportunities.

The PFS is a key component of Grafintec`s strategy to develop a Finnish value chain for anode materials production, aligned with the objectives of the funding received from Business Finland as part of the BATCircle2.0 (Finland-based Circular Ecosystem of Battery Metals) consortium. BATCircle2.0 is a key project in Business Finland’s Smart Mobility and Batteries from Finland programmes.

At the start of February, the Company signed an agreement with the municipality of Korsholm to secure a new site at the GigaVaasa area (Plot 1, Block 3017) to establish a Graphite Anode Materials Plant (“GAMP”). Grafintec will work closely with the municipality of Korsholm and other important stakeholders and intends to apply for a long-term site reservation for Plot 1 within the second half of 2023.

KOSOVO

Vardar Minerals Limited (“Vardar”)

Beowulf’s investment in Vardar gives the Company exposure to base metals and precious metals exploration in the highly prospective Tethyan Belt.

Exploration Permits

Vardar has a rolling programme of exploration permit applications and renewals, see table below:

|

Licence Number |

Term1 |

Licence |

Valid From |

Valid To |

Area (km2) |

|

2879 |

2nd |

Mitrovica |

2022-03-11 |

2024-01-27 |

27.1 |

|

2878 |

2nd |

Viti N |

2022-03-22 |

2024-01-27 |

35.5 |

|

2912 |

2nd |

Viti SE |

2022-03-11 |

2024-01-27 |

44.1 |

|

2935 |

1st |

Shala |

2022-03-11 |

2025-02-25 |

87.5 |

|

3122 |

1st |

Shala East |

2022-09-06 |

2025-08-17 |

78.8 |

|

3123 |

1st |

Shala West |

2022-10-22 |

2025-10-11 |

36.2 |

|

3054 |

1st |

Zvecan |

2022-06-27 |

2024-05-14 |

6.4 |

1 Refers to whether the licence has been renewed e.g. 2nd means licence has been renewed after its 1st term.

Exploration Overview

Vardar’s exploration permits are located within the Tethyan Belt, a major orogenic metallogenic province for gold and base metals which extends from the Alps (Carpathians/Balkans) to Turkey, Iran and Indochina, and contains several world class discoveries.

The Tethyan Belt of south-east Europe can be regarded as Europe’s chief copper-gold (lead-zinc-silver) province. Mitrovica and Viti occur within calc-alkaline magmatic arc(s) which developed during the closure of the Neotethys Ocean, primarily targeting epithermal gold, lead-zinc-silver replacement deposits and porphyry related copper-gold mineralisation.

The lack of modern-day exploration in the Balkans presents a real opportunity for new mineral deposit discoveries.

Mitrovica

The Mitrovica licence is located immediately to the west and north west of the world class Stan Terg former lead-zinc-silver mine, which dates back to the 1930s; with current reserves of 29 Mt of ore at 3.45 per cent lead, 2.30 per cent zinc, and 80 g/t silver (ITT/UNMIK 2001 report), together with the past production of approximately 34 Mt of ore, the deposit represents an important source of metals in the south eastern part of Europe (Source: Strmić Palinkaš S., Palinkaš L.A et al, 2013. Metallogenic Model of the Trepča Pb-Zn-Ag Skarn Deposit, Kosovo: Evidence from Fluid Inclusions, Rare Earth Elements, and Stable Isotope Data. Economic Geology, 108, 135-162). The licence is showing its potential for a range of porphyry related mineralisation types.

Shala

During the year, three Shala exploration licences were approved, extending to the north and northeast of the Mitrovica licence, its polymetallic epithermal system and associated lead-zinc-silver and gold-silver-copper mineralisation. The new areas are situated in the prospective Vardar lead-zinc-silver belt along trend from historical mining districts.

The new licences include prospective carbonate host rocks along with Oligocene magmatic rocks which provide the heat and metal source in the surrounding lead-zinc ore districts; alteration and gossan outcrops have been noted in early reconnaissance visits further demonstrating the potential for lead-zinc-silver mineralisation in both of the licences.

Viti

The Viti project is located in south-eastern Kosovo and encompasses an interpreted circular intrusive, indicated by regional airborne magnetic data. There is evidence of intense alteration typically associated with porphyry systems, with several copper occurrences and stream sample anomalies in proximity to, and within the project area.

In 2019, two stratigraphic holes, totalling 439 metres, were drilled to test for alteration type and potential associated mineralisation in the gossanous zone, and identified highly altered trachyte porphyry dykes with associated copper and gold mineralisation, with down the hole intersections of 1 m at 0.5 g/t and 10 m at 0.12 g/t.

In 2020, the Company reported results from detailed 3D IP and resistivity surveys undertaken over the Metal Creek prospect, which forms part of the Viti project. High chargeability anomalies associated with an extensive north-northwest trending zone of alteration and anomalous multi-element soil sample and rock grab sample results were delineated. The newly defined high chargeability anomalies sit near gold and copper mineralisation, associated with altered porphyritic trachyte dykes, intersected by previous stratigraphic drilling. These anomalies could represent higher grade mineralised zones.

Zvecan

The Zvecan licence is a small extension licence east of the main Mitrovica project and was created by changes in municipality boundaries.

2022 Update

During 2022, the Company invested a further £1.2 million to fund drilling taking the Company’s ownership of Vardar to approximately 59.5 per cent. At the signing date of this report, the Company has invested a further £250,000 and now owns a 61.1 per cent interest in Vardar.

Significant and positive exploration results were delivered by Vardar in 2022, which resulted in the identification of a high sulphidation Polymetallic Epithermal System at Majdan Peak (“MP”), part of the Mitrovica licence. Epithermal systems, which are formed at shallow levels in the earth’s crust, are highly prospective for their gold and silver contents and can also contain lead, zinc and copper.

During the year, drilling focused on the MP target and the results both supported the potential for epithermal mineralisation of economic grades to be present and for comparisons to be drawn with the Chelopech copper-gold deposit in Bulgari. Numerous additional base and precious metal targets were also defined for future drilling.

The exploration programme consisted of 16 holes, totalling 3709.7 metres(m) of diamond drilling, including 3 holes (643.5 m) at MP South and 13 holes (3066.2 m) at MP North. All drillholes intersected abundant sulphides, intense alteration, and multiple generations of veining which are all factors indicative of a large polymetallic epithermal system. Significant gold-copper-silver, lead-zinc-silver and gold intersections include:

- Drillhole MP006: 10.8m at 0.48 grammes per tonne (”g/t”) gold (”Au”), 0.1 per cent copper (”Cu”) and 18 g/t silver (”Ag”), including 3.2m at 1.1 g/t Au, 0.2 per cent Cu and 50 g/t Ag;

- Drillhole MP006: 6.8m at 4.1 per cent lead (”Pb”), 0.6 per cent zinc (”Zn”) and 15 g/t Ag; and

- Drillhole MP013: 16.1m at 0.21 g/t Au.

Following this, on 8 September 2022, the Company announced additional analysis of drilling and exploration activities in and around the Majdan Peak South (“MPS”) area. This analysis generated additional exploration targets effectively increasing the significant district potential. The additional targets include Gold Ridge and Red Lead.

The main objective of exploration is to discover an economic deposit of base and precious metals, and recent drilling has shown this potential. Drilling at MPS intercepted several noteworthy precious metals intersections, including:

- Drillhole MP002: 8.8 m at 0.34 g/t Au, including 0.9m at 1.52 g/t Au and 20 g/t Ag; and

- Drillhole MP003: 36.4m at 19 g/t Ag, 0.5 per cent Pb and 0.2 per cent Zn, including:

- 1.5m at 128 g/t Ag, 0.35 per cent Cu, 1.5 per cent Pb and 0.3 per cent Zn;

- 1.1m at 71 g/t Ag, 0.1 per cent Cu, 0.7 per cent Pb and 0.3 per cent Zn;

- 1.0m at 50 g/t Ag, 0.2 per cent Cu, 0.5 per cent Pb and 0.3 per cent Zn;

- 4.8m at 44 g/t Ag and 0.7 per cent Pb; and

- 1.1m at 46 g/t Ag, 2.7 per cent Pb and 0.6 per cent Zn.

On 14 December 2022, Beowulf released results from detailed geological mapping over the Red Lead target, located within the Mitrovica Licence, situated approximately 2km east of the world class Stan Terg lead-zinc deposit, which is still in production. The target is defined by a two kilometre East-Northeast trending lead-zinc-copper-gold in soil sample anomaly along with:

Mineralised trachyte bodies (with up to three per cent zinc from rock sampling);

- Prominent induced polarisation (“IP”) anomalies indicative of potential sulphide metal sources; and

- Hydrothermal breccias and gossanous outcrops.

Detailed geological mapping undertaken in December identified marble units together with gossans, trachyte bodies and carbonate alteration, highlighting the potential for carbonate-replacement style lead-zinc-silver mineralisation. As this important target shares the same host rocks, and alteration as seen the neighbouring Stan Terg deposit, it is considered a highly prospective target for follow up drilling.

ESG

The Company’s overall purpose is to be a responsible and innovative company that creates value for our shareholders, the wider society and the environment, through sustainably producing critical raw materials needed for the global transition to a Green Economy.

On 13 May 2022, regarding Community Initiatives, the Company announced that discussions were taking place with the responsible local agency in Jokkmokk about conducting surveys to map the current workforce and future workforce, school leavers and university students in the region, to determine what initiatives need to be started to ensure sufficient locally based skilled persons are available for work at the mine or in other businesses established by the economic stimulus created by the mine.

The Company wants to be recognised for living its values of Respect, Partnership and Responsibility. In its recent ESG work it has identified, as material to the Company’s activities, the following main Sustainable Development Goals and relevant actions under each goal which the Company will be focusing on:

- Goal 6: Ensure availability and sustainable management of water and sanitation for all

- Target 6.1 – By 2030, achieve universal and equitable access to safe and affordable drinking water for all

- Target 6.4 – By 2030, substantially increase water-use efficiency across all sectors and ensure sustainable withdrawals and supply of freshwater to address water scarcity and substantially reduce the number of people suffering from water scarcity

- Goal 8: Decent work and economic growth

- Target 8.2 – Achieve higher levels of economic productivity through diversification, technological upgrading and innovation, including through a focus on high-value added and labour-intensive sectors

- Target 8.4 – Improve progressively, through 2030, global resource efficiency in consumption and production and endeavour to decouple economic growth from environmental degradation, in accordance with the 10-year framework of programmes on sustainable consumption and production, with developed countries taking the lead

- Target 8.5 – By 2030, achieve full and productive employment and decent work for all women and men, including young people and persons with disabilities, and equal pay for work of equal value

- Goal 9: Industry, innovation and infrastructure

- Target 9.1 – Develop quality, reliable, sustainable and resilient infrastructure, including regional and transborder infrastructure, to support economic development and human well-being, with a focus on affordable and equitable access for all

- Target 9.4 – By 2030, upgrade infrastructure and retrofit industries to make them sustainable, with increased resource-use efficiency and greater adoption of clean and environmentally sound technologies and industrial processes, with all countries taking action in accordance with their respective capabilities

- Goal 12: Responsible production and consumption

- Target 12.2 – By 2030, achieve the sustainable management and efficient use of natural resources

- Target 12.5 – By 2030, substantially reduce waste generation through prevention, reduction, recycling and reuse

- Target 12.6 – Encourage companies, especially large and transnational companies, to adopt sustainable practices and to integrate sustainability information into their reporting cycle

- Goal 13: Climate Action

- Target 13.2 – Integrate climate change measures into national policies, strategies and planning

When it comes to the development of the Company’s projects and with Kallak as the frontrunner, the above goals and our future compliance with The Equator Principles are being factored into our thinking, design, engineering, and planning of our operations and management systems.

The Company’s ESG Policy is available on the website following the link below:

https://beowulfmining.com/about-us/esg-policy/

REMUNERATION REPORT

The Directors have chosen to voluntarily present an unaudited remuneration report although is not required by the Companies Act 2006. Details of the Remuneration Committee’s composition and responsibilities are set out in the Corporate Governance Report and its terms of reference can be found on the Group’s website: https://beowulfmining.com

Executive Directors’ terms of engagement

Mr Budge was the sole Executive Director and Chief Executive Officer during the reporting period. His annual salary was £210,000 (2021: £180,000). Post period, Mr Budge stepped down as CEO on 3 May 2023.

Post period, Mr Röstin assumed the role of Executive Chairman and interim CEO effective 3 May 2023 at the time of Mr Budge’s resignation.

Non-Executive Directors’ terms of engagement

The Non-Executive Directors have specific terms of engagement under a letter of appointment. Their remuneration is determined by the Board. In the event that a Non-Executive Director undertakes additional assignments or work for the Company, this is covered under a separate consultancy agreement.

Mr Davies annual fee is £36,000 per annum (2021: £33,000). Mr Davies has a consultancy agreement with the Company for the provision of exploration advice over and above his Non-Executive duties. Mr Davies has a one month notice period under his letter of appointment.

Mr Littorin resigned as Non-Executive Director and Mr Röstin was appointed as Non-Executive Director on 31 October 2022. Under Mr Röstin’s letter of appointment, he is paid a fee in Swedish Krona of 500,000 per annum. Mr Rostin has a notice period of one month under his letter of appointment.

Indemnity Agreements

Pursuant to the Companies Act 2006 and the Company’s articles of association, the Board may exercise the powers of the Company to indemnify its Directors against certain liabilities, and to provide its Directors with funds to meet expenditure incurred, or to be incurred, in defending certain legal proceedings or in connection with certain applications to the court. In exercise of that power, and by resolution of the Board on 26 July 2016, the Company has agreed to enter into this Deed of Indemnity with each Director.

Aggregate Directors’ Remuneration

The remuneration paid to the Directors in accordance with their agreements, during the years ended 31 December 2022 and 31 December 2021, was as follows:

|

Name |

Position |

Salary & Fees1 |

Benefits2 |

Pension3 |

Share-based payments |

2022 Total

|

2021 Total

|

|

|

|

£ |

£ |

£ |

|

£ |

£ |

|

Mr K R Budge4 |

Chief Executive Officer |

210,000 |

887 |

5,667 |

158,817 |

375,371 |

186,377 |

|

Mr C Davies |

Non-Executive Director |

39,000 |

– |

– |

14,528 |

53,528 |

33,000 |

|

Mr J Rostin5 |

Non-Executive Director |

25,328 |

– |

– |

– |

25,328 |

– |

|

Mr SO Littorin |

Non-Executive Director |

34,215 |

– |

– |

– |

34,215 |

38,041 |

|

Total |

|

308,543 |

887 |

5,667 |

173,345 |

488,442 |

257,418 |

Notes:

(1) Does not include expenses reimbursed to the Directors.

(2) Personal life insurance policy

(3) Employer contributions to personal pension.

(4) Post period, Kurt Budge resigned as CEO effective 3 May 2023

(5) Post period, Johan Röstin assumed the role of Executive Chairman / Interim CEO.

Each Director is also paid all reasonable expenses incurred wholly, necessarily, and exclusively in the proper performance of his duties.

The beneficial and other interests of the Directors holding office on 31 December 2022 in the issued share capital of the Company were as follows:

|

ORDINARY SHARES |

31 December 2022 |

31 December 2021 |

|

Mr K R Budge |

5,957,997 |

5,957,997 |

|

Mr C Davies |

88,800 |

88,800 |

As at 31 December 2022, 8,500,000 options have vested.

|

ORDINARY SHARES UNDER OPTION |

NUMBER |

EXERCISE PRICE |

EXPIRY DATE |

|

Mr K R Budge |

3,500,000 |

7.35 pence |

14 January 2024 |

|

Mr K R Budge |

9,500,000 |

5.25 pence |

27 September 2032 |

|

Mr K R Budge |

2,500,000 |

1 pence |

27 September 2032 |

|

Mr C Davies |

2,500,000 |

7.35 pence |

14 January 2024 |

|

Mr C Davies |

2,000,000 |

5.25 pence |

27 September 2032 |

As at 31 December 2021, all options have vested.

|

ORDINARY SHARES UNDER OPTION |

NUMBER |

EXERCISE PRICE |

EXPIRY DATE |

|

Mr K R Budge |

3,500,000 |

7.35 pence |

14 January 2024 |

|

Mr C Davies |

2,500,000 |

12 pence |

26 January 2022 |

|

Mr C Davies |

2,500,000 |

7.35 pence |

14 January 2024 |

ON BEHALF OF THE REMUNERATION COMMITTEE

Chris Davies

Non-Executive Director

2 June 2023

CONSOLIDATED INCOME STATEMENT

FOR THE YEAR ENDED 31 DECEMBER 2022

|

|

|

2022 |

|

2021 |

|

|

Note |

£ |

|

£ |

|

|

|

|

|

|

|

CONTINUING OPERATIONS |

|

|

|

|

|

Administrative expenses |

|

(1,806,582) |

|

(1,503,049) |

|

Impairment of property, plant and equipment |

9 |

– |

|

(48,966) |

|

Impairment of exploration assets |

8 |

(36,988) |

|

– |

|

|

|

|

|

|

|

OPERATING LOSS |

|

(1,843,570) |

|

(1,552,015) |

|

|

|

|

|

|

|

Gain on disposal of investment |

|

21,951 |

|

– |

|

Finance costs |

3 |

(304,806) |

|

(256) |

|

Finance income |

3 |

176 |

|

71 |

|

Grant income |

6 |

84,797 |

|

66,589 |

|

|

|

|

|

|

|

LOSS BEFORE TAX |

|

(2,041,452) |

|

(1,485,611) |

|

|

|

|

|

|

|

Tax expense |

5 |

– |

|

– |

|

|

|

|

|

|

|

LOSS FOR THE YEAR |

|

(2,041,452) |

|

(1,485,611) |

|

|

|

|

|

|

|

Loss attributable to: |

|

|

|

|

|

Owners of the parent |

|

(1,948,459) |

|

(1,351,179) |

|

|

15 |

(92,993) |

|

(134,432) |

|

|

|

|

|

|

|

|

|

(2,041,452) |

|

(1,485,611) |

|

|

|

|

|

|

|

Loss per share attributable to the ordinary equity holder of the parent: |

|

|

|

|

|

Basic and diluted (pence) |

7 |

(0.23) |

|

(0.16) |

|

|

|

|

|

|

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED 31 DECEMBER 2022

|

|

|

2022 |

|

2021 |

|

|

Note |

£ |

|

£ |

|

|

|

|

|

|

|

LOSS FOR THE YEAR |

|

(2,041,452) |

|

(1,485,611) |

|

|

|

|

|

|

|

OTHER COMPREHENSIVE INCOME |

|

|

|

|

|

Items that may be reclassified subsequently to profit or loss: |

|

|

|

|

|

Exchange losses arising on translation of foreign operations |

|

(32,945) |

|

(794,368) |

|

|

|

|

|

|

|

|

|

(32,945) |

|

(794,368) |

|

|

|

|

|

|

|

TOTAL COMPREHENSIVE LOSS |

|

(2,074,397) |

|

(2,279,979) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive loss attributable to: |

|

|

|

|

|

Owners of the parent |

|

(2,020,889) |

|

(2,110,892) |

|

Non-controlling interests |

15 |

(53,508) |

|

(169,087) |

|

|

|

|

|

|

|

|

|

(2,074,397) |

|

(2,279,979) |

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2022

|

|

Note |

2022 |

|

2021 |

|

|

|

£ |

|

£ |

|

ASSETS |

|

|

|

|

|

NON-CURRENT ASSETS |

|

|

|

|

|

Intangible assets |

8 |

13,002,465 |

|

11,235,656 |

|

Property, plant and equipment |

9 |

129,715 |

|

133,428 |

|

Loans and other financial assets |

11 |

5,181 |

|

5,247 |

|

Right-of-use asset |

12 |

19,279 |

|

7,401 |

|

|

|

13,156,640 |

|

11,381,732 |

|

CURRENT ASSETS |

|

|

|

|

|

Trade and other receivables |

13 |

220,427 |

|

183,139 |

|

Cash and cash equivalents |

14 |

1,776,556 |

|

3,336,134 |

|

|

|

1,996,983 |

|

3,519,273 |

|

|

|

|

|

|

|

TOTAL ASSETS |

|

15,153,623 |

|

14,901,005 |

|

|

|

|

|

|

|

EQUITY |

|

|

|

|

|

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

Share capital |

16 |

8,317,106 |

|

8,317,106 |

|

Share premium |

18 |

24,689,311 |

|

24,689,311 |

|

Capital contribution reserve |

18 |

46,451 |

|

46,451 |

|

Share based payment reserve |

18 |

516,098 |

|

668,482 |

|

Merger reserve |

18 |

137,700 |

|

137,700 |

|

Translation reserve |

18 |

(1,289,415) |

|

(1,216,985) |

|

Accumulated losses |

18 |

(20,323,414) |

|

(18,470,675) |

|

|

|

12,093,837 |

|

14,171,390 |

|

Non-controlling interests |

15 |

568,732 |

|

325,039 |

|

TOTAL EQUITY |

|

12,662,569 |

|

14,496,429 |

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

Trade and other payables |

19 |

625,730 |

|

357,236 |

|

Deferred income |

20 |

– |

|

39,849 |

|

Lease liability |

21 |

10,840 |

|

7,491 |

|

Borrowings |

22 |

1,845,947 |

|

– |

|

|

|

2,482,517 |

|

404,576 |

|

NON-CURRENT LIABILITIES |

|

|

|

|

|

Lease liability |

|

8,537 |

|

– |

|

|

|

8,537 |

|

– |

|

TOTAL LIABILITIES |

|

2,491,054 |

|

404,576 |

|

|

|

|

|

|

|

TOTAL EQUITY AND LIABILITIES |

|

15,153,623 |

|

14,901,005 |

The financial statements were approved and authorised for issue by the Board of Directors on 2 June 2023 and were signed on its behalf by:

Mr J Rostin – Director

Company Number 02330496

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED 31 DECEMBER 2022

|

|

Note |

Share capital £ |

|

Share premium £ |

|

Merger reserve £ |

|

Capital contribution reserve £ |

|

Share based payments reserve £ |

|

Translation reserve £ |

|

Accumulated losses £ |

|

Totals £ |

|

Non – controlling interest £ |

|

Totals £ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At 1 January 2021 |

|

8,281,752 |

|

24,684,737 |

|

137,700 |

|

46,451 |

|

732,185 |

|

(457,272) |

|

(17,083,186) |

|

16,342,367 |

|

394,113 |

|

16,736,480 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss for the year |

|

– |

|

– |

|

– |

|

– |

|

– |

|

– |

|

(1,351,179) |

|

(1,351,179) |

|

(134,432) |

|

(1,485,611) |

|

Foreign exchange translation |

|

– |

|

– |

|

– |

|

– |

|

– |

|

(759,713) |

|

– |

|

(759,713) |

|

(34,655) |

|

(794,368) |

|

Total comprehensive income |

|

– |

|

– |

|

– |

|

– |

|

– |

|

(759,713) |

|

(1,351,179) |

|

(2,110,892) |

|

(169,087) |

|

(2,279,979) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transactions with owners |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issue of share capital |

16 |

35,354 |

|

23,334 |

|

– |

|

– |

|

– |

|

– |

|

– |

|

58,688 |

|

– |

|

58,688 |

|

Cost of issue |

16 |

– |

|

(18,760) |

|

– |

|

– |

|

– |

|

– |

|

– |

|

(18,760) |

|

– |

|

(18,760) |

|

Step up interest in subsidiary |

10 |

– |

|

– |

|

– |

|

– |

|

– |

|

– |

|

(100,013) |

|

(100,013) |

|

100,013 |

|

– |

|

Transfer of reserve on option exercised |

|

– |

|

– |

|

– |

|

– |

|

(63,703) |

|

– |

|

63,703 |

|

– |

|

– |

|

– |

|

At 31 December 2021 |

|

8,317,106 |

|

24,689,311 |

|

137,700 |

|

46,451 |

|

668,482 |

|

(1,216,985) |

|

(18,470,675) |

|

14,171,390 |

|

325,039 |

|

14,496,429 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss for the year |

|

– |

|

– |

|

– |

|

– |

|

– |

|

– |

|

(1,948,459) |

|

(1,948,459) |

|

(92,993) |

|

(2,041,452) |

|

Foreign exchange translation |

|

– |

|

– |

|

– |

|

– |

|

– |

|

(72,430) |

|

– |

|

(72,430) |

|

39,485 |

|

(32,945) |

|

Total comprehensive income |

|

– |

|

– |

|

– |

|

– |

|

– |

|

(72,430) |

|

(1,948,459) |

|

(2,020,889) |

|

(53,508) |

|

(2,074,397) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transactions with owners |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity-settled share-based payment transactions |

17 |

– |

|

– |

|

– |

|

– |

|

240,537 |

|

– |

|

– |

|

240,537 |

|

– |

|

240,537 |

|

Step up interest in subsidiary |

10 |

– |

|

– |

|

– |

|

– |

|

– |

|

– |

|

(297,201) |

|

(297,201) |

|

297,201 |

|

– |

|

Transfer of reserve on option lapsed |

|

– |

|

– |

|

– |

|

– |

|

(392,921) |

|

– |

|

392,921 |

|

– |

|

– |

|

– |

|

At 31 December 2022 |

|

8,317,106 |

|

24,689,311 |

|

137,700 |

|

46,451 |

|

516,098 |

|

(1,289,415) |

|

(20,323,414) |

|

12,093,837 |

|

568,732 |

|

12,662,569 |

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEAR ENDED 31 DECEMBER 2022

|

|

|

2022 |

|

2021 |

|

|

Note |

£ |

|

£ |

|

Cash flows from operating activities |

|

|

|

|

|

Loss before income tax |

|

(2,041,452) |

|

(1,485,611) |

|

Depreciation of property, plant and equipment |

4 |

45,133 |

|

36,790 |

|

Equity-settled share-based transactions |

|

240,537 |

|

23,334 |

|

Impairment of exploration costs |

4 |

36,988 |

|

– |

|

Impairment of property, plant and equipment |

9 |

– |

|

48,966 |

|

Finance income |

3 |

(176) |

|

(71) |

|

Finance cost |

3 |

304,806 |

|

256 |

|

Grant income |

6 |

(84,797) |

|

(66,589) |

|

Gain on sale of property, plant and equipment |

|

– |

|

(17,414) |

|

Gain on sale of investment |

|

(21,951) |

|

– |

|

Amortisation of right-of-use assets |

12 |

6,384 |

|

5,630 |

|

Unrealised foreign exchange losses |

|

55,337 |

|

292,452 |

|

|

|

(1,459,191) |

|

(1,162,257) |

|

|

|

|

|

|

|

Increase in trade and other receivables |

|

(36,535) |

|

(12,796) |

|

Decrease in trade and other payables |

|

(43,827) |

|

(174,732) |

|

|

|

|

|

|

|

Net cash used in operating activities |

|

(1,539,553) |

|

(1,349,785) |

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

Purchase of intangible assets |

8 |

(1,536,674) |

|

(735,847) |

|

Purchase of property, plant and equipment |

9 |

(34,397) |

|

(86,219) |

|

Proceeds from sale of property, plant and equipment |

|

– |

|

24,806 |

|

Disposal of investments |

4 |

21,951 |

|

– |

|

Grant receipt |

|

84,797 |

|

24,031 |

|

Grant repaid |

20 |

(39,849) |

|

– |

|

Interest received |

3 |

176 |

|

71 |

|

|

|

|

|

|

|

Net cash used in investing activities |

|

(1,503,996) |

|

(773,158) |

|

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

Proceeds from issue of shares in prior year |

|

– |

|

1,392,081 |

|

Proceeds from issue of shares |

16 |

– |

|

35,354 |

|

Payment of share issue costs |

16 |

– |

|

(18,760) |

|

Lease principal |

21 |

(6,347) |

|

(5,594) |

|

Lease interest paid |

21 |

(264) |

|

(256) |

|

Proceeds from borrowings, net of issue costs |

22 |

1,554,381 |

|

– |

|

Interest paid |

|

(10) |

|

– |

|

|

|

|

|

|

|

Net cash from financing activities |

|

1,547,760 |

|

1,402,825 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Decrease in cash and cash equivalents |

|

(1,495,789) |

|

(720,118) |

|

Cash and cash equivalents at beginning of year |

|

3,336,134 |

|

4,329,414 |

|

Effect of foreign exchange rate changes |

|

(63,789) |

|

(273,162) |

|

|

|

|

|

|

|

Cash and cash equivalents at end of year |

|

1,776,556 |

|

3,336,134 |

- ACCOUNTING POLICIES

Nature of operations

Beowulf Mining plc (the “Company”) is domiciled in England. The Company’s registered office is 201 Temple Chambers, 3-7 Temple Avenue, London, EC4Y 0DT. These consolidated financial statements comprise the Company and its subsidiaries (collectively the “Group” and individually “Group companies”). The Group is engaged in the acquisition, exploration and evaluation of natural resources assets and has not yet generated revenues.

The principal accounting policies applied in the preparation of these consolidated financial statements are set out below:

Going concern

At 31 December 2022, the Group had a cash balance of £1.78 million (2021: £3.34 million) and the Company had a cash balance of £1.67 million (2021: £3.08 million).