Results for the first half year ended on 30 September 2023

‘Prime’, the world’s first travel subscription platform, continues to excel and grows its membership by 41% YoY, surpassing 5.2 million members today[1]

Excellent results allow business to confidently reconfirm self-set FY25 targets will be met or exceeded

Barcelona, 15 November 2023. – eDreams ODIGEO(hereinafter ‘eDO’, ‘the Company’ or ‘the Group’), the world’s leading travel subscription company and one of Europe’s largest e-commerce firms, today released its results for the first half of its fiscal year 2024, ended 30 September 2023.

The company delivered yet another excellent performance, marked by a substantial increase in profitability. Cash EBITDA saw a remarkable growth of 84% compared to the same period last year, primarily driven by the exceptional performance of the Company’s subscription platform, ’Prime.’ This model has become the primary driver of profits and revenues for the Group, consistently delivering strong results with significantly enhanced margins and overall profitability. The continuous expansion of the membership base, which experienced 41% growth in the past 12 months alone, along with the increasing maturity and renewals from existing members, delivers a positive impact on margins.

With the business advancing into year two of its 3.5-year strategic guidance outlined in Capital Markets Day 2021, the ongoing exceptional execution and strategic delivery allows the business to confidently reconfirm its self-imposed targets for 2025: greater than 7.25 million Prime members, around €80 ARPU (Average Revenue Per User) and Cash EBITDA in excess of €180 million. The Company’s robust growth fundamentals lay the ground for further expansion beyond 2025.

H1 RESULTS HIGHLIGHTS

- Significant profit improvements driven by the strength of the subscription business

- Cash EBITDA grew by 84% to €63.5 million compared to €34.5 million reported in 1H FY23. Cash EBITDA Margin improved by 9 percentage points margin since 1Q FY23.

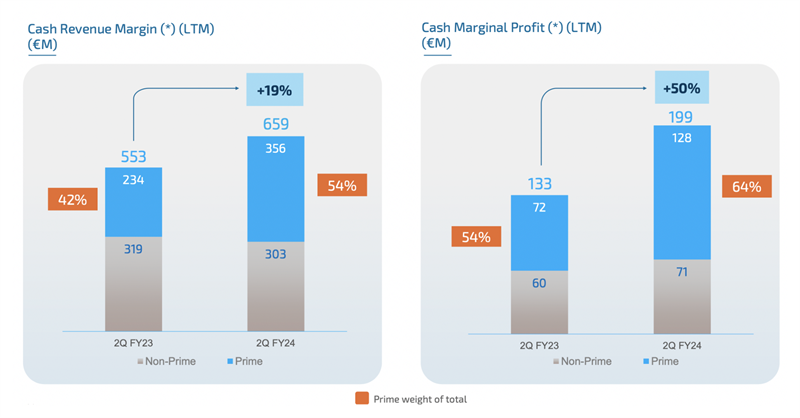

- Cash Revenue Margin topped €354.4 million, up 12%. Revenue Margin grew 13%, reaching €327.0 million in the first half. Cash Marginal Profit was up 46% to €108.9 million in 1H FY24 and the margin had a 9 percentage points improvement since 1Q FY23.

- As guided, the maturity of Prime members is the most important driver for profitability. The increasing number of Prime members renewing their memberships has resulted in a substantial improvement in profitability.

- Prime model is a proven success

- Prime surpassed 5 million members in 2Q FY24, reaching 5.1 million subscribers. Over the last 24 months alone, the programme added 3.4 million new subscribers. In October[2], membership topped 5.2 million.

- The successful transition to a subscription-focused business model is also evident in the rise of Prime’s contribution to the overall Revenue Margin, which increased from 38% to 55% in H1 FY24.

- Self-imposed FY25 targets will be met or exceeded with further growth potential beyond 2025

Dana Dunne, CEO of eDreams ODIGEO commented: “We are delighted with our outperformance. Our strategic shift to a subscription-led business continues to yield results, notably increasing profitability and enhancing predictability. With a rapidly growing membership base, committed and highly satisfied members who book significantly more often than non-subscribers, and a steady flow of recurring revenues, our business has never been more solid and promising.

Today marks the two-year anniversary since we unveiled our 3.5-year strategic roadmap, a transformational journey to consolidate eDO as a leading global subscription business. Throughout this period, we have consistently fulfilled our commitments, even in the face of unforeseen macroeconomic challenges, including the Omicron variant, the conflict in Ukraine, and double-digit inflation rates, among other factors.

Our unique model has proven its resilience, clearly setting us apart from other travel brands and positioning us in the pole position for further growth. Not only do we have confidence in our ability to meet or even surpass our self-imposed targets for 2025, but we’re also excited about the strong foundational growth potential that we foresee extending well beyond 2025.”

BUSINESS REVIEW

eDreams ODIGEO made further significant progress in 1H FY24 following the pivot to a subscription-based model. The business achieved continued rapid Revenue Margin growth and sharply improved margins, resulting in rising profitability. In 1H FY24, eDO continued to see significant Cash Marginal Profit and Cash EBITDA Margin as more Prime members renewed their memberships, with 72% of Cash Marginal Profit now being driven by Prime. As guided, the maturity of Prime members is the most important driver for profitability.

Despite the industry moving to more normalised seasonality patterns in 1H FY24, eDreams ODIGEO continued to show solid growth rates in Revenue Margin and Cash Revenue Margin, which increased by 13% and 12%, respectively, vs the same period last year, following the successful expansion of the Prime Member Base.

Overall, 1H FY24 has observed the improving trends seen in the previous quarters as well as significant improvements in profitability as more Prime members renew their memberships. In 1H FY24, Marginal Profit and Cash Marginal Profit increased by 74% and 46% compared to 1H FY23, and stood at €81.5 million and €108.9 million, respectively.

In 1H FY24 Cash Marginal Profit Margin increased to 31% from 23% in 1H FY23, a 7 percentage point improvement. Cash EBITDA also showed substantial improvements, up 84% to €63.5 million compared to €34.5 million reported in 1H FY23. As the maturity of Prime members increases, it is proven the margins improve. Cash EBITDA Margin in 1H FY24 stood at 18% vs 11% in 1H FY23. As guided in 1Q FY23, strong growth in year 1 Prime members delayed profitability as profitability improves from year 2 onwards. In 1H FY24 Cash Marginal Profit Margin for Prime increased to 38% from 31% in 1H FY23, a 7 percentage point improvement in just one year, as the Cash Marginal Profit for Prime weight over total expanded 29 percentage points from 43% in 1H FY23 to 72% in 1H FY24.

While the bottom-line result showed a notable improvement of €22.4 million from the previous year, the remarkable growth in revenues—€38 million—requires a longer period to fully translate into net income. This is the result of targeted investments in future growth. Specifically, the decision to invest in expanding the Prime membership base means that profitability for Prime members in their initial year is deferred to the second year and beyond, as first-year subscribers do not generate as much immediate profits as more mature members. Furthermore, the company is actively bolstering its tech workforce to further expand its subscription platform. These additional personnel expenses take some time to effectively contribute to enhancements in the product and platform, and consequently, generate incremental profits. As these forward-looking investments mature, the already evident robust growth in the top line will ultimately lead to improved bottom-line results too.

Cash Flow from Operations increased by €40.5 million to €73.7 million, mainly due to the successful expansion of the Prime Member Base, which resulted in higher EBITDA. Working capital inflow in the period was €31.7 million, mainly driven by the growth of our business.

Furthermore, mobile bookings also improved and accounted for 59% of our total flight bookings, up from 54% in 2Q FY23, an increase of 5 percentage points in just one year.

SUMMARY INCOME STATEMENT

| (in € million) | H1 FY24 | VarFY24-FY23 | H1 FY23 | 2Q FY24 | Var. FY24-FY23 | 2Q FY23 |

| Revenue Margin excluding Adjusted Revenue Items | 327.0 | 13% | 289.0 | 169.5 | 18% | 143.3 |

| Cash Revenue Margin | 354.4 | 12% | 316.5 | 187.5 | 19% | 157.4 |

| Cash Marginal Profit | 108.9 | 46% | 74.4 | 56.9 | 39% | 40.9 |

| Cash EBITDA | 63.5 | 84% | 34.5 | 34.1 | 66% | 20.5 |

| Adjusted EBITDA | 36.1 | 419% | 7.0 | 16.1 | 151% | 6.4 |

| Net Income | (1.6) | n.a. | (24.0) | (5.7) | n.a. | (10.1) |

| Adjusted Net Income | (2.0) | n.a. | (19.0) | (3.1) | n.a. | (7.5) |

| (in thousands) | ||||||

| Prime Members | 5,089 | 41% | 3,611 | 5,089 | 41% | 3,611 |

PRIME OVERVIEW

Prime continued to outperform and grew by 41% year-on-year, topping 5.2 million members in October[3]. The Company’s travel subscription platform, the first of its kind in the industry, has delivered ongoing strong growth as reflected in the fact that in the last 24 months alone, the programme added a remarkable 3.4 million new subscribers, despite global macroeconomic concerns.

In 2Q FY24, the programme achieved 380,000 net adds of members and continues to be well ahead of the implied run rate needed to reach the self-imposed target of 7.25 million members by FY25. The revenue margin for Prime grew by 67%, while Cash Revenue Margin for Prime rose by 53%, mainly due to the 41% growth of Prime Members and, as expected, because Prime ARPU, as anticipated and guided, increased to €78.8 converging towards the target of €80 per user. ARPU is rising because of the increased usage of the programme and value per member which also results in increased Revenue Margin because there is an increasing amount of the ARPU recognised. Prime members make more bookings than Non-Prime customers, a remarkable 3.4 times more in H1 FY24.

FINANCIAL DISCLOSURES ADAPTED TO THE SUBSCRIPTION MODEL

In light of the shift in the Company’s business model, from transactional to subscription-based, with most profits and revenues now emanating from this segment, eDO decided to adapt its financial disclosures to better reflect its operating performance as a subscription company. The Company considers Prime/Non-Prime segments as a better reflection of the Company’s operating performance. Hence, since the start of FY24, the Company discloses Prime vs. Non-Prime at Revenue Margin, Variable Costs, Marginal Profit and Adjusted EBITDA levels. The Group also started reporting revenue breakdown by timing of revenue recognition to align with the new reportable segments. Also, to better align the financials with the evolution of the subscription service, the Group also changed the Prime base of revenue recognition from ”based on usage” to ”based on gradual model”

ENDS

About eDreams ODIGEO

eDreams ODIGEO is one of the world’s largest online travel companies and one of the largest e-commerce businesses in Europe. Under its four leading online travel agency brands – eDreams, GO Voyages, Opodo, Travellink, and the metasearch engine Liligo – it serves more than 20 million customers per year across 44 markets. Listed on the Spanish Stock Market, eDreams ODIGEO works with nearly 700 airlines. The business conceptualised Prime, the first subscription product in the travel sector which has topped 5 million members since launching in 2017. The brand offers the best quality products in regular flights, low-cost airlines, hotels, dynamic packages, cruises, car rental and travel insurance to make travel easier, more accessible, and better value for consumers across the globe.

(*) GLOSSARY OF TERMS

Reconcilable to GAAP measures

Adjusted EBITDA means operating profit / loss before depreciation and amortisation, impairment and profit / loss on disposals of non-current assets, as well as adjusted items corresponding to certain share-based compensation, restructuring expenses and other income and expense items which are considered by Management to not be reflective of the Group’s ongoing operations. Adjusted EBITDA provides to the reader a better view about the ongoing EBITDA generated by the Group.

Adjusted Net Income means the IFRS net income less certain share-based compensation, restructuring expenses and other income and expense items which are considered by Management to not be reflective of the Group’s ongoing operations. Adjusted Net Income provides to the reader a better view about the ongoing results generated by the Group.

Adjusted Revenue items refers to adjusted items that are included inside revenue, considered as exceptional by the management and not reflective of the Group’s ongoing operations.

Cash EBITDA means ”Adjusted EBITDA”, plus the variation of the Prime deferred revenue corresponding to the Prime fees that have been collected and that are pending to be accrued. The Prime fees pending to be accrued are non-refundable and will be booked as revenue based on usage, which refers to each instance the customer uses Prime to make a Booking with a discount, or when the Prime contracted period expires. Cash EBITDA provides to the reader a view of the sum of the ongoing EBITDA and the full Prime fees generated in the period.

Cash EBITDA Margin means Cash EBITDA divided by Cash Revenue Margin.

Cash Marginal Profit means ”Marginal Profit” plus the variation of the Prime deferred revenue corresponding to the Prime fees that have been collected and that are pending to be accrued. The Prime fees pending to be accrued are non-refundable and will be booked as revenue based on usage, which refers to each instance the customer uses Prime to make a Booking with a discount, or when the Prime contracted period expires. Cash Marginal Profit provides a measure of the sum of the Marginal Profit and the full Prime fees generated in the period.

Cash Marginal Profit Margin means Cash Marginal Profit divided by Cash Revenue Margin.

Cash Revenue Margin means ”Revenue Margin” plus the variation of the Prime deferred revenue corresponding to the Prime fees that have been collected and that are pending to be accrued. The Prime fees pending to be accrued are non-refundable and will be booked as revenue based on usage, which refers to each instance the customer uses Prime to make a Booking with a discount, or when the Prime contracted period expires. Cash Revenue Margin provides a measure of the sum of the Revenue Margin and the full Prime fees generated in the period.

Cash Revenue Margin per Booking means Cash Revenue Margin divided by the number of Bookings. Marginal Profit means “Revenue Margin” less “Variable Costs”. It is the measure of profit that Management uses to analyse the results by segments.

Prime ARPU means the Cash Revenue Margin generated from Prime users on a last twelve months basis. It is calculated considering all the Cash Revenue Margin elements linked to the bookings done by Prime members (such as but not limited to, the Prime fees collected, GDS incentives, commissions, ancillary services, etc.) divided by the average number of Prime members during the same period. Management considers this is a relevant measure to follow the Prime performance. As Prime is a yearly programme, this measure is calculated on a last twelve months basis.

Revenue Margin means the IFRS revenue less the cost of supplies. The Group’s Management uses Revenue Margin to provide a measure of its revenue after reflecting the deduction of amounts payable to suppliers in connection with the revenue recognition criteria used for products sold under the principal model (gross value basis). Accordingly, Revenue Margin provides a comparable revenue measure for products, whether sold under the agency or principal model.

Variable Costs includes all expenses which depend on the number of transactions processed. These include acquisition costs, merchant costs and other costs of a variable nature, as well as personnel costs related to call centers as well as corporate sales personnel. The Group’s Management believes the presentation of Variable Costs may be useful to readers to help understand its cost structure and the magnitude of certain costs. The Group has the ability to reduce certain costs in response to changes affecting the number of transactions processed.

Other Defined Terms

Bookings refers to the number of transactions under the agency model and the principal model as well as transactions made under white label arrangements. One Booking can encompass one or more products and one or more passengers.

Prime members means the total number of customers that have a Prime subscription in a given period.

Prime / Non-Prime: Prime means the profit and loss measure generated from Prime users. In the case of Cash Revenue Margin (*) for Prime, it includes elements such as, but not limited to, the Prime fees collected, GDS incentives, commissions, ancillary services, etc. Non-Prime means the profit and loss measure generated from non-Prime users.

[1] As of 31st October 2023

[2] As of 31st October 2023

[3] As of 31st October 2023