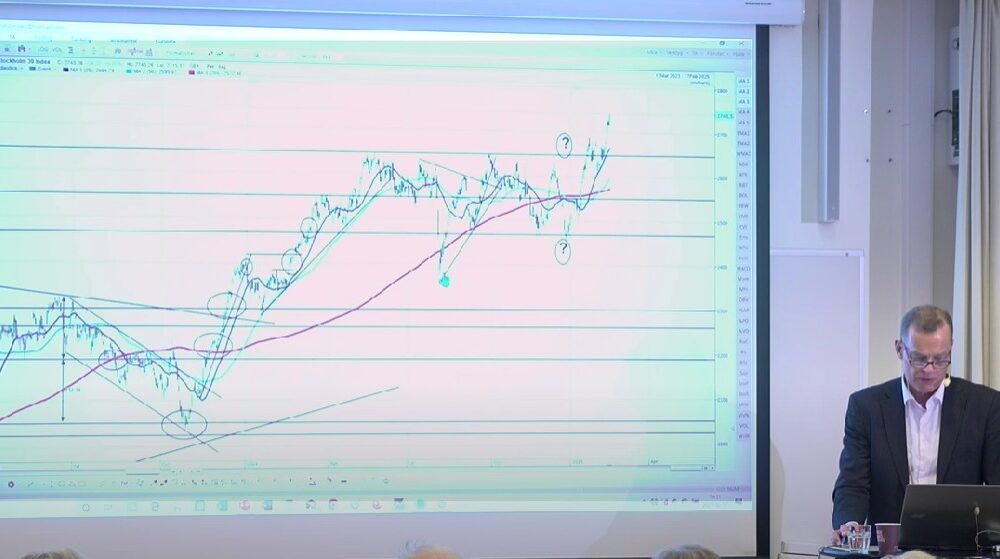

Anders Haglund går under en timme igenom tekniska analyser på ett antal olika tillgångar. Han börjar med den stora bilden över marknaden och går sedan in...

Regeringen har beslutat om en lagrådsremiss med förslag till lättnader i byggkraven för studentbostäder. Syftet är att öka möjligheterna till flexibilitet vid byggandet. – På många...

Viking Lines resenärer dricker varje år 8,5 miljoner koppar kaffe. Nu satsar rederiet på ett helt nytt kaffe som ger minskade klimatutsläpp och bättre levnadsvillkor för odlarna....

Sveriges Radios Kulturnytt gör just nu en mycket välkommen granskning av villkoren i musikbranschen. Igår lyftes artisten Siw Malmkvists situation med ett avtal som inte förnyats...

Stockholm, 18 februari 2025 – Den 4 November 2024 beslutade styrelsen i Blick Global Group AB (”Blick” eller ”Bolaget”) att genomföra en nyemission om högst 4...

Lappland Guldprospektering AB (publ) är ett svenskt guldprospekteringsbolag med verksamhet i norra Sverige. Lappland Guldprospekterings huvudprojekt är Stortjärnhobben i södra Lappland för vilket beviljats en bearbetningskoncession....

Bokslutskommuniké för verksamhetsåret 2024 flyttas från 21 februari 2025 till 28 februari 2025 Anledningen till senareläggning är sjukdom. I brödtexten i det föregående utskicket stod det...

Bokslutskommuniké för verksamhetsåret 2024 flyttas från 21 februari 2025 till 27 februari 2025 Anledningen till senareläggning är sjukdom. För ytterligare information, kontakta: Teodor Aastrup VD Attana...

Nordic LEVEL Technology AB, en del av Nordic LEVEL Group AB (publ.), har ingått avtal om leverans av säkerhetstjänster för ett trossamfund. Avtalet omfattar larm, accessystem...

Som en del av Kristinehamns kommuns långsiktiga strategi tar kommunen nu ett viktigt kliv i sitt säkerhetsarbete tillsammans med Amido. Genom att samla tre passersystem i...