Analys från DailyFX

Gold Prices Chop At Support, but Beware Jackson Hole

To receive James Stanley’s Analysis directly via email, please sign up here.

Talking Points:

- Gold Technical Strategy: Gold prices continue consolidating near-resistance; under-side of wedge being tested.

- The longer-term bullish structure of Gold is still in-tact; but as FOMC officials are talking-up higher rates, this could bring a deeper retracement before top-side plays become attractive.

- If you’re looking for trading ideas, check out our Trading Guides. And if you want something more short-term in nature, check out our SSI indicator.

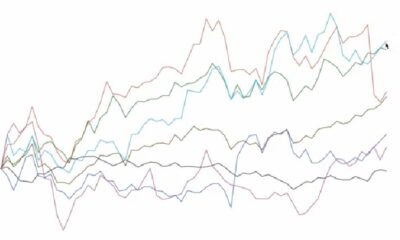

In our last article, we looked at the wedge formation that had developed in Gold prices after the bullish advance of August stalled below the July high. And connecting that July high to the August high gave a down-ward sloping trend-line that made up the top-side of a symmetrical wedge formation that continues to hold. Given the drivers behind Gold’s price action this year, this wedge-formation near resistance made sense. Gold prices have seen considerable pops-higher on the year as FOMC rate hike expectaitons have gotten kicked further-and-further into the future. And when the Fed does get more aggressive or hawkish, as we saw in May as many members of the bank talked up the prospect of higher rates, Gold prices get hit as investors buy USD in preparation for a ‘potential’ rate hike.

And this is somewhat of the issue with long-Gold scenarios at the current juncture. The July FOMC meeting saw the bank make a hawkish-tweak to their statement, very similar to what was seen at April’s FOMC meeting. And just like we saw in April, the market’s reaction to this ‘less dovish, slightly more hawkish’ statement was one of disbelief as markets continued to expect the Federal Reserve to stay loose and passive. But in the weeks following that April meeting and throughout May, and happening again this August following the July FOMC meeting, we’ve seen follow-thru with multiple Fed members talking up the prospect of higher rates. Last week, we heard from Mr. William Dudley and Mr. Dennis Lockhart, and already this week we’ve heard similar such comments from Vice Chairman Mr. Stanley Fischer. As these comments have come-in, Gold prices have continued to test deeper support levels with a bounce off of the bottom-portion of that symmetrical wedge this morning.

Created with Marketscope/Trading Station II; prepared by James Stanley

Given the Jackson Hole Economic Symposium on deck for later in the week in which we’ll hear much, much more from many Central Bankers including a keynote speech from Chair Yellen herself, and there is a significant amount of opportunity for even more hawkish commentary on U.S. rate hikes. Such a scenario could bring additional strength into the U.S. Dollar and weakness to Gold prices; but longer-term this could be a beneficial occurrence.

To be sure, we’re not saying that the Fed will be raising rates in September. Rather, it looks as though the Federal Reserve wants to keep markets ‘on their toes’ by assuring that they’re ready to hike rates when the underlying data is strong enough to allow it; but this may be well into 2017 before that actually happens. Instead, we’re looking to play a ‘redux’ of the May scenario, in which a hawkish Federal Reserve drives a deeper retracement in Gold prices so that longer-term positions could be sought near ‘bigger picture’ levels of support.

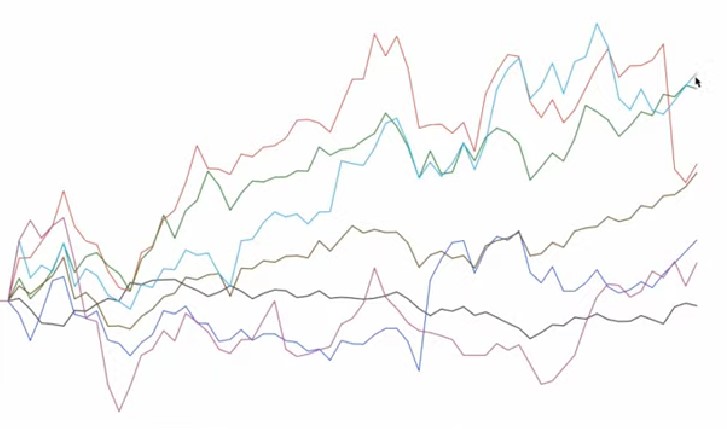

On the chart below, we look at three such zones of support that could become attractive in a strong-USD type of scenario; allowing for longer-term bullish entries in Gold.

Created with Marketscope/Trading Station II; prepared by James Stanley

— Written by James Stanley, Analyst for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX

Analys från DailyFX

EURUSD Weekly Technical Analysis: New Month, More Weakness

What’s inside:

- EURUSD broke the ‘neckline’ of a bearish ‘head-and-shoulders’ pattern, April trend-line

- Resistance in vicinity of 11825/80 likely to keep a lid on further strength

- Targeting the low to mid-11600s with more selling

Confidence is essential to successful trading, see this new guide – ’Building Confidence in Trading’.

Coming into last week we pointed out the likelihood of finally seeing a resolution of the range EURUSD had been stuck in for the past few weeks, and one of the outcomes we made note of as a possibility was for the triggering of a ’head-and-shoulders’ pattern. Indeed, we saw a break of the ’neckline’ along with a drop below the April trend-line. This led to decent selling before a minor bounce took shape during the latter part of last week.

Looking ahead to next week the euro is set up for further losses as the path of least resistance has turned lower. Looking to a capper on any further strength there is resistance in the 11825-11880 area (old support becomes new resistance). As long as the euro stays below this area a downward bias will remain firmly intact.

Looking lower towards support eyes will be on the August low at 11662 and the 2016 high of 11616, of which the latter just happens to align almost precisely with the measured move target of the ‘head-and-shoulders’ pattern (determined by subtracting the height of the pattern from the neckline).

Bottom line: Shorts look set to have the upperhand as a fresh month gets underway as long as the euro remains capped by resistance. On weakness, we’ll be watching how the euro responds to a drop into support levels.

For a longer-term outlook on EURUSD, check out the just released Q4 Forecast.

EURUSD: Daily

—Written by Paul Robinson, Market Analyst

You can receive Paul’s analysis directly via email bysigning up here.

You can follow Paul on Twitter at@PaulRobinonFX.

Analys från DailyFX

Euro Bias Mixed Heading into October, Q4’17

Why and how do we use IG Client Sentiment in trading? See our guide and real-time data.

EURUSD: Retail trader data shows 37.3% of traders are net-long with the ratio of traders short to long at 1.68 to 1. In fact, traders have remained net-short since Apr 18 when EURUSD traded near 1.07831; price has moved 9.6% higher since then. The number of traders net-long is 15.4% lower than yesterday and 16.4% higher from last week, while the number of traders net-short is 0.4% higher than yesterday and 10.5% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURUSD prices may continue to rise. Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EURUSD trading bias.

— Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

Analys från DailyFX

British Pound Reversal Potential Persists Heading into New Quarter

Why and how do we use IG Client Sentiment in trading? See our guide and real-time data.

GBPUSD: Retail trader data shows 38.2% of traders are net-long with the ratio of traders short to long at 1.62 to 1. In fact, traders have remained net-short since Sep 05 when GBPUSD traded near 1.29615; price has moved 3.4% higher since then. The number of traders net-long is 0.1% higher than yesterday and 13.4% higher from last week, while the number of traders net-short is 10.6% lower than yesterday and 18.3% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBPUSD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current GBPUSD price trend may soon reverse lower despite the fact traders remain net-short.

— Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

-

Analys från DailyFX10 år ago

EUR/USD Flirts with Monthly Close Under 30 Year Trendline

-

Marknadsnyheter2 år ago

Marknadsnyheter2 år agoUpptäck de bästa verktygen för att analysera Bitcoin!

-

Marknadsnyheter5 år ago

BrainCool AB (publ): erhåller bidrag (grant) om 0,9 MSEK från Vinnova för bolagets projekt inom behandling av covid-19 patienter med hög feber

-

Analys från DailyFX12 år ago

Japanese Yen Breakout or Fakeout? ZAR/JPY May Provide the Answer

-

Marknadsnyheter2 år ago

Marknadsnyheter2 år agoDärför föredrar svenska spelare att spela via mobiltelefonen

-

Analys från DailyFX12 år ago

Price & Time: Key Levels to Watch in the Aftermath of NFP

-

Analys från DailyFX8 år ago

Gold Prices Falter at Resistance: Is the Bullish Run Finished?

-

Nyheter7 år ago

Nyheter7 år agoTeknisk analys med Martin Hallström och Nils Brobacke