Marknadsnyheter

2017 annual reports — Landshypotek Bank committed to all of Sweden

fr, mar 16, 2018 12:45 CET

Today, Landshypotek Bank and Landshypotek Ekonomisk Förening publish their 2017 annual reports. Landshypotek Bank posted strong earnings and has a growing presence in the lending and savings markets. In autumn 2017, Landshypotek Bank completed a successful mortgage market entrance.

2017 annual reports — Landshypotek Bank committed to all of Sweden

Today, Landshypotek Bank and Landshypotek Ekonomisk Förening publish their 2017 annual reports. Landshypotek Bank posted strong earnings and has a growing presence in the lending and savings markets. In autumn 2017, Landshypotek Bank completed a successful mortgage market entrance.

The volume of loans outstanding increased SEK 2 billion to SEK 68.5 billion (66.5) during the year. Deposits also rose and totalled SEK 12.7 billion (11.7) at year end.

In 2017, the bank welcomed more farming and forestry loan customers as well as savers. The bank also opened its doors to providing mortgages to homeowners outside of the major cities with its successful mortgage market entry.

“Our underlying earnings posted a historic high. Above all else, we have had a great autumn with a successful market launch of our mortgage loans and a substantial increase in our visibility. This means we have been able to welcome numerous new customers — both for farming and forestry and for mortgages — to our bank,” says Catharina Åbjörnsson Lindgren, Acting CEO of Landshypotek Bank.

The Annual Report provides more comments on and descriptions of the bank’s and the association’s development over the past year. It also sets out Landshypotek Bank’s foundation as a bank with a difference, together with digitalisation innovation, sustainability perspectives, member and employee commitment, and the values-driven assignment for Swedish farming and forestry.

Landshypotek Bank is owned by its loan customers and organised as a cooperative association, Landshypotek Ekonomisk Förening. The bank’s profits are reinvested in operations and distributed to members. Should this year’s proposed dividend be adopted, SEK 900 million will have been returned to farming and forestry loan customers over the last six years.

Following a Group contribution of SEK 170 million from the bank to the association, the association’s Board proposes a dividend of 9 percent on member contributions, corresponding to SEK 153 million. The dividend resolution will be taken at the General Meeting in April.

“It is fantastic to work at a values-driven bank where it is clear where the profits go. It is an important part of our mission to continue to ensure that it is possible to run farming and forestry companies, to produce Swedish food and to have well-kept forests in Sweden. Our customers make Sweden a better place,” says Catharina Åbjörnsson Lindgren.

This information is information that Landshypotek Bank AB is obliged to make public pursuant to the Securities Markets Act. The information was submitted for publication at 12:45 pm CET on 16 March 2018.

At a glance — figures for Landshypotek Bank 2017

Operating profit amounted to MSEK 339.2 (353.4). The underlying operating profit, excluding the net result of financial transactions, was MSEK 387.3 (327.3).

Net interest income amounted to MSEK 800.4 (737.2).

Costs totalled MSEK 402.5 (402.4).

Net loan losses declined and amounted to MSEK 12.5 (14.8).

Lending amounted to SEK 68.5 billion (66.5).

Deposits amounted to SEK 12.7 billion (11.7).

For further information and comments, please contact:

Sofie Essayh, Communication and Press Officer at Landshypotek Bank, +46 70 2851363

Catharina Åbjörnsson Lindgren, Acting CEO, and Fredrik Sandberg, CFO and Acting Deputy CEO, can be contacted through Sofie Essayh.

Marknadsnyheter

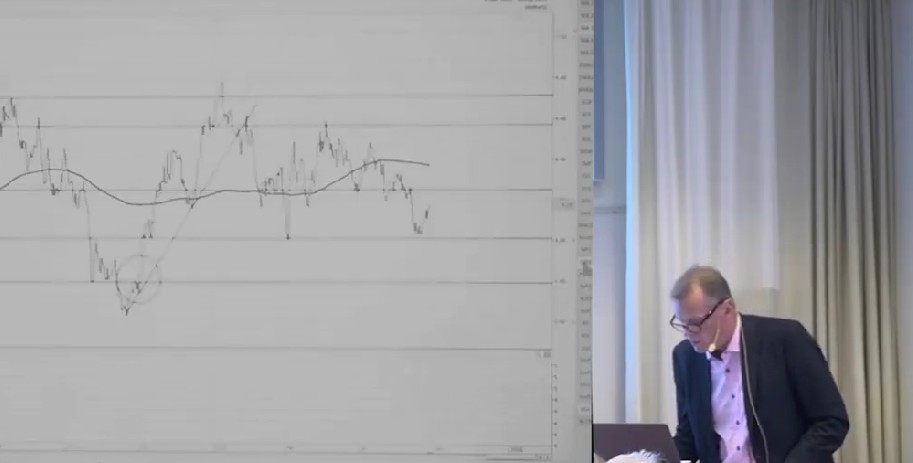

Teknisk analys på flera marknader med Anders Haglund

Anders Haglund går igenom den tekniska analysen på flera marknader samt även några olika enskilda aktier.

Marknadsnyheter

JRS chefsstrateg Torbjörn Söderberg om börsen framåt

JRS chefsstrateg Torbjörn Söderberg pratar med Jesper Norberg på EFN om börsens väg framåt. Man tar upp värderingar och makro, samt hur han själv väljer att agera.

Marknadsnyheter

Kreditkort skapar problem för USAs konsumenter – CNBC granskar

CNBC tittar närmare på hur kreditkort skapar problem för konsumenterna i USA som får betala räntor på upp till 36 %, och ovanpå det kommer nya avgifter. När det skapar så här stora problem blir det ett problem för ekonomin som helhet, det är inte bara ett individuellt problem.

CNBC granskar kreditkort och problemen de skapar

Vi skrev nyligen om rekordhög belåning hos investerare i USA. Det är samma sak här, när det är så många individer som är så hårt belånade blir det ett problem för hela aktiemarknaden.

-

Analys från DailyFX10 år ago

EUR/USD Flirts with Monthly Close Under 30 Year Trendline

-

Marknadsnyheter5 år ago

BrainCool AB (publ): erhåller bidrag (grant) om 0,9 MSEK från Vinnova för bolagets projekt inom behandling av covid-19 patienter med hög feber

-

Marknadsnyheter3 år ago

Marknadsnyheter3 år agoUpptäck de bästa verktygen för att analysera Bitcoin!

-

Analys från DailyFX12 år ago

Japanese Yen Breakout or Fakeout? ZAR/JPY May Provide the Answer

-

Marknadsnyheter2 år ago

Marknadsnyheter2 år agoDärför föredrar svenska spelare att spela via mobiltelefonen

-

Analys från DailyFX12 år ago

Price & Time: Key Levels to Watch in the Aftermath of NFP

-

Analys från DailyFX8 år ago

Gold Prices Falter at Resistance: Is the Bullish Run Finished?

-

Nyheter7 år ago

Nyheter7 år agoTeknisk analys med Martin Hallström och Nils Brobacke