Marknadsnyheter

Coop återkallar Coop Ägg Frigående 12-pack och 24-pack samt Xtra Ägg Frigående 15-pack

Coop återkallar Coop Ägg Frigående 12-pack, Coop Ägg Frigående 24-pack samt Xtra Ägg Frigående 15-pack med tre olika bäst före-datum. Anledningen till återkallelsen är att varorna kan innehålla salmonella. Leverantören av äggen har vid en rutinkontroll upptäckt salmonella i ett av de stall där äggen har värpts.

Återkallelsen gäller följande produkter med följande bäst före-datum:

- Coop Ägg Frigående inomhus, 12-pack, storlek ML, bäst före-datum 2023-01- 26, 2023-01-27, 2023-01-28.

- Coop Ägg Frigående inomhus, 24-pack, storlek M, bäst före-datum 2023-01- 26, 2023-01-27, 2023-01-28.

- Xtra Ägg Frigående inomhus, 15-pack, storlek S, bäst före-datum 2023-01- 26, 2023-01-27, 2023-01-28.

Coop tar händelsen på mycket stort allvar och utreder med leverantören hur detta har kunnat ske. Varorna kan innebära en hälsofara men vid upphettning till 70 grader dör salmonellabakterien.

Vid återkallelsen stoppas produkten i kassan och är inte möjlig att köpa. Kunder som har köpt någon av produkterna ovan med aktuellt bäst före-datum uppmanas lämna tillbaka produkten i Coops butiker och få pengarna tillbaka.

Coop beklagar det inträffade.

För mer information kontakta

Coops presstjänst: 010-743 13 13 eller media@coop.se

Coop

Coop är en av Sveriges största dagligvarukedjor som levererar prisvärd, hållbar matglädje och har mer än 800 butiker från Kiruna i norr till Smygehamn i söder. Coop har sedan 2008 erbjudit näthandel av mat och vår butik på coop.se erbjuder mer än 80 procent av de svenska hushållen möjligheten att få tillgång till sin beställning via hemleverans eller andra leveransmöjligheter. Coop rankas som ett av Sveriges mest hållbara varumärken och har störst andel ekologisk försäljning i branschen. Totalt omsätter Coop i Sverige 44 miljarder kronor och har över 22 000 medarbetare. För mer information om Coop besök: https://www.coop.se.

Marknadsnyheter

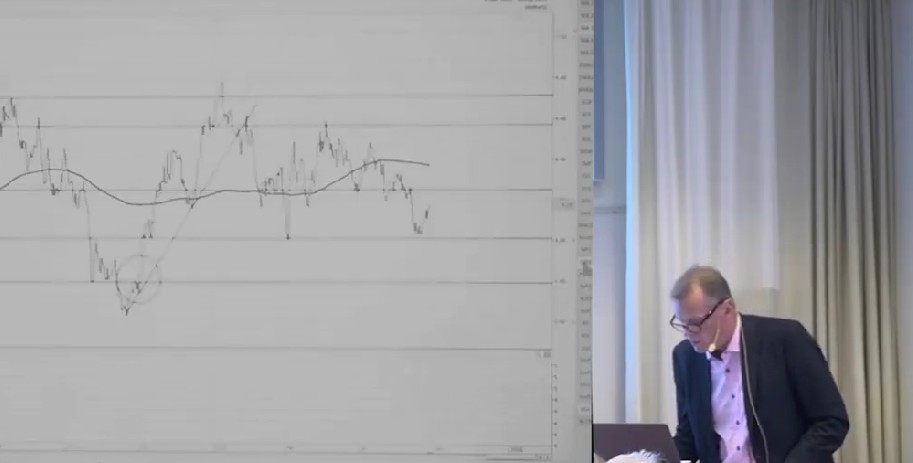

Teknisk analys på flera marknader med Anders Haglund

Anders Haglund går igenom den tekniska analysen på flera marknader samt även några olika enskilda aktier.

Marknadsnyheter

JRS chefsstrateg Torbjörn Söderberg om börsen framåt

JRS chefsstrateg Torbjörn Söderberg pratar med Jesper Norberg på EFN om börsens väg framåt. Man tar upp värderingar och makro, samt hur han själv väljer att agera.

Marknadsnyheter

Kreditkort skapar problem för USAs konsumenter – CNBC granskar

CNBC tittar närmare på hur kreditkort skapar problem för konsumenterna i USA som får betala räntor på upp till 36 %, och ovanpå det kommer nya avgifter. När det skapar så här stora problem blir det ett problem för ekonomin som helhet, det är inte bara ett individuellt problem.

CNBC granskar kreditkort och problemen de skapar

Vi skrev nyligen om rekordhög belåning hos investerare i USA. Det är samma sak här, när det är så många individer som är så hårt belånade blir det ett problem för hela aktiemarknaden.

-

Analys från DailyFX10 år ago

EUR/USD Flirts with Monthly Close Under 30 Year Trendline

-

Marknadsnyheter5 år ago

BrainCool AB (publ): erhåller bidrag (grant) om 0,9 MSEK från Vinnova för bolagets projekt inom behandling av covid-19 patienter med hög feber

-

Marknadsnyheter3 år ago

Marknadsnyheter3 år agoUpptäck de bästa verktygen för att analysera Bitcoin!

-

Analys från DailyFX12 år ago

Japanese Yen Breakout or Fakeout? ZAR/JPY May Provide the Answer

-

Marknadsnyheter2 år ago

Marknadsnyheter2 år agoDärför föredrar svenska spelare att spela via mobiltelefonen

-

Analys från DailyFX12 år ago

Price & Time: Key Levels to Watch in the Aftermath of NFP

-

Analys från DailyFX8 år ago

Gold Prices Falter at Resistance: Is the Bullish Run Finished?

-

Nyheter7 år ago

Nyheter7 år agoTeknisk analys med Martin Hallström och Nils Brobacke