Marknadsnyheter

Acroud publicerar delårsrapport Q3 2024: A challenging quarter

Financial highlights during third quarter 2024

• Revenue amounted to EUR 9 240 (9 868) thousand, corresponding to a decline of -6%

and an organic decline of -1.3%.

• Adjusted EBITDA (before items affecting comparability) was EUR 815 (1 175) thousand decreasing by 31% year-on-year. EBITDA amounted to EUR 790 (945) thousand, decreasing by 16% year-on-year.

• Profit after tax was EUR -1 040 (-1 874) thousand. Adjusted profit after tax (before items affecting comparability and currency effects) was EUR -780 (-753) thousand.

• Earnings per share after dilution amounted to EUR -0.006 (-0.012). Adjusted earnings per share (before items affecting comparability and currency effects) was EUR -0.005 (-0.005).

• New Depositing Customers (NDC) amounted to 41 204 (72 270) decreasing by 43%.

• Cash flow from operating activities amounted to EUR 206 (875) thousand.

Important events during the quarter

As per written procedure, in Q3 2024, Acroud paid five (5) per cent of the initial nominal amount of the the outstanding bond. Following this payment that happened on the 10th of July 2024, the Company has a net bond loan of SEK 190 million which amounts to SEK 180 million when issued at 95% of par.

For more information on the Written Procedure, please refer to Press Release issued 17 June 2024, which can be found on the Company’s website www.acroud.com.

Important events after the quarter

After the quarter, the company announced that it will until further notice postpone the interest payment due on 7 October 2024 on its SEK 225,000,000 senior secured bonds with ISIN SE001756248 1 (the ”Bonds”). Acroud also announced that it has entered into a standstill agreement with certain larger bondholders in order to receive time to find and implement a long-term viable solution for the Company which will strengthen its financial and liquidity position and to manage the upcoming maturity of the Bonds .

On 31 October 2024, the company paid the postponed interest together with accrued default interest.

On 12 November 2024, Kim Mikkelsen resigned from his designation of Chairman and Member of the board of directors of Acroud. Proposal for a new board member will be presented no later than in connection with the notice for the 2025 annual general meeting. Peter Åström assumed, with immediate effect, the role of chairman of the board of directors until the next general meeting.

CEO comments: A challenging quarter

The third quarter of 2024 has been a challenging period, not only for Acroud but for the industry as a whole. Many of our competitors have reported weaker figures, underscoring the broader market challenges we are collectively facing. Despite this backdrop, our efforts to improve our capital structure remain a priority, as we continue to focus on positioning Acroud for long-term stability and growth.

Performance Overview

For Q3 2024, revenue amounted to EUR 9,240 thousand, representing a decline of 6% compared to the same period last year, with an organic decline of 1.3%. Adjusted EBITDA (before items affecting comparability) was EUR 815 thousand, a year-on-year decrease of 31%. While these figures reflect a contraction, we recognize that our ability to maintain relatively stable revenue during a cooling industry quarter highlights the resilience of our diversified offerings and strategic approach.

Our focus remains on long-term sustainability, even as profitability is impacted in the short term by the challenges of the broader market environment and the associated costs of improving our financial structure. Cash flow from operating activities amounted to EUR 206 thousand, and profit after tax was EUR -1,040 thousand. Adjusted profit after tax was EUR -780 thousand, slightly lower compared to Q3 2023 (-753 thousand).

New Depositing Customers (NDC) totaled 41,204, a 43% decline year-on-year. This decline aligns with the cautious market environment and reflects our continued prioritization of high-quality NDCs over sheer volume. We remain confident that this strategic direction will drive sustainable growth in the long term, even as it impacts short-term metrics.

Strategic Focus on Capital Structure

We are making steady progress in restructuring and strengthening our capital structure. By optimizing the allocation of resources, we aim to free up more funds for reinvestment into growth initiatives. This is vital to ensuring that Acroud is positioned to capitalize on opportunities when the market stabilizes and rebounds.

We have also made strides in our efforts to streamline operations and reduce inefficiencies, aligning the business with current market realities while remaining focused on long-term value creation.

Organizational Changes

In November, our Chairman of the Board announced his decision to step down to focus on his role as a long-term investor in the company, rather than being actively involved in the Board. We thank him for his contributions during his tenure and for his continued commitment to supporting Acroud’s growth and success as a key shareholder. The Board is working diligently to ensure a smooth transition and continuity of leadership.

Looking Ahead

While Q3 was marked by industry-wide challenges, we remain optimistic about the future. Our continued focus on strengthening the company’s financial foundation, improving operational efficiency, and prioritizing high-quality growth initiatives positions us well to navigate the current market headwinds.

Our strategic efforts to improve capital structure will unlock opportunities for reinvestment, and we are committed to returning to a growth trajectory that benefits all stakeholders.

I want to extend my gratitude to our team, partners, and investors for their continued support and resilience during this challenging period. Together, we are building a stronger, more adaptable Acroud, prepared to thrive as market conditions evolve.

Join the Ride!

Robert Andersson, CEO

21 November 2024

Responsible parties

This information constitutes inside information that Acroud AB (publ) is required to disclose under the EU Market Abuse Regulation 596/2014. The information in this press release has been published through the agency of the contact persons below, at the time specified by Acroud AB’s (publ) news distributor Cision for publication of this press release. The persons below may also be contacted for further information.

For further information, please contact:

Robert Andersson, President and CEO

+356 9999 8017

Andrzej Mieszkowicz, CFO

+356 9911 2090

ACROUD AB (publ)

Telephone: +356 2132 3750/1

E-mail: info@acroud.com

Website: www.acroud.com

Certified Adviser: FNCA Sweden AB, info@fnca.se

From May 2024 (Q1 Report) Acroud has changed reporting and company language to English. This means that Interim Reports and the correlated press releases will be issued in English only.

About ACROUD AB

ACROUD is a fast-growing global challenger that operates and develops comparison and news sites within Poker, Sports Betting and Casino. Acroud also offers SaaS solutions for the iGaming affiliate industry. In past years, a number of companies have joined the ride and thus several experienced individuals in the industry leads Acroud’s journey to become ”The Mediahouse of The Future”. Our mission is to connect people, Content Creators (Youtubers, Streamers, Affiliates) and businesses. We are growing fast and remain a leading global player in the industry with just over 70 people in Malta, United Kingdom, Denmark and Sweden. Acroud has been listed on the Nasdaq First North Growth Market since June 2018.

Marknadsnyheter

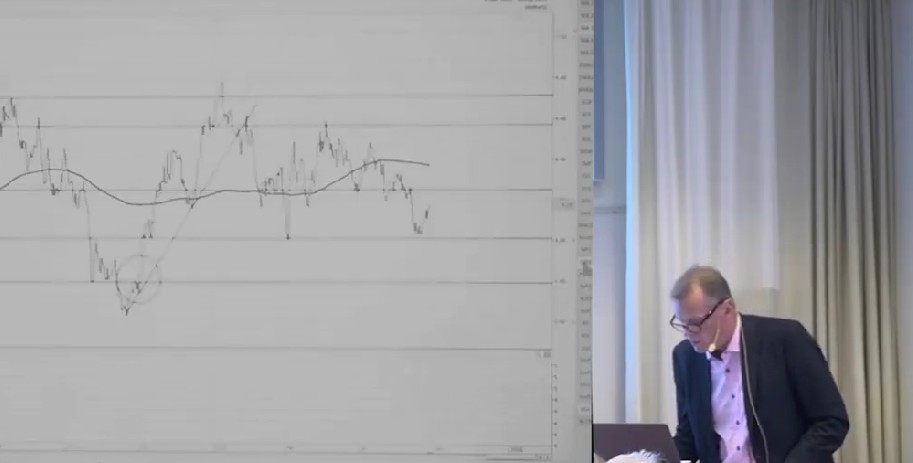

Teknisk analys på flera marknader med Anders Haglund

Anders Haglund går igenom den tekniska analysen på flera marknader samt även några olika enskilda aktier.

Marknadsnyheter

JRS chefsstrateg Torbjörn Söderberg om börsen framåt

JRS chefsstrateg Torbjörn Söderberg pratar med Jesper Norberg på EFN om börsens väg framåt. Man tar upp värderingar och makro, samt hur han själv väljer att agera.

Marknadsnyheter

Kreditkort skapar problem för USAs konsumenter – CNBC granskar

CNBC tittar närmare på hur kreditkort skapar problem för konsumenterna i USA som får betala räntor på upp till 36 %, och ovanpå det kommer nya avgifter. När det skapar så här stora problem blir det ett problem för ekonomin som helhet, det är inte bara ett individuellt problem.

CNBC granskar kreditkort och problemen de skapar

Vi skrev nyligen om rekordhög belåning hos investerare i USA. Det är samma sak här, när det är så många individer som är så hårt belånade blir det ett problem för hela aktiemarknaden.

-

Analys från DailyFX10 år ago

EUR/USD Flirts with Monthly Close Under 30 Year Trendline

-

Marknadsnyheter5 år ago

BrainCool AB (publ): erhåller bidrag (grant) om 0,9 MSEK från Vinnova för bolagets projekt inom behandling av covid-19 patienter med hög feber

-

Marknadsnyheter3 år ago

Marknadsnyheter3 år agoUpptäck de bästa verktygen för att analysera Bitcoin!

-

Analys från DailyFX12 år ago

Japanese Yen Breakout or Fakeout? ZAR/JPY May Provide the Answer

-

Marknadsnyheter2 år ago

Marknadsnyheter2 år agoDärför föredrar svenska spelare att spela via mobiltelefonen

-

Analys från DailyFX12 år ago

Price & Time: Key Levels to Watch in the Aftermath of NFP

-

Analys från DailyFX8 år ago

Gold Prices Falter at Resistance: Is the Bullish Run Finished?

-

Nyheter7 år ago

Nyheter7 år agoTeknisk analys med Martin Hallström och Nils Brobacke