Marknadsnyheter

eDreams ODIGEO continues to outperform the market and delivers strong growth in subscribers, bookings, revenues and profits

Barcelona, 15 November 2022. – eDreams ODIGEO (hereinafter ‘eDO’ or ‘the Company’), Europe’s largest online travel company, the largest globally in terms of flights outside of China and one of the largest European e-commerce businesses, today reports its results for the first half of its fiscal year 2023 ended 30 September 2022.

With 247 websites and apps in 44 countries, 21 languages and 37 different currencies on one central platform, eDreams ODIGEO now covers 80% of the global travel market.

eDO continues to outperform the industry and its peers, as it has consistently done for the last two years. Since launching its subscription programme, Prime, eDO has become a higher quality business with a loyal customer base and a recurring revenue stream that delivers predictable and sustainable customer relationships, together with the associated ensuring financial benefits. Despite the macroeconomic context, the travel market, particularly leisure travel, will still grow. The Company continues to outperform the market, with its booking levels standing at plus 48% vs 2019 pre-COVID, and almost 1 million new subscribers added in the last 6 months alone. The continued strong performance of the business allows it to reconfirm its March 2025 guidance of over 7.25 million subscribers, ARPU of €80 and cash EBITDA of €180 million.

RESULTS HIGHLIGHTS

- eDreams ODIGEO continues to deliver strong Bookings growth

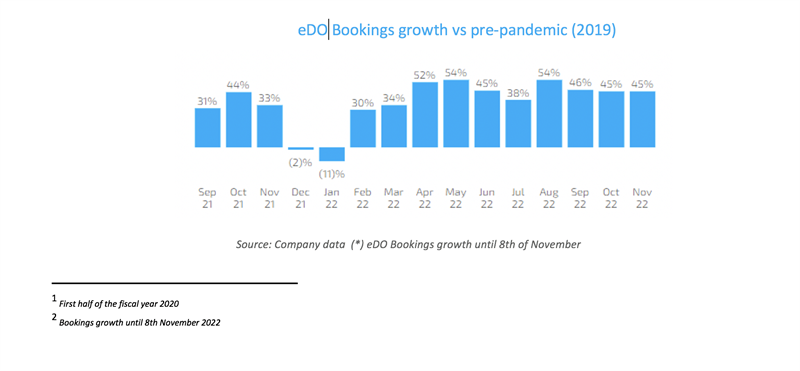

- In the first half of the fiscal year 2023, eDO achieved strong Bookings, reaching 8.6 million, which represents 50% above the same period last year and +48% above pre-COVID-191.

- In October and November2 despite macro-economic headwinds, Bookings were up 45% above pre-COVID-191

- eDO Bookings performance is materially better than the market, with a business that has increased its quality with the pivot to subscription.

- The world’s first travel subscription programme, eDreams Prime, continues to outperform

-

- The Company reached 3.6 million subscribers, which is the result of a 479,000 run rate per quarter during the first half of the fiscal year 2023. This represents growth of +8% and +47% vs fiscal years 2022 and 2021 quarterly run rates, respectively.

- Despite Omicron, Ukraine War, high inflation and a market still below Pre-COVID levels, Prime’s Net Adds run rate is ahead of expectations, and churn rates have slightly improved.

- Solid financial performance with strong growth in Cash Revenue Margin and meaningful Cash EBITDA Margin improvement

- In the first half of the fiscal year, Revenue Margin and Cash Revenue Margin continued above pre-COVID levels, by 3% and 12% respectively.

- The Company delivered strong growth in Cash Revenue Margin, up 69% year-on-year to €316.5 million, despite travel options constrained by COVID-19 travel restriction uncertainty. Revenue Margin increased by 72%, to €289.0 million, due to the 50% increase in Bookings and 15% increase in Revenue Margin per Booking.

- Cash Marginal Profit increased to €74.4 million in the period; up +51% from the first half of the fiscal year 2022.

- As expected, the business delivered strong Cash EBITDA in the second quarter, which resulted in €34.5 million in the first half of the year (€20.5 million in the second quarter of the fiscal year 2023 standalone), up 78% vs the same period last year. As guided in the first quarter of the fiscal year, strong growth in the first year of Prime members delays profitability as it jumps in their second year.

- The Company is progressing at a brisk pace with the strategic expansion of its global workforce, which will grow by 50% to further fuel its long-term growth as a subscription business. The higher investments in personnel and the effects of foreign currency exchange resulted in higher fixed costs. This, coupled with higher variable costs associated with the notable increase in trading, drove the bottom-line result.

- Looking ahead

- These results demonstrate the Company is well on track to meet its self-imposed targets by the fiscal year 2025:

- Cash EBITDA in excess of €180 million

- Greater than 7.25 million Prime members

- Average Revenue per User (ARPU) of €80, approximately.

- These results demonstrate the Company is well on track to meet its self-imposed targets by the fiscal year 2025:

Dana Dunne, CEO of eDreams ODIGEO commented: “We are delighted to deliver another solid set of results, which continue to demonstrate that our subscription model is breaking the mold and revolutionising the way people book travel. Our successful transition from a transaction-led business to one primarily based on subscriptions is once again reflected in the continued and strong growth of our subscriber base, which has now3 topped 3.8 million members.

Exactly one year ago, we set ambitious goals for ourselves: exceeding 7.25 million Prime members and €180 million in Cash EBITDA by 2025. Throughout the last 12 months, we have made excellent progress towards these and our performance in the first half of the fiscal year shows that we are well on track to deliver on our 3-year guidance, as we have consistently done. Everyone at eDO is looking forward to delivering further growth and superior returns for our shareholders and great service and an unrivalled proposition for our customers.

Looking at the wider industry, travel has shown strong growth for decades, except during the global shutdown of COVID. Through economic downturns, conflict or even natural disasters, the leisure traveller has demonstrated their desire to keep travelling. Now is no different and we expect the resurgence to continue. eDreams ODIGEO is trading 48% above pre-COVID levels and is therefore undeniably better positioned than anybody else to take advantage of this next phase with its focus on leisure travel and a proposition which delivers unbeatable choice and value to its customers.”

BUSINESS REVIEW

Throughout the first quarter, the travel market continued to improve and recover significantly, with eDreams ODIGEO’s trading demonstrating its recovery from COVID-19 with best-in-class performance and outperforming the market (and its competitors) by a significant margin, which was driven by the increased quality of its business with the pivot to subscription and consumers’ desire to travel.

eDreams ODIGEO, with its unique customer proposition and reaching 3.8 million Prime subscribers in November4, is positioned to take advantage in a post-COVID19 era to attract more customers and capture further market share.

Throughout the pandemic, eDreams ODIGEO has consistently outperformed the Global OTAs and the airline industries, which highlights the strength and adaptability of its business model. eDreams ODIGEO’s superior value proposition is leading to outperforming the industry. In the second quarter of the fiscal year 2023, the Company outperformed the regular airlines by 64 percentage points and the Low-Cost carriers by 40 percentage points. Despite eDO’s superior value proposition leading to outperforming the industry peers, the gap is expected to close as corporate travel returns.

[3] As of 8th of November 2022

[4] As of 8th November2022.

IMPROVEMENTS IN YEAR-ON-YEAR TRADING AHEAD OF AIRLINE INDUSTRY

| REGION | 2Q FY22 | 3Q FY22 | 4Q FY22 | 1Q FY23 | 2Q FY23 |

| eDO Total | 22% | 26% | 20% | 50% | 46% |

| IATA Europe | (52)% | (41)% | (40)% | (21)% | (18)% |

| Low Cost Airlines | (36)% | (26)% | (43)% | 1% | 6% |

| eDO vs IATA | 74ppt | 67ppt | 60ppt | 71ppt | 64ppt |

| eDO vs Low Cost | 58ppt | 52ppt | 63ppt | 49ppt | 40ppt |

Source: IATA Economics, Corporate Low Cost Airlines Websites & Company Data.

Despite the conflict in Ukraine, the global increase in inflation, and recent industry disruptions, in the first quarter of the fiscal year 2023, eDO achieved strong Bookings, reaching 8.6 million Bookings, which represents +50% above the same period last year and +48% above pre-COVID. Additionally, mobile bookings remained stable and accounted for 54% of the total flight bookings made in the second quarter.

FINANCIAL REVIEW

Revenue Margin and Cash Revenue Margin continue above pre-COVID levels by 3% and 12%, respectively. Cash Revenue Margin in the first half of the fiscal year 2023 increased by +69% compared to the same period last year, due to Bookings being up +50% and the increase in Revenue Margin per Booking of +15% driven by the increased quality of our business with the pivot to subscription.

Overall, in the first half of the fiscal year, eDO has seen the improving trends it saw in the fiscal year 2022 and a return to profitability. Cash Marginal Profit stood at €74.4 million, an increase of +51% compared to the previous year, when it reached €49.2 million. As expected, strong Cash EBITDA in the second quarter of the fiscal year 2023, which resulted in €34.5 million in the aggregated of the half year (€20.5 million in the second quarter alone), up 78% vs the same period last year. As guided in the first quarter, strong growth in Prime members in their first year delays growth in profitability but jumps in the second year. In addition, if instead of reaching 3.6 million members in the second quarter of the fiscal year 2023, the Company had reached 3.5 million members (110,000 less net adds, with 290,000 new members instead of 400,000), eDO would have achieved an 18% Cash EBITDA margin instead of 13%, which would have represented 5 points higher Cash EBITDA Margin.

Revenue diversification initiatives continue to develop. The Revenue Diversification Ratio continues to grow and has increased to 73% in the last twelve months to the second quarter of 2023, up from +54% in the same period of the fiscal year 2021, rising 17 percentage points in two years.

Adjusted Net Income was a loss of €19.0 million in the first half of the fiscal year 2023, compared to a loss of €27.7 million in the same period last year. The Company believes that Adjusted Net Income better reflects the real ongoing operational performance of the business.

The bottom-line result is mainly driven by the planned strategic expansion of the Company’s global workforce. As announced last year, eDO plans to add 500 new employees by March 2025 and it has already increased its workforce by 201 employees year-on-year, with 170 new employees hired between March and September 2022 alone, representing 34% of the target headcount achieved in less than 15% of the time. The higher investments in personnel and the effects of foreign currency exchange resulted in higher fixed costs. This, coupled with higher variable costs associated with the notable increase in trading, contributed to the bottom-line result.

In the first half of the fiscal year 2023, despite Ukraine war, recent air industry disruptions, which affected good portions of the first quarter, and macro headwinds, the Company ended the quarter with a positive Cash Flow from Operations of €33.1 million, mainly due to a working capital inflow of €19.5 million

The inflow during the first half of the fiscal year 2023 is smaller than in the first half of the fiscal year 2022 due to the higher recovery of volumes, especially in the second quarter of fiscal year 2022, with the massive vaccination and release of travel restrictions while in the first half of the fiscal year 2023 the volumes have been more stable.

Unsurprisingly, leverage ratios have been temporarily impacted. As announced on the 19th of January, the Company successfully refinanced all its debt with better contractual terms for the debt, including most importantly the maintenance covenant. EBITDA of reference is now Cash EBITDA, covenant now springs at 40% vs 30% previously, and from September 2022 and December 2022 the Cash EBITDA of reference is the higher of last quarter annualised or LTM.

SUMMARY INCOME STATEMENT

| (in € million) | 2Q FY23 | Var. FY23 vs. FY22 | 2Q FY22 | 1H FY23 | Var. FY22 vs. FY21 | 1H FY22 |

| Revenue Margin | 143.3 | 43% | 99.9 | 289.0 | 72% | 168.4 |

| Cash Revenue Margin | 157.3 | 39% | 113.5 | 316.5 | 69% | 187.0 |

| Cash EBITDA | 20.5 | 26% | 16.2 | 34.5 | 78% | 19.4 |

| Adjusted EBITDA (*) | 6.4 | 138%. | 2.7 | 7.0 | 837% | 0.7 |

| Net income | (10.1) | N.A. | (13.6) | (24.0) | N.A. | (37.5) |

| Adjusted net income (*) | (7.5) | N.A. | (12.2) | (19.0) | N.A. | (27.7) |

| (in thousands) | ||||||

| Bookings | 4,181 | 19% | 3,513 | 8,583 | 50% | 5,740 |

PRIME REVIEW

eDreams ODIGEO is the leader and inventor of a subscription-based model in travel. Prime continues to improve the quality of the business and grows strongly. Prime membership grew by 109% year-on-year to 3.6 million subscribers, which is the result of a 479,000 run rate per quarter during the first half of the fiscal year 2023 (+8% and +47% vs quarterly run rates of fiscal years 2022 and 2021, respectively). Over the past 5 years, eDreams ODIGEO has successfully developed and tested its unique subscription offering and has a bright future ahead. During the pandemic, the Company continued to invest and innovate its subscription offering and has seen remarkable results.

One year after the start of super high growth in Prime Net Adds, Gross Adds will be partially offset by churn applying to a higher Prime member base. The average revenue per user (ARPU)3 of Prime is converging with the guidance of €80 per member and stood at €80.4 per member. Prime Cash Marginal Profit in the last 12 months to the second quarter of the fiscal year 2023 reached 54%.

Looking ahead

These results demonstrate that the Company is well on track to meet its self-imposed targets by the fiscal year 2025:

-

-

- Cash EBITDA in excess of €180 million

- Greater than 7.25 million Prime members

- Average Revenue per User (ARPU) of €80, approximately.

-

-ENDS-

About eDreams ODIGEO

eDreams ODIGEO is one of the world’s largest online travel companies and one of the largest e-commerce businesses in Europe. The business is the largest player worldwide in flight revenues, excluding China, and the largest in Europe. Under its four leading online travel agency brands – eDreams, GO Voyages, Opodo, Travellink, and the metasearch engine Liligo – it serves more than 17 million customers per year across 44 markets. Listed on the Spanish Stock Market, eDreams ODIGEO works with over 690 airlines and +2.1 million hotels. The business conceptualised Prime, the first subscription product in the travel sector which has attracted 3.8 million members since launching in 2017. The brand offers the best quality products and the widest choice of regular flights, low-cost airlines, hotels, dynamic packages, cruises, car rental services and travel insurance products to make travel easier, more accessible, and better value for consumers across the globe.

GLOSSARY OF TERMS

Cash EBITDA means ”Adjusted EBITDA”, plus the variation of the Prime deferred revenue corresponding to the Prime fees that have been collected and that are pending to be accrued. The Prime fees pending to be accrued are non-refundable and will be booked as revenue based on usage, which refers to each instance the customer uses Prime to make a Booking with a discount, or when the Prime contracted period expires. Cash EBITDA provides to the reader a view of the sum of the ongoing EBITDA and the full Prime fees generated in the period.

Cash Marginal Profit means ”Marginal Profit” plus the variation of the Prime deferred revenue corresponding to the Prime fees that have been collected and that are pending to be accrued. The Prime fees pending to be accrued are non-refundable and will be booked as revenue based on usage, which refers to each instance the customer uses Prime to make a Booking with a discount, or when the Prime contracted period expires. Cash Marginal Profit provides a measure of the sum of the Marginal Profit and the full Prime fees generated in the period.

Cash Revenue Margin means ”Revenue Margin” plus the variation of the Prime deferred revenue corresponding to the Prime fees that have been collected and that are pending to be accrued. The Prime fees pending to be accrued are non-refundable and will be booked as revenue based on usage, which refers to each instance the customer uses Prime to make a Booking with a discount, or when the Prime contracted period expires. Cash Revenue Margin provides a measure of the sum of the Revenue Margin and the full Prime fees generated in the period.

Marknadsnyheter

JRS chefsstrateg Torbjörn Söderberg om börsen framåt

JRS chefsstrateg Torbjörn Söderberg pratar med Jesper Norberg på EFN om börsens väg framåt. Man tar upp värderingar och makro, samt hur han själv väljer att agera.

Marknadsnyheter

Kreditkort skapar problem för USAs konsumenter – CNBC granskar

CNBC tittar närmare på hur kreditkort skapar problem för konsumenterna i USA som får betala räntor på upp till 36 %, och ovanpå det kommer nya avgifter. När det skapar så här stora problem blir det ett problem för ekonomin som helhet, det är inte bara ett individuellt problem.

CNBC granskar kreditkort och problemen de skapar

Vi skrev nyligen om rekordhög belåning hos investerare i USA. Det är samma sak här, när det är så många individer som är så hårt belånade blir det ett problem för hela aktiemarknaden.

Marknadsnyheter

Varför går det så dåligt för Las Vegas?

Det pratas mycket om att Las Vegas har blivit tomt. Det kommer färre besökare både från USA och utlandet, i en sådan omfattning att vägar som förut var fyllda med bilar nu är smidiga att ta sig fram på. De enda som fortsatt verkar komma är affärsresenärerna.

Las Vegas får mycket kritik för att ha blivit för giriga. Hotellen har börjat lägga på alla möjliga konstiga avgifter för att tjäna mer, restaurangerna lägger på avgifter och dessutom har det tillkommit flera nya skatter. Besökarna känner sig lurade.

-

Analys från DailyFX10 år ago

EUR/USD Flirts with Monthly Close Under 30 Year Trendline

-

Marknadsnyheter5 år ago

BrainCool AB (publ): erhåller bidrag (grant) om 0,9 MSEK från Vinnova för bolagets projekt inom behandling av covid-19 patienter med hög feber

-

Marknadsnyheter3 år ago

Marknadsnyheter3 år agoUpptäck de bästa verktygen för att analysera Bitcoin!

-

Analys från DailyFX12 år ago

Japanese Yen Breakout or Fakeout? ZAR/JPY May Provide the Answer

-

Marknadsnyheter2 år ago

Marknadsnyheter2 år agoDärför föredrar svenska spelare att spela via mobiltelefonen

-

Analys från DailyFX12 år ago

Price & Time: Key Levels to Watch in the Aftermath of NFP

-

Analys från DailyFX8 år ago

Gold Prices Falter at Resistance: Is the Bullish Run Finished?

-

Nyheter7 år ago

Nyheter7 år agoTeknisk analys med Martin Hallström och Nils Brobacke