Marknadsnyheter

eDreams ODIGEO delivers strong performance with surging profitability, revenues and subscribers

Results for the Q1 ‘24 ended 30th June 2023

Continued success of subscription model as it becomes the largest profit and revenue contributor

On track to meet or exceed 2025 targets

Barcelona, 31 August 2023. – eDreams ODIGEO (hereinafter ‘eDO’ or ‘the Company’), the world’s leading travel subscription company and one of Europe’s largest e-commerce firms, today released its results for Q1 FY24 ended 30 June 2023.

The Company achieved yet another quarter of outperformance, again powered by the strength of its subscription-based model with growth across all key metrics; profits, revenues and subscribers all surged. Prime, the world’s first and largest travel subscription platform, remains the primary driver for the Company’s growth as it continued to outperform outstandingly, with its membership base growing by 47% to 4.7 million members in Q1 of the fiscal year, and totalling 4.9 million members today(1).

The Company’s continued and effective strategic execution brings it ever nearer to achieving its self-imposed targets for 2025: greater than 7.25 million Prime members, around €80 ARPU (Average Revenue Per User) and Cash EBITDA in excess of €180 million.

RESULTS HIGHLIGHTS

● Subscription model continues to drive significant improvements in profitability

○ As guided previously, the maturity of Prime members is the most important driver for profitability and this has resulted in substantial improvements in profitability as more Prime members renew their memberships and are in year two or beyond of their subscription.

○ Cash EBITDA more than doubled to €29.4 million, against €14.0 million reported in Q1 of fiscal year 2023. Cash EBITDA Margin increased dramatically by 9 percentage points year-on-year.

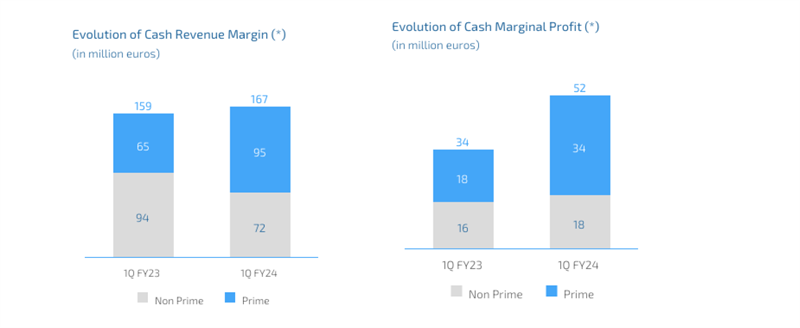

○ Cash Marginal Profit stood at €52.0 million, up 55%, and the margin had a 10 percentage points improvement year-on-year.

○ Revenue Margin – excluding Adjusted Revenue Items – and Cash Revenue Margin increased by 8% and 5%, respectively year-on-year, following the successful expansion of the Prime Member Base, despite the context of an industry moving to more normalised seasonality patterns.

● Prime continues to outperform

○ The world’s first and largest travel subscription platform, Prime, continues to improve the quality of the business and grows strongly. Membership grew by 47%, reaching 4.7 million at the end of Q1 and topping 4.9 million in August (2).

● Future reporting

○ Following the shift in the Company’s business from transactional to subscription-based the Company has decided to adapt its financial disclosures to better reflect its operating performance as a subscription company. From here on, performance indicators will be presented within two new segments: Prime and Non-Prime (more detailed description of future metrics is highlighted in the Financial Overview).

● Well on track to meet self-imposed 2025 targets

– Greater than 7.25 million Prime members

– Prime ARPU (Average Revenue Per User) of €80, approximately

– Cash EBITDA in excess of €180 million.

Dana Dunne, CEO of eDreams ODIGEO commented: ”We have achieved a stellar start to our fiscal year, results that directly reflect the success of our strategic and innovative approach and the dedication of our talented team. Our investments and decisions are clearly bearing fruit, putting us in an optimal position to expand further. With 2025 only 18 months away, we are now looking beyond our once-seen-as-ambitious 2025 targets, which are now well within reach thanks to the excellent operational and strategic execution of our plans.

In 2017, we introduced our Prime subscription programme, setting us apart from traditional travel companies. While industries like supermarkets (Costco) or video streaming (Netflix) had successfully embraced subscriptions long ago, the travel industry had not ventured into this territory until we took the lead. Today, our results demonstrate our success, with most of our revenues and profits now being derived from this segment. We are now unequivocally a subscription company. As a result, we are introducing a new reporting breakdown, aligned with similar subscription businesses, thus enabling our key stakeholders to better understand our progress.

This performance is deeply rooted in our ever-increasing tech capabilities. As we continue to strengthen our tech powerhouse, notably in the field of AI, we have emerged as a leader not only in the travel sector but also in the broader e-commerce industry, blazing a trail for others to follow. As we chart the path forward, we do so with increased confidence in the boundless opportunities that await us”.

GENERAL OVERVIEW ON Q1 PERFORMANCE

eDreams ODIGEO made further significant progress in Q1 of the fiscal year 2024. The business delivered continued rapid revenue margin growth, with sharply improved margins resulting in rising profitability following the pivot to a subscription-based model. As guided, the maturity of Prime members is the most important driver for profitability. The continued growth of Prime membership to 4.7 million members by the period end and 4.9 million to date has resulted in strong improvements in profitability as more and more Prime members renew their memberships. In Q1 of the fiscal year 2024, eDreams ODIGEO continued to see significant Cash Marginal Profit and Cash EBITDA Margin improvements as the maturity of Prime members increased.

Despite the industry moving to more normalised seasonality patterns, eDreams ODIGEO continued to deliver solid growth rates in revenues. Revenue Margin – excluding Adjusted Revenue Items – and Cash Revenue Margin in Q1 increased 8% and 5%, respectively, vs. the same period last year, following the successful expansion of the Prime Member Base.

Prime Revenue Margin was up 65%, while Prime Cash Revenue Margin increased by 46%, in line with the growth of Prime Members of 47%. This strong Revenue Margin growth rates were offset by the Non-Prime Revenue Margin, which decreased 23% vs. Q1 of the fiscal year 2023, as the Q1 of the fiscal year 2023 was positively impacted by a catch-up of Omicron Bookings.

In addition, regarding Revenue Margin by the timing of recognition, the increase in Gradual Revenue Margin follows the strong growth of the Prime Business as the subscription fees are a substantial part of the Gradual Revenue Margin, and the decrease in Transaction Date Revenue Margin is due to 1Q FY23 being positively impacted by a catch up of Omicron Bookings. Additionally, mobile bookings also improved and accounted for 58% of our total flight bookings, a record in the history of the company.

Overall, Q1 of fiscal year 2023 has seen the improving trends seen in the previous quarters as well as significant improvements in profitability due to an increasing number of Prime members renewing their memberships.

FINANCIAL OVERVIEW

Marginal Profit and Cash Marginal Profit stood at €42.6 million and €52.0 million, an increase of 112% and 55% compared to Q1 of fiscal year 2023, respectively. Cash Marginal Profit Margin increased to 31% from 21% in Q1 of fiscal year 2023, a 10 percentage point improvement. Cash EBITDA also showed substantial improvements, which resulted in €29.4 million in the first quarter of fiscal year 2024, up 110% vs. the same period last year.

As the maturity of Prime members increases, margins improve. Cash EBITDA Margin in Q1 of the fiscal year 2024 stood at 18% vs. 9% in the same period of the fiscal year 2023. As guided in Q1 of fiscal year 2023, strong growth in year 1 Prime members delays profitability, as profitability improves from year 2 onwards. In Q1 of the fiscal year 2024, Cash Marginal Profit Margin for Prime increased to 35% from 27% in the Q1 of fiscal year 2023, a 9 percentage point improvement in a ear, as the Cash Marginal Profit for Prime weight over total expanded 13pp, from 52% in Q1 of fiscal year 2023 to 65% in the same period of fiscal year 2024. Net Income and Adjusted Net Income were a gain of €4.1 million and €1.1 million in Q1 of fiscal year 2024 (vs. loss of €13.9 million and €11.5 million the previous year), respectively.

SUMMARY INCOME STATEMENT

| (in € million) | 1Q FY24 | Var FY24- FY23 | 1Q FY23 |

| Revenue Margin excluding Adjusted Revenue Items | 157.5 | 8% | 145.7 |

| Cash Revenue Margin | 166.9 | 5% | 159.1 |

| Cash Marginal Profit | 52 | 55% | 33.5 |

| Cash EBITDA | 29.4 | 110% | 14.0 |

| Adjusted EBITDA | 20.0 | 3475% | 0.6 |

| Net Income | 4.1 | n/a | (13.9) |

| Adjusted Net Income | 1.1 | n/a | (11.5) |

NEW DISCLOSURE TO BETTER UNDERSTAND THE SUBSCRIPTION MODEL

In light of the shift in the Company’s business model, from transactional to subscription-based, with a predominant share of profits and revenues now emanating from this segment, eDO decided to adapt its financial disclosures to better reflect its operating performance as a subscription company. The Company considers Prime/Non-Prime segments as a better reflection of the Company’s operating performance. Hence, from the Q1 onwards, the Company will disclose Prime vs. Non-Prime at Revenue Margin, Variable Costs, Marginal Profit and Adjusted EBITDA levels. The Group will also start reporting revenue breakdown by timing of revenue recognition to align with the new reportable segments. Also, to better align the financials with the evolution of the subscription service, the Group has also decided to change the Prime base of revenue recognition from ”based on usage” to ”based on gradual model”.

-ENDS-

About eDreams ODIGEO

eDreams ODIGEO is one of the world’s largest online travel companies and one of the largest e-commerce businesses in Europe. Under its four leading online travel agency brands – eDreams, GO Voyages, Opodo, Travellink, and the metasearch engine Liligo – it serves more than 20 million customers per year across 44 markets. Listed on the Spanish Stock Market, eDreams ODIGEO works with nearly 700 airlines. The business conceptualised Prime, the first subscription product in the travel sector which has topped 4.9 million members since launching in 2017. The brand offers the best quality products in regular flights, low-cost airlines, hotels, dynamic packages, cruises, car rental and travel insurance to make travel easier, more accessible, and better value for consumers across the globe.

(*) GLOSSARY OF TERMS

Reconcilable to GAAP measures

Adjusted EBITDA means operating profit / loss before depreciation and amortisation, impairment and profit / loss on disposals of non-current assets, as well as adjusted items corresponding to certain share-based compensation, restructuring expenses and other income and expense items which are considered by Management to not be reflective of the Group’s ongoing operations. Adjusted EBITDA provides to the reader a better view about the ongoing EBITDA generated by the Group.

Adjusted Net Income means the IFRS net income less certain share-based compensation, restructuring expenses and other income and expense items which are considered by Management to not be reflective of the Group’s ongoing operations. Adjusted Net Income provides to the reader a better view about the ongoing results generated by the Group.

Adjusted Revenue items refers to adjusted items that are included inside revenue, considered as exceptional by the management and not reflective of the Group’s ongoing operations.

Cash EBITDA means ”Adjusted EBITDA”, plus the variation of the Prime deferred revenue corresponding to the Prime fees that have been collected and that are pending to be accrued. The Prime fees pending to be accrued are non-refundable and will be booked as revenue based on usage, which refers to each instance the customer uses Prime to make a Booking with a discount, or when the Prime contracted period expires. Cash EBITDA provides to the reader a view of the sum of the ongoing EBITDA and the full Prime fees generated in the period.

Cash EBITDA Margin means Cash EBITDA divided by Cash Revenue Margin.

Cash Marginal Profit means ”Marginal Profit” plus the variation of the Prime deferred revenue corresponding to the Prime fees that have been collected and that are pending to be accrued. The Prime fees pending to be accrued are non-refundable and will be booked as revenue based on usage, which refers to each instance the customer uses Prime to make a Booking with a discount, or when the Prime contracted period expires. Cash Marginal Profit provides a measure of the sum of the Marginal Profit and the full Prime fees generated in the period.

Cash Marginal Profit Margin means Cash Marginal Profit divided by Cash Revenue Margin.

Cash Revenue Margin means ”Revenue Margin” plus the variation of the Prime deferred revenue corresponding to the Prime fees that have been collected and that are pending to be accrued. The Prime fees pending to be accrued are non-refundable and will be booked as revenue based on usage, which refers to each instance the customer uses Prime to make a Booking with a discount, or when the Prime contracted period expires. Cash Revenue Margin provides a measure of the sum of the Revenue Margin and the full Prime fees generated in the period.

Cash Revenue Margin per Booking means Cash Revenue Margin divided by the number of Bookings. Marginal Profit means “Revenue Margin” less “Variable Costs”. It is the measure of profit that Management uses to analyse the results by segments.

Prime ARPU means the Cash Revenue Margin generated from Prime users on a last twelve months basis. It is calculated considering all the Cash Revenue Margin elements linked to the bookings done by Prime members (such as but not limited to, the Prime fees collected, GDS incentives, commissions, ancillary services, etc.) divided by the average number of Prime members during the same period. Management considers this is a relevant measure to follow the Prime performance. As Prime is a yearly programme, this measure is calculated on a last twelve months basis.

Revenue Margin means the IFRS revenue less the cost of supplies. The Group’s Management uses Revenue Margin to provide a measure of its revenue after reflecting the deduction of amounts payable to suppliers in connection with the revenue recognition criteria used for products sold under the principal model (gross value basis). Accordingly, Revenue Margin provides a comparable revenue measure for products, whether sold under the agency or principal model.

Variable Costs includes all expenses which depend on the number of transactions processed. These include acquisition costs, merchant costs and other costs of a variable nature, as well as personnel costs related to call centers as well as corporate sales personnel. The Group’s Management believes the presentation of Variable Costs may be useful to readers to help understand its cost structure and the magnitude of certain costs. The Group has the ability to reduce certain costs in response to changes affecting the number of transactions processed.

Other Defined Terms

Bookings refers to the number of transactions under the agency model and the principal model as well as transactions made under white label arrangements. One Booking can encompass one or more products and one or more passengers.

Prime members means the total number of customers that have a Prime subscription in a given period.

Prime / Non-Prime: Prime means the profit and loss measure generated from Prime users. In the case of Cash Revenue Margin (*) for Prime, it includes elements such as, but not limited to, the Prime fees collected, GDS incentives, commissions, ancillary services, etc. Non-Prime means the profit and loss measure generated from non-Prime users.

(1) As of 22nd August 2023

(2) As of 22nd August 2023

Marknadsnyheter

Regeringen föreslår lättnader i byggkraven för studentbostäder

Regeringen har beslutat om en lagrådsremiss med förslag till lättnader i byggkraven för studentbostäder. Syftet är att öka möjligheterna till flexibilitet vid byggandet.

– På många studieorter är det svårt för studenter att hitta boende. Därför behöver byggregelverket förenklas. Syftet är att möjliggöra för fler studentbostäder genom sänkta byggkostnader och ökad flexibilitet, säger infrastruktur- och bostadsminister Andreas Carlson.

Förslaget innebär att det blir möjligt att göra undantag från kraven på tillgänglighet och användbarhet i en byggnad som innehåller studentbostäder. Undantagen ska kunna tillämpas vid både nyproduktion och vid ändring av en byggnad.

Det ska vara möjligt att göra undantag för högst 80 procent av studentbostäderna i ett byggprojekt. Minst 20 procent av studentbostäderna ska fortfarande uppfylla gällande krav på tillgänglighet och användbarhet för personer med nedsatt rörelse- eller orienteringsförmåga.

Lagändringen ger större flexibilitet vid byggande av studentbostäder och skapar fler tänkbara sätt att utforma planlösningar. Till exempel kan bostadsytan minskas och fler bostäder rymmas inom en given yta.

De föreslagna undantagen ska inte hindra personer med funktionsnedsättning att vara delaktiga i sociala sammanhang. En studentbostad som omfattas av undantagen ska kunna besökas av en person med nedsatt rörelse- eller orienteringsförmåga.

Regeringen breddar också definitionen av studentbostäder till att inkludera all vuxenutbildning för att göra det möjligt för fler kommuner att erbjuda studentbostäder.

Förslagen föreslås träda i kraft den 1 juli 2025.

Lagrådsremissen: Lättnader i byggkraven för studentbostäder – Regeringen.se

Presskontakt

Ebba Gustavsson

Pressekreterare hos infrastruktur- och bostadsminister Andreas Carlson

Telefon (växel) 08-405 10 00

Mobil 076-12 70 488

ebba.gustavsson@regeringskansliet.se

Marknadsnyheter

“Vi behöver tillsammans enas om vettiga avtal, som sätter standard för branschen”

Sveriges Radios Kulturnytt gör just nu en mycket välkommen granskning av villkoren i musikbranschen. Igår lyftes artisten Siw Malmkvists situation med ett avtal som inte förnyats på över 60 år. Hennes situation är tyvärr långt ifrån unik. Musikerförbundet har länge uppmärksammat att majorbolagen fortsätter att betala extremt låga royaltynivåer till artister vars kontrakt skrevs på 1960-talet – en tid då digital streaming inte existerade.

– Jag kan intyga att artisterna som talar ut i P1 är långt ifrån ensamma om sin situation och vi uppmanar deras artistkollegor att gå ut med sitt tydliga stöd till de som vågar bryta tystnaden om oskäliga ersättningar, säger Musikerförbundets ordförande Karin Inde.

Musiker och artister skapar det värde som skivbolagen tjänar pengar på, men ändå ser vi gång på gång hur bolagen behåller stora delar av intäkterna. Att en av Sveriges mest folkkära artister, med en karriär som sträcker sig över decennier, fortfarande har en oskälig royalty är ett tydligt bevis på branschens obalans.

– Tystnadskulturen kring prissättning är enbart bra för bolagen. Både artister och musiker skulle verkligen tjäna på att dela med sig till varandra om hur betalningar och dealar verkligen ser ut. Förstås i trygga, egna rum. Det är bara bolagen som tjänar på att vi inte pratar med varandra om pengar, säger Karin Inde.

Stort tack till de modiga artister som ser till att lyfta problematiken! För att vi ska få till en i grunden mer rättvis musikbransch behöver de stora parterna i sammanhanget – skivbolagen, musikerna och artisterna – göra som de flesta andra svenska branscher lyckas med:

– Vi behöver tillsammans enas om vettiga och balanserade avtal, som sätter standard för branschen. Musikerförbundet är redo att göra vår del i arbetet för bättre villkor i musikbranschen, frågan är om skivbolagen är redo, säger Karin Inde.

Karin Inde

Förbundsordförande

karin.inde@musikerforbundet.se

+46 (0)704447228

Musikerförbundet är fackförbundet för professionella musiker och artister. Vi arbetar för förbättrade upphovsrättsliga och arbetsrättsliga villkor och för att våra medlemmar ska få en rättvis del av de värden de skapar i samhället.

Marknadsnyheter

Bönor från egen kaffeskog, sump till jord – Viking Lines nya kaffe gör gott på många olika sätt

Viking Lines resenärer dricker varje år 8,5 miljoner koppar kaffe. Nu satsar rederiet på ett helt nytt kaffe som ger minskade klimatutsläpp och bättre levnadsvillkor för odlarna. Kaffet från Slow Forest odlas på rederiets egen odling i Laos utan kemiska gödningsmedel, handplockas och rostas därefter i Danmark.

Allt kaffe som serveras på Viking Lines fartyg är nu hållbart producerat Slow Forest-kaffe, odlat på rederiets 75 hektar stora odling på högplatåerna i Laos och rostat i Danmark. Kaffeplantorna odlas bland träd på återbeskogad mark, i stället för på traditionellt skövlade plantager. Viking Lines odling ligger i en kolsänka där målsättningen är att plantera 30 000 träd, vilket innebär nästan 400 träd per hektar. Kaffeskogen förbättrar också den lokala biologiska mångfalden i området.

Odlingen, bearbetningen och rostningen av kaffet hanteras av Slow Forest Coffee. För företaget är det viktigt att produktionskedjan är rättvis och transparent. Utöver miljöfördelarna erbjuder Slow Forest bättre lönevillkor och sjukersättning för byns odlare.

”Den traditionella kaffetillverkningens koldioxidavtryck är stort och merparten av intäkterna går till Europa i stället för produktionsländerna. Vi ville göra annorlunda. Våra kunder vill göra hållbara val, och nu kan de njuta av sitt kaffe med bättre samvete än någonsin tidigare,” berättar Viking Lines restaurangchef Janne Lindholm.

Bönorna till Slow Forest-kaffet får sakta mogna i skuggan av träden, utan kemiska gödningsmedel. De plockas också för hand, vilket avsevärt förbättrar kaffets kvalitet och smak. Viking Lines nya kaffe består till 100 procent av Arabica-bönor, med en balanserad syrlighet samt smak av nötter och choklad. Rostningsprofilen har skapats av den världsberömda danska rostningsmästaren Michael de Renouard.

”Vi valde en mörkrost till fartygets kaffe, vilket passar både finländarnas och svenskarnas nuvarande smakpreferenser gällande rostning. Finländarnas smak gällande kaffe har under de senaste åren utvecklats mot en mörkare rostning. Innan vi gjorde vårt slutgiltiga val testades det nya kaffet i Viking Cinderellas bufférestaurang och personalmässen – och båda testgrupperna gav toppbetyg. Då 8,5 miljoner koppar kaffe bryggs varje år kan inget lämnas åt slumpen!” säger Janne Lindholm.

Viking Lines hållbarhetsmål stannar inte vid produktionskedjan. Kaffesump från fartygen återvinns nämligen som råmaterial för trädgårdsjord. Detta minskar avsevärt användningen av jungfrulig torv vid tillverkningen av mylla.

”Vi har som mål att allt som tagits ombord på fartygen som är möjligt att återvinna ska återanvändas eller återvinnas. Det gäller inte bara kaffet utan även matavfall och till exempel textilier som tas ur bruk. Ett bra exempel på vårt livscykeltänkande är att frityrolja från fartygets restauranger blir till biobränsle för den finska sjöfartsindustrin,” säger Viking Lines hållbarhetschef Dani Lindberg.

Slow Forest Coffee – 5 fakta:

- Slow Forest Coffee är ett kaffeföretag som verkar i Laos, Vietnam och Indonesien i samarbete med över 500 lokala kaffeodlare.

- Företaget grundades år 2019 av Pinja Puustjärvi, driven av en vilja att skydda skogarna i Laos och stötta lokala odlare. Puustjärvi bodde som barn i Laos på grund av sin fars arbete.

- Kaffet odlas i restaurerade kaffeskogar, som binder stora mängder kol och ökar den biologiska mångfalden.

- Det är viktigt för företaget att produktionskedjan är ansvarsfull och transparent, samt att verksamheten gynnar både miljön och de lokala samhällena.

- Slow Forest Coffee betalar odlarna bättre ersättning än genomsnittet i Laos och erbjuder förmåner som underlättar deras liv: förskottsbetalningar, utbildning och möjligheten att låna pengar från en krisfond.

Mera infomation om Slow Forest Coffee här

Tilläggsinformation:

Janne Lindholm, restaurangchef

janne.lindholm@vikingline.com, tel. +358 400 744 806

Dani Lindberg, hållbarhetschef

dani.lindberg@vikingline.com, tel. +358 18 27 000

Johanna Boijer-Svahnström, informationsdirektör

johanna.boijer@vikingline.com, tel. +358 18 270 00

Christa Grönlund, informationschef

christa.gronlund@vikingline.com, tel. +358 9 123 51

-

Analys från DailyFX10 år ago

EUR/USD Flirts with Monthly Close Under 30 Year Trendline

-

Marknadsnyheter2 år ago

Marknadsnyheter2 år agoUpptäck de bästa verktygen för att analysera Bitcoin!

-

Marknadsnyheter5 år ago

BrainCool AB (publ): erhåller bidrag (grant) om 0,9 MSEK från Vinnova för bolagets projekt inom behandling av covid-19 patienter med hög feber

-

Analys från DailyFX12 år ago

Japanese Yen Breakout or Fakeout? ZAR/JPY May Provide the Answer

-

Marknadsnyheter2 år ago

Marknadsnyheter2 år agoDärför föredrar svenska spelare att spela via mobiltelefonen

-

Analys från DailyFX12 år ago

Price & Time: Key Levels to Watch in the Aftermath of NFP

-

Analys från DailyFX8 år ago

Gold Prices Falter at Resistance: Is the Bullish Run Finished?

-

Nyheter7 år ago

Nyheter7 år agoTeknisk analys med Martin Hallström och Nils Brobacke