Marknadsnyheter

FAIRNESS OPINION

to, apr 26, 2018 18:00 CET

Pareto Securities AB

Berzelii Park 9

P.O. Box 7415

103 91 Stockholm

Sweden

26 April 2018

To the Independent Committee of the Board of Directors of:

Swedol AB (publ) (“Swedol” or the “Company”)

Box 631 SE-135 26 Tyresö

Sweden

FAIRNESS OPINION

To the Independent Committee of the Board of Directors of Swedol

Pareto Securities AB (”Pareto”) has been requested by the Independent Committee of the Board of Directors of Swedol (the “Committee”) to give a statement (the “Opinion”) regarding the valuation of the Company’s shares in connection with the public takeover offer by Nordstjernan Aktiebolag (“Nordstjernan”) announced on 16 April 2018 (the “Transaction”). In the Transaction, Nordstjernan offers SEK 32.00 per share in Swedol, corresponding to a total equity value of approximately SEK 2,662 million (the “Transaction Valuation”).

Pareto has prepared this Opinion on the basis of publicly available information and information from the Company, including inter alia management estimates. Pareto has based its statement on the presumption that this material is accurate and correct. Pareto has not undertaken any independent examination in this respect and does not represent or warrant its accuracy. The evaluation of the Transaction Valuation has been made on objective criteria to the extent possible, based on generally accepted and recognized valuation methods that have been deemed necessary and applicable. Pareto’s valuation is essentially based on commercial, economic and other conditions available that can be validated on this date.

Pareto is, based on the evaluation described above, of the opinion that the Transaction Valuation does not reflect the current underlying value in the Company and thereof an unfair valuation of Swedol.

Pareto will receive a fixed fee for delivering this Opinion. The fee is independent of the conclusion of the Opinion. As of the date of this Opinion, Pareto doesn’t have any ongoing assignments for the Company or the Committee, except for being the financial adviser in connection with the Transaction. However, as a leading investment bank in the Nordic region, Pareto has had and in the future may have assignments for Swedol or any of its major shareholders, however none that are, in the opinion of Pareto, influencing the assessments made in this Opinion. The Opinion is dated 26 April 2018 and the valuation date is 13 April 2018. Events or information occurring after that date have not been subject to consideration herein.

Evaluations of this nature will always contain an element of uncertainty, and although reasonable care and efforts have been exerted, Pareto does not accept any legal or financial liability related to the Opinion or for any consequences resulting from acting to or relying on statements made in the Opinion.

This Opinion does not represent a recommendation to the Committee, Swedol or its shareholders to accept or reject the proposed Transaction. Pareto recommends the Committee to evaluate the proposal in accordance with own judgment and preferences.

Kind regards,

Pareto Securities AB

För ytterligare information, vänligen besök www.swedol.se eller kontakta:

Christina Åqvist, talesperson för kommittén

Tel.: 070-600 57 75, e-post: christina.aqvist@distrelec.com.

Denna information är sådan som Swedol AB ska offentliggöra enligt takeoverreglerna samt EU:s marknadsmissbruksförordning och takeoverreglerna. Informationen lämnades, genom ovanstående kontaktpersons försorg, för offentliggörande den 26 april 2018, kl. 18.00.

Taggar:

Marknadsnyheter

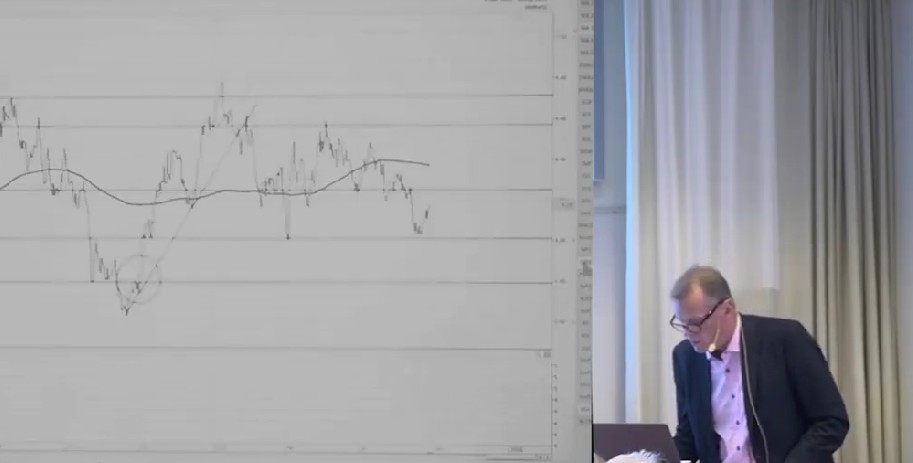

Teknisk analys på flera marknader med Anders Haglund

Anders Haglund går igenom den tekniska analysen på flera marknader samt även några olika enskilda aktier.

Marknadsnyheter

JRS chefsstrateg Torbjörn Söderberg om börsen framåt

JRS chefsstrateg Torbjörn Söderberg pratar med Jesper Norberg på EFN om börsens väg framåt. Man tar upp värderingar och makro, samt hur han själv väljer att agera.

Marknadsnyheter

Kreditkort skapar problem för USAs konsumenter – CNBC granskar

CNBC tittar närmare på hur kreditkort skapar problem för konsumenterna i USA som får betala räntor på upp till 36 %, och ovanpå det kommer nya avgifter. När det skapar så här stora problem blir det ett problem för ekonomin som helhet, det är inte bara ett individuellt problem.

CNBC granskar kreditkort och problemen de skapar

Vi skrev nyligen om rekordhög belåning hos investerare i USA. Det är samma sak här, när det är så många individer som är så hårt belånade blir det ett problem för hela aktiemarknaden.

-

Analys från DailyFX10 år ago

EUR/USD Flirts with Monthly Close Under 30 Year Trendline

-

Marknadsnyheter5 år ago

BrainCool AB (publ): erhåller bidrag (grant) om 0,9 MSEK från Vinnova för bolagets projekt inom behandling av covid-19 patienter med hög feber

-

Marknadsnyheter3 år ago

Marknadsnyheter3 år agoUpptäck de bästa verktygen för att analysera Bitcoin!

-

Analys från DailyFX12 år ago

Japanese Yen Breakout or Fakeout? ZAR/JPY May Provide the Answer

-

Marknadsnyheter2 år ago

Marknadsnyheter2 år agoDärför föredrar svenska spelare att spela via mobiltelefonen

-

Analys från DailyFX12 år ago

Price & Time: Key Levels to Watch in the Aftermath of NFP

-

Analys från DailyFX8 år ago

Gold Prices Falter at Resistance: Is the Bullish Run Finished?

-

Nyheter7 år ago

Nyheter7 år agoTeknisk analys med Martin Hallström och Nils Brobacke