Marknadsnyheter

Implantica offentliggör utbetalning av aktietilldelningar baserade på av bolagsstämman godkända aktierelaterade incitamentsprogrammet genom en riktad emission av egna aktier i bolaget utan betalning

Implantica AG (publ.), ett medicintekniskt företag som ligger i framkant när det gäller att introducera avancerad teknik i kroppen, meddelar att bolaget den 23 december 2024 genomförde en riktad nyemission av aktier utan betalning för att tillgodose delar av aktieincitamentsprogrammet för nyckelpersoner.

Totalt har 100 000 nya depåbevis skapats, vilket motsvarar en ökning med 0,2 % av det totala antalet depåbevis. Det totala antalet utestående depåbevis har ökat till 58 211 537 efter emissionen från 58 111 537 före emissionen.

Årsstämman som hölls den 10 maj 2022 bemyndigade styrelsen att genomföra en långsiktig incitamentsplan enligt vilken ledande befattningshavare och utvalda nyckelmedarbetare belönas med aktierelaterade incitament.

För ytterligare information, vänligen kontakta:

Nicole Pehrsson, Chief Corporate Affairs Officer

Telefon (CH): +41 (0)79 335 09 49

nicole.pehrsson@implantica.com

Implantica är noterat på Nasdaq First North Premier Growth Market i Stockholm.

Bolagets Certified Adviser är FNCA Sweden AB, info@fnca.se

Informationen lämnades, genom ovanstående kontaktpersons försorg, för offentliggörande den 23 december 2024 kl. 17:20 (CET).

Om Implantica

Implantica är ett medicintekniskt företag som arbetar med att föra in avancerad teknik i kroppen. Implanticas huvudprodukt, RefluxStop™, är ett CE-märkt implantat för förebyggande av gastroesofageal reflux som har potential att skapa ett paradigmskifte inom anti-refluxbehandling och stöds av framgångsrika kliniska studieresultat. Implantica fokuserar också på e-hälsa inuti kroppen och har utvecklat en bred, patentskyddad produktpipeline som delvis bygger på två plattformstekniker: en e-hälsoplattform som är utformad för att övervaka ett brett spektrum av hälsoparametrar, styra behandlingen inifrån kroppen och kommunicera med vårdgivaren på distans och en trådlös energiplattform som är utformad för att driva fjärrstyrda implantat trådlöst genom intakt hud. Implantica är noterat på Nasdaq First North Premier Growth Market (ticker: IMP A SDB). Besök www.implantica.com för mer information.

Om RefluxStop™

RefluxStop är en ny innovativ behandling med stor potential till ett paradigmskifte inom kirurgi mot sura uppstötningar. Dess unika verkningsmekanism skiljer sig fullständigt från nuvarande kirurgiska lösningar. Befintliga kirurgiska ingrepp omsluter matpassagen för att stödja den nedre esofagusfinkterns stängningsmekanism och är ofta förknippade med biverkningar som sväljsvårigheter, smärta vid sväljning och oförmåga att rapa och/eller kräkas.

RefluxStop däremot behandlar sura återflöden utan att påverka matpassagen. Den återställer och bibehåller den nedre esofagusfinktern i sin ursprungliga, naturliga position. RefluxStops verkningsmekanism är inriktad på att rekonstruera alla tre komponenterna i antirefluxbarriären, som om de äventyras kan leda till sura återflöden. Den gör det genom att återställa och stödja kroppens naturliga anatomiska fysiologi, vilket möjliggör att kroppen själv löser problemet med de sura uppstötningarna.

Nyhetsrum

https://www.implantica.com/media/media-kit

Gemenskap

https://ch.linkedin.com/company/implantica

https://www.twitter.com/implantica

Kontakt för media:

Juanita Eberhart, VP Marketing & Advocacy

M: +1 925-381-4581

juanita.eberhart@implantica.com

Marknadsnyheter

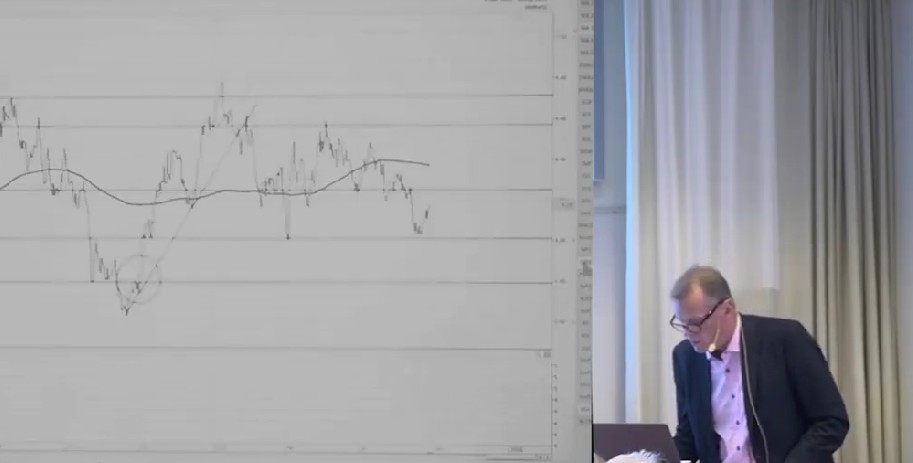

Teknisk analys på flera marknader med Anders Haglund

Anders Haglund går igenom den tekniska analysen på flera marknader samt även några olika enskilda aktier.

Marknadsnyheter

JRS chefsstrateg Torbjörn Söderberg om börsen framåt

JRS chefsstrateg Torbjörn Söderberg pratar med Jesper Norberg på EFN om börsens väg framåt. Man tar upp värderingar och makro, samt hur han själv väljer att agera.

Marknadsnyheter

Kreditkort skapar problem för USAs konsumenter – CNBC granskar

CNBC tittar närmare på hur kreditkort skapar problem för konsumenterna i USA som får betala räntor på upp till 36 %, och ovanpå det kommer nya avgifter. När det skapar så här stora problem blir det ett problem för ekonomin som helhet, det är inte bara ett individuellt problem.

CNBC granskar kreditkort och problemen de skapar

Vi skrev nyligen om rekordhög belåning hos investerare i USA. Det är samma sak här, när det är så många individer som är så hårt belånade blir det ett problem för hela aktiemarknaden.

-

Analys från DailyFX10 år ago

EUR/USD Flirts with Monthly Close Under 30 Year Trendline

-

Marknadsnyheter5 år ago

BrainCool AB (publ): erhåller bidrag (grant) om 0,9 MSEK från Vinnova för bolagets projekt inom behandling av covid-19 patienter med hög feber

-

Marknadsnyheter3 år ago

Marknadsnyheter3 år agoUpptäck de bästa verktygen för att analysera Bitcoin!

-

Analys från DailyFX12 år ago

Japanese Yen Breakout or Fakeout? ZAR/JPY May Provide the Answer

-

Marknadsnyheter2 år ago

Marknadsnyheter2 år agoDärför föredrar svenska spelare att spela via mobiltelefonen

-

Analys från DailyFX12 år ago

Price & Time: Key Levels to Watch in the Aftermath of NFP

-

Analys från DailyFX8 år ago

Gold Prices Falter at Resistance: Is the Bullish Run Finished?

-

Nyheter7 år ago

Nyheter7 år agoTeknisk analys med Martin Hallström och Nils Brobacke