Analys från DailyFX

"Picture-Perfect" Trades the Computers May Miss

Talking Points:

- The Value of Benchmarks and Validation

- Real Proof About Computers’ Limitations

- 2 Classic Trade Set-ups Computers May Not See

Most intuitively understand that following a sensible, proven life regimen is the way to balance the conflict that sometimes arises between our logical side and our very human, emotional side. In trading, it is actually better to check emotions at the door, instead relying on the analytic, logical self.

And while logic coupled with automation will help temper our emotions, too much automation isn’t good, either. Recognizing our own strengths and the limitations of computer automation will help strike that balance and make for positive strides in trading.

A Plan

For traders, that “proven regimen” is called a benchmarked trading plan, and it will make the road ahead much easier. Without that black and white proof in hand, a trader likely won’t have the confidence needed to risk valuable capital on a daily basis.

A benchmark is a spreadsheet that shows the complete history of a method’s trades in up, down, and sideways markets. It provides an abundance of useful information including that all-important win/loss percentage and risk/reward ratio.

This is the ultimate end game when it comes to market analysis, and it tells when a method is reliable enough to risk real money trading.

Statistical Validation

Once there is statistical proof that a particular trading method is working successfully (by way of the benchmark spreadsheet), it’s then possible to start demo or live trading that method with the goal of matching personal performance to that of the benchmark for the chosen time period.

Keep in mind it will be virtually impossible to match the benchmark because it is unlikely to be able to stay awake for days straight and manage every trade to the letter of the plan. For this reason, the benchmark is technically hypothetical (see Figure 1 below). It is a record of how to ideally initiate and manage trades, which is often different from the real outcome.

Guest Commentary: Benchmark Spreadsheet for Daytrading Method

Fractals Limit Computers

If finding a viable trading method that provides desirable results in all environments were easy, everyone would have one. One of the largest drawbacks for aspiring traders is that they are relying on the computer for indicators. The fractal, or asymmetrical nature, of markets does not lend itself to being measured with technical indicators, which are, at best, secondary, or lagging indicators, of price itself.

The beauty of fractal design is that each new iteration, or pattern, is slightly different than the previous one. While the human eye is good at recognizing this pattern, a computer is not. The computer calculates symmetry, or exactness, in a world that is far from exact.

In a fractal world, each new pattern is a slight variation of the previous pattern—like branches of a tree, or waves hitting a beach—where after just a handful of samples, that difference will have increased enough to be unrecognizable to the original or programed pattern.

On the other hand, however, our eyes can easily follow the string of slight changes to a pattern over time.

Guest Commentary: “Picture-Perfect” Trades a Computer Might Miss

Man vs. The Machine

One example of a pattern that’s easy for the naked eye to see, but that a program likely would not, is seen in Figure 2 above. The two retracement levels, which are identical in terms of percentage, are drawn from the low of the last correction to the high of the ensuing rally, and provide high-probability long-entry levels following price dips. The standard deviation line of the Bollinger Bands also provides a nice visual and lends further confidence. By the way, ”nice visual” is not in a computer programmer’s lexicon!

To an experienced trader, these two dips in the overall uptrend are picture-perfect trading opportunities that stand out nicely. To the computer, however, they are widely different in both length and timing. In terms of ease and understanding, it is far simpler to draw those retracement levels by hand than try to get a program to draw them instead.

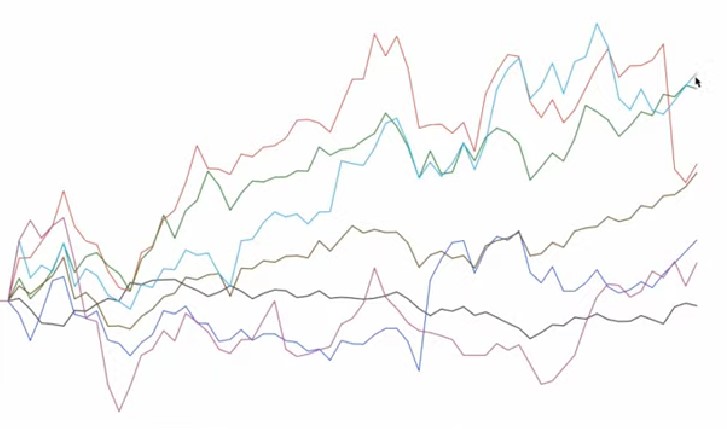

While the computer is a great tool, you have to know its limitations, and a big one is pattern recognition. Figure 3 is the same chart, except we have highlighted the two patterns by outlining them.

Guest Commentary: Fractal Patterns in USD/JPY (Dec. 20)

Fractal in Nature

In Figure 3 above, we get a more intuitive view of the market. First, we see the larger pattern on the left with an upside climax, followed by a characteristic dip (retracement) to support (green line). There is a smaller pattern on the right within that larger pattern, again with a retracement to the green line that is nearly identical in percentage terms to the retracement in the first box.

Once you have an experienced eye for pattern recognition, you will notice right away the similar behavior that markets exhibit on all time frames. For example, notice the small box created by the overlap of the two larger boxes.

Notice we have a price ”retracement” following a sharp rally, which is again identical in scale to the other two retracement levels we’ve already highlighted with those short green horizontal lines. It is this similar behavior we are referring to when we say markets are fractal in nature. The sum of the parts equals the whole, and the parts themselves are similar, albeit asymmetrical, miniatures of the whole.

The understanding of this behavior is what we have used to construct the trading method that formed the basis for the benchmark spreadsheet in Figure 1.

Seeing markets from a fractal perspective is definitely an eye-opener, but it also takes a different way of thinking, as does relying on a pre-scripted trading plan instead of your own thoughts. If, however, you are not seeing desirable results in your trading approach right now, you may want to get out from behind the computer and follow intuition instead.

By Jay Norris, author, The Secret to Trading: Risk Tolerance Threshold Theory

Analys från DailyFX

EURUSD Weekly Technical Analysis: New Month, More Weakness

What’s inside:

- EURUSD broke the ‘neckline’ of a bearish ‘head-and-shoulders’ pattern, April trend-line

- Resistance in vicinity of 11825/80 likely to keep a lid on further strength

- Targeting the low to mid-11600s with more selling

Confidence is essential to successful trading, see this new guide – ’Building Confidence in Trading’.

Coming into last week we pointed out the likelihood of finally seeing a resolution of the range EURUSD had been stuck in for the past few weeks, and one of the outcomes we made note of as a possibility was for the triggering of a ’head-and-shoulders’ pattern. Indeed, we saw a break of the ’neckline’ along with a drop below the April trend-line. This led to decent selling before a minor bounce took shape during the latter part of last week.

Looking ahead to next week the euro is set up for further losses as the path of least resistance has turned lower. Looking to a capper on any further strength there is resistance in the 11825-11880 area (old support becomes new resistance). As long as the euro stays below this area a downward bias will remain firmly intact.

Looking lower towards support eyes will be on the August low at 11662 and the 2016 high of 11616, of which the latter just happens to align almost precisely with the measured move target of the ‘head-and-shoulders’ pattern (determined by subtracting the height of the pattern from the neckline).

Bottom line: Shorts look set to have the upperhand as a fresh month gets underway as long as the euro remains capped by resistance. On weakness, we’ll be watching how the euro responds to a drop into support levels.

For a longer-term outlook on EURUSD, check out the just released Q4 Forecast.

EURUSD: Daily

—Written by Paul Robinson, Market Analyst

You can receive Paul’s analysis directly via email bysigning up here.

You can follow Paul on Twitter at@PaulRobinonFX.

Analys från DailyFX

Euro Bias Mixed Heading into October, Q4’17

Why and how do we use IG Client Sentiment in trading? See our guide and real-time data.

EURUSD: Retail trader data shows 37.3% of traders are net-long with the ratio of traders short to long at 1.68 to 1. In fact, traders have remained net-short since Apr 18 when EURUSD traded near 1.07831; price has moved 9.6% higher since then. The number of traders net-long is 15.4% lower than yesterday and 16.4% higher from last week, while the number of traders net-short is 0.4% higher than yesterday and 10.5% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURUSD prices may continue to rise. Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EURUSD trading bias.

— Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

Analys från DailyFX

British Pound Reversal Potential Persists Heading into New Quarter

Why and how do we use IG Client Sentiment in trading? See our guide and real-time data.

GBPUSD: Retail trader data shows 38.2% of traders are net-long with the ratio of traders short to long at 1.62 to 1. In fact, traders have remained net-short since Sep 05 when GBPUSD traded near 1.29615; price has moved 3.4% higher since then. The number of traders net-long is 0.1% higher than yesterday and 13.4% higher from last week, while the number of traders net-short is 10.6% lower than yesterday and 18.3% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBPUSD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current GBPUSD price trend may soon reverse lower despite the fact traders remain net-short.

— Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

-

Analys från DailyFX8 år ago

EUR/USD Flirts with Monthly Close Under 30 Year Trendline

-

Marknadsnyheter1 år ago

Marknadsnyheter1 år agoUpptäck de bästa verktygen för att analysera Bitcoin!

-

Marknadsnyheter4 år ago

BrainCool AB (publ): erhåller bidrag (grant) om 0,9 MSEK från Vinnova för bolagets projekt inom behandling av covid-19 patienter med hög feber

-

Analys från DailyFX11 år ago

Japanese Yen Breakout or Fakeout? ZAR/JPY May Provide the Answer

-

Analys från DailyFX11 år ago

Price & Time: Key Levels to Watch in the Aftermath of NFP

-

Analys från DailyFX7 år ago

Gold Prices Falter at Resistance: Is the Bullish Run Finished?

-

Nyheter5 år ago

Nyheter5 år agoTeknisk analys med Martin Hallström och Nils Brobacke

-

Marknadsnyheter6 år ago

Tudorza reduces exacerbations and demonstrates cardiovascular safety in COPD patients