Marknadsnyheter

UPS releases 2Q 2022 earnings

- Consolidated Revenues of $24.8B, Up 5.7% from Last Year

- Consolidated Operating Profit of $3.5B, Up 8.5% from Last Year; Up 9.3% on an Adjusted* Basis

- Diluted EPS of $3.25; Adjusted Diluted EPS Up 7.5% Over Last Year to $3.29

- Reaffirms Full-Year 2022 Financial Guidance; Raises Targeted Share Repurchases to $3B for 2022

ATLANTA – July 26, 2022 – UPS (NYSE:UPS) today announced second-quarter 2022 consolidated revenues of $24.8 billion, a 5.7% increase over the second quarter of 2021. Consolidated operating profit was $3.5 billion, up 8.5% compared to the second quarter of 2021, and up 9.3% on an adjusted basis. Diluted earnings per share was $3.25 for the quarter; adjusted diluted earnings per share of $3.29 was 7.5% above the same period in 2021.

For the second quarter of 2022, GAAP results included after-tax transformation and other charges of $31 million, or $0.04 per diluted share.

“I want to thank UPSers around the world for delivering outstanding service to our customers,” said Carol Tomé, UPS chief executive officer. “While the external environment is ever changing, our better not bigger strategic framework has fundamentally improved nearly every aspect of our business, enabling greater agility and strong financial performance.”

U.S. Domestic Segment

| 2Q 2022 | Adjusted2Q 2022 | 2Q 2021 | Adjusted2Q 2021 | |

| Revenue | $15,459 M | $14,402 M | ||

| Operating profit | $1,829 M | $1,855 M | $1,567 M | $1,675 M |

- Revenue grew 7.3%, driven by an 11.9% increase in revenue per piece.

- Operating margin was 11.8%; adjusted operating margin was 12.0%.

International Segment

| 2Q 2022 | Adjusted2Q 2022 | 2Q 2021 | Adjusted2Q 2021 | |

| Revenue | $5,073 M | $4,817 M | ||

| Operating profit | $1,193 M | $1,204 M | $1,184 M | $1,190 M |

- Revenue increased 5.3%, driven by a 14.8% increase in revenue per piece.

- Operating margin was 23.5%; adjusted operating margin was 23.7%.

Supply Chain Solutions1

| 2Q 2022 | Adjusted2Q 2022 | 2Q 2021 | Adjusted2Q 2021 | |

| Revenue | $4,234 M | $4,205 M | ||

| Operating profit | $513 M | $517 M | $507 M | $408 M |

1 Consists of operating segments that do not meet the criteria of a reportable segment under ASC Topic 280 – Segment Reporting.

- Revenue increased 0.7%, led by Forwarding and our healthcare business.

- Operating margin was 12.1%; adjusted operating margin was 12.2%.

2022 Outlook

The company provides guidance on an adjusted (non-GAAP) basis because it is not possible to predict or provide a reconciliation reflecting the impact of future pension adjustments or other unanticipated events, which would be included in reported (GAAP) results and could be material.

For 2022, UPS reaffirms its full-year financial targets:

- Consolidated revenue of about $102 billion

- Consolidated adjusted operating margin of approximately 13.7%

- Adjusted return on invested capital above 30%

- Capital expenditures of 5.4% of revenue, or approximately $5.5 billion

- Dividend payments, subject to board approval, of about $5.2 billion

Finally, UPS is raising the amount of targeted share repurchases for 2022, taking the target to $3 billion for the year.

* “Adjusted” amounts are non-GAAP financial measures. See the appendix to this release for a discussion of non-GAAP financial measures, including a reconciliation to the most closely correlated GAAP measure.

Contacts:

UPS Media Relations: 404-828-7123 or pr@ups.com

UPS Investor Relations: 404-828-6059 (option 4) or investor@ups.com

# # #

Conference Call Information

UPS CEO Carol Tomé and CFO Brian Newman will discuss second-quarter results with investors and analysts during a conference call at 8:30 a.m. ET, July 26, 2022. That call will be open to others through a live Webcast. To access the call, go to www.investors.ups.com and click on “Earnings Conference Call.” Additional financial information is included in the detailed financial schedules being posted on www.investors.ups.com under “Quarterly Earnings and Financials” and as filed with the SEC as an exhibit to our Current Report on Form 8-K.

About UPS

UPS (NYSE: UPS) is one of the world’s largest companies, with 2021 revenue of $97.3 billion, and provides a broad range of integrated logistics solutions for customers in more than 220 countries and territories. Focused on its purpose statement, “Moving our world forward by delivering what matters,” the company’s 534,000 employees embrace a strategy that is simply stated and powerfully executed: Customer First. People Led. Innovation Driven. UPS is committed to reducing its impact on the environment and supporting the communities we serve around the world. UPS also takes an unwavering stance in support of diversity, equity, and inclusion. More information can be found at www.ups.com, about.ups.com and www.investors.ups.com.

Forward-Looking Statements

This release and our filings with the Securities and Exchange Commission contain and in the future may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements other than those of current or historical fact, and all statements accompanied by terms such as “will,” “believe,” “project,” “expect,” “estimate,” “assume,” “intend,” “anticipate,” “target,” “plan,” and similar terms, are intended to be forward-looking statements. Forward-looking statements are made subject to the safe harbor provisions of the federal securities laws pursuant to Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934.

From time to time, we also include written or oral forward-looking statements in other publicly disclosed materials. Forward-looking statements may relate to our intent, belief, forecasts of, or current expectations about our strategic direction, prospects, future results, or future events; they do not relate strictly to historical or current facts. Management believes that these forward-looking statements are reasonable as and when made. However, caution should be taken not to place undue reliance on any forward-looking statements because such statements speak only as of the date when made and the future, by its very nature, cannot be predicted with certainty.

Forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience and our present expectations or anticipated results. These risks and uncertainties, include, but are not limited to the impact of: continued uncertainties related to the COVID-19 pandemic on our business and operations, financial performance and liquidity, our customers and suppliers, and on the global economy; changes in general economic conditions, in the U.S. or internationally; industry evolution and significant competition; changes in our relationships with our significant customers; our ability to attract and retain qualified employees; increased or more complex physical or data security requirements, or any data security breach; strikes, work stoppages or slowdowns by our employees; results of negotiations and ratifications of labor contracts; our ability to maintain our brand image and corporate reputation; disruptions to our information technology infrastructure; global climate change; interruptions in or impacts on our business from natural or man-made events or disasters including terrorist attacks, epidemics or pandemics; exposure to changing economic, political and social developments in international markets; our ability to realize the anticipated benefits from acquisitions, dispositions, joint ventures or strategic alliances; changing prices of energy, including gasoline, diesel and jet fuel, or interruptions in supplies of these commodities; changes in exchange rates or interest rates; our ability to accurately forecast our future capital investment needs; significant expenses and funding obligations relating to employee health, retiree health and/or pension benefits; our ability to manage insurance and claims expenses; changes in business strategy, government regulations, or economic or market conditions that may result in impairments of our assets; potential additional U.S. or international tax liabilities; increasingly stringent laws and regulations, including relating to climate change; potential claims or litigation related to labor and employment, personal injury, property damage, business practices, environmental liability and other matters; and other risks discussed in our filings with the Securities and Exchange Commission from time to time, including our Annual Report on Form 10-K for the year ended December 31, 2021, our Quarterly Report on Form 10-Q for the quarter ended March 31, 2022, and subsequently filed reports. You should consider the limitations on, and risks associated with, forward-looking statements and not unduly rely on the accuracy of predictions contained in such forward-looking statements. We do not undertake any obligation to update forward-looking statements to reflect events, circumstances, changes in expectations, or the occurrence of unanticipated events after the date of those statements.

Information, including comparisons to prior periods, may reflect adjusted results. See the appendix for reconciliations of adjusted results and other non-GAAP financial measures.

Reconciliation of GAAP and Non-GAAP Financial Measures

From time to time we supplement the reporting of our financial information determined under generally accepted accounting principles (”GAAP”) with certain non-GAAP financial measures. These include: ”adjusted” compensation and benefits; operating expenses; earnings before interest, taxes, depreciation and amortization (“EBITDA”); operating profit; operating margin; other income and (expense); income before income taxes; income tax expense; effective tax rate; net income; and earnings per share. We present revenue, revenue per piece and operating profit on a constant currency basis. Additionally, we disclose free cash flow, return on invested capital (“ROIC”) and the ratio of adjusted total debt to adjusted EBITDA.

We believe that these non-GAAP measures provide meaningful information to assist users of our financial statements in more fully understanding our financial results and cash flows and assessing our ongoing performance, because they exclude items that may not be indicative of, or are unrelated to, our underlying operations and may provide a useful baseline for analyzing trends in our underlying

businesses. These non-GAAP measures are used internally by management for business unit operating performance analysis, business unit resource allocation and in connection with incentive compensation award determinations.

Non-GAAP financial measures should be considered in addition to, and not as an alternative for, our

reported results prepared in accordance with GAAP. Our adjusted financial information does not represent a comprehensive basis of accounting. Therefore, our adjusted financial information may not be comparable to similarly titled information reported by other companies.

Transformation and Other Charges

Adjusted EBITDA, operating profit, operating margin, income before income taxes, net income and

earnings per share may exclude the impact of charges related to transformation activities, goodwill and asset impairments, and divestitures.

Changes in Foreign Currency Exchange Rates and Hedging Activities

Currency-neutral revenue, revenue per piece and operating profit exclude the period over period impact of foreign currency exchange rate changes and any foreign currency hedging activities. These measures are calculated by dividing current period reported U.S. dollar revenue, revenue per piece and operating profit by the current period average exchange rates to derive current period local currency revenue, revenue per piece and operating profit. The derived amounts are then multiplied by the average foreign exchange rates used to translate the comparable results for each month in the prior year period (including the impact of any foreign currency hedging activities). The difference between the current period reported U.S. dollar revenue, revenue per piece and operating profit and the derived current period U.S. dollar revenue, revenue per piece and operating profit is the period over period impact of foreign currency exchange rates and hedging activities.

Pension and Postretirement Adjustments

We recognize changes in the fair value of plan assets and net actuarial gains and losses in excess of a 10% corridor (defined as 10% of the greater of the fair value of plan assets or the plan’s projected

benefit obligation), as well as gains and losses resulting from plan amendments, for our pension and

postretirement defined benefit plans immediately as part of other pension income (expense). We

supplement the presentation of our income before income taxes, net income and earnings per share with adjusted measures that exclude the impact of these gains and losses and the related income tax effects. We believe excluding these defined benefit plan gains and losses provides important supplemental information by removing the volatility associated with plan amendments and short-term changes in market interest rates, equity values and similar factors.

The deferred income tax effects of pension and postretirement adjustments are calculated by multiplying the statutory tax rates applicable in each tax jurisdiction, including the U.S. federal jurisdiction and various U.S. state and non-U.S. jurisdictions, by the adjustments.

Free Cash Flow

We calculate free cash flow as cash flows from operating activities less capital expenditures, proceeds from disposals of property, plant and equipment, and plus or minus the net changes in finance receivables and other investing activities. We believe free cash flow is an important indicator of how much cash is generated by our ongoing business operations and we use this as a measure of incremental cash available to invest in our business, meet our debt obligations and return cash to shareowners.

Return on Invested Capital

ROIC is calculated as the trailing twelve months (“TTM”) of adjusted operating income divided by the

average of total debt, non-current pension and postretirement benefit obligations and shareowners’

equity, at the current period end and the corresponding period end of the prior year. Because ROIC is not a measure defined by GAAP, we calculate it, in part, using non-GAAP financial measures that we believe are most indicative of our ongoing business performance. We consider ROIC to be a useful measure for evaluating the effectiveness and efficiency of our long-term capital investments.

Adjusted Total Debt / Adjusted EBITDA

Adjusted total debt is defined as our long-term debt and finance leases, including current maturities, plus non-current pension and postretirement benefit obligations. Adjusted EBITDA is defined as earnings before interest, taxes, depreciation and amortization adjusted for restructuring and other costs and investment income and other. We believe the ratio of adjusted total debt to adjusted EBITDA is an important indicator of our financial strength, and is a ratio used by third parties when evaluating the level of our indebtedness.

Forward-Looking Non-GAAP Metrics

From time to time when presenting forward-looking non-GAAP metrics, we are unable to provide quantitative reconciliations to the most closely correlated GAAP measure due to the uncertainty in the timing, amount or nature of any adjustments, which could be material in any period.

Reconciliation of GAAP and Non-GAAP Income Statement Items

(in millions, except per share amounts):

| Three Months Ended June 30, 2022 | |||||

| As Reported (GAAP) | Transformation & Other Adj.(1) | As Adjusted(Non-GAAP) | |||

| U.S. Domestic Package | $ 13,630 | $ 26 | $ 13,604 | ||

| International Package | 3,880 | 11 | 3,869 | ||

| Supply Chain Solutions | 3,721 | 4 | 3,717 | ||

| Operating Expense | 21,231 | 41 | 21,190 | ||

| U.S. Domestic Package | 1,829 | 26 | 1,855 | ||

| International Package | 1,193 | 11 | 1,204 | ||

| Supply Chain Solutions | 513 | 4 | 517 | ||

| Operating Profit | 3,535 | 41 | 3,576 | ||

| Other Income and (Expense): | |||||

| Other pension income (expense) | 298 | — | 298 | ||

| Investment income (expense) and other | 35 | — | 35 | ||

| Interest expense | (171) | — | (171) | ||

| Total Other Income (Expense) | 162 | — | 162 | ||

| Income Before Income Taxes | 3,697 | 41 | 3,738 | ||

| Income Tax Expense | 848 | 10 | 858 | ||

| Net Income | $ 2,849 | $ 31 | $ 2,880 | ||

| Basic Earnings Per Share | $ 3.26 | $ 0.04 | $ 3.30 | ||

| Diluted Earnings Per Share | $ 3.25 | $ 0.04 | $ 3.29 | ||

(1) Transformation & Other of $41 million reflects other employee benefits costs of $23 million and other costs of $18 million.

Reconciliation of GAAP and Non-GAAP Income Statement Items

(in millions, except per share amounts):

| Six Months Ended June 30, 2022 | |||||||

| As Reported (GAAP) | Pension Adj.(1) | Transformation & Other Adj.(2) | As Adjusted(Non-GAAP) | ||||

| U.S. Domestic Package | $ 27,092 | $ — | $ 69 | $ 27,023 | |||

| International Package | 7,640 | — | 15 | 7,625 | |||

| Supply Chain Solutions | 7,626 | — | 12 | 7,614 | |||

| Operating Expense | 42,358 | — | 96 | 42,262 | |||

| U.S. Domestic Package | 3,491 | — | 69 | 3,560 | |||

| International Package | 2,309 | — | 15 | 2,324 | |||

| Supply Chain Solutions | 986 | — | 12 | 998 | |||

| Operating Profit | 6,786 | — | 96 | 6,882 | |||

| Other Income and (Expense): | |||||||

| Other pension income (expense) | 629 | (33) | — | 596 | |||

| Investment income (expense) and other | 19 | — | — | 19 | |||

| Interest expense | (345) | — | — | (345) | |||

| Total Other Income (Expense) | 303 | (33) | — | 270 | |||

| Income Before Income Taxes | 7,089 | (33) | 96 | 7,152 | |||

| Income Tax Expense | 1,578 | (9) | 22 | 1,591 | |||

| Net Income | $ 5,511 | $ (24) | $ 74 | $ 5,561 | |||

| Basic Earnings Per Share | $ 6.31 | $ (0.03) | $ 0.08 | $ 6.36 | |||

| Diluted Earnings Per Share | $ 6.28 | $ (0.03) | $ 0.08 | $ 6.33 | |||

(1) Represents the impact of curtailment of benefits effective December 31, 2023, for the Canada LTD Retirement Plan.

(2) Transformation & Other of $96 million reflects other employee benefits costs of $56 million and other costs of $40 million.

Reconciliation of Currency Adjusted Revenue, Revenue Per Piece,

and Adjusted Operating Profit

(in millions, except per piece amounts)

| Three Months Ended June 30, | ||||||||||||

| 2022As-Reported(GAAP) | 2021As-Reported(GAAP) | % Change(GAAP) | CurrencyImpact | 2022CurrencyNeutral(Non-GAAP)(1) | % Change(Non-GAAP) | |||||||

| Average Revenue Per Piece: | ||||||||||||

| International Package: | ||||||||||||

| Domestic | $ 7.61 | $ 7.44 | 2.3 % | $ 0.84 | $ 8.45 | 13.6 % | ||||||

| Export | 36.91 | 32.60 | 13.2 % | 1.53 | 38.44 | 17.9 % | ||||||

| Total International Package | $ 22.17 | $ 19.32 | 14.8 % | $ 1.18 | $ 23.35 | 20.9 % | ||||||

| Consolidated | $ 13.72 | $ 12.26 | 11.9 % | $ 0.18 | $ 13.90 | 13.4 % | ||||||

| Revenue: | ||||||||||||

| U.S. Domestic Package | $ 15,459 | $ 14,402 | 7.3 % | $ — | $ 15,459 | 7.3 % | ||||||

| International Package | 5,073 | 4,817 | 5.3 % | 261 | 5,334 | 10.7 % | ||||||

| Supply Chain Solutions(2) | 4,234 | 4,205 | 0.7 % | 62 | 4,296 | 2.2 % | ||||||

| Total revenue | $ 24,766 | $ 23,424 | 5.7 % | $ 323 | $ 25,089 | 7.1 % | ||||||

| 2022As-Adjusted(Non-GAAP) | 2021As-Adjusted(Non-GAAP) | % Change(Non-GAAP) | CurrencyImpact | 2022As-AdjustedCurrencyNeutral(Non-GAAP)(1) | % Change(Non-GAAP) | |||||||

| As-Adjusted Operating Profit(3): | ||||||||||||

| U.S. Domestic Package | $ 1,855 | $ 1,675 | 10.7 % | $ — | $ 1,855 | 10.7 % | ||||||

| International Package | 1,204 | 1,190 | 1.2 % | 60 | 1,264 | 6.2 % | ||||||

| Supply Chain Solutions(2) | 517 | 408 | 26.7 % | (15) | 502 | 23.0 % | ||||||

| Total operating profit | $ 3,576 | $ 3,273 | 9.3 % | $ 45 | $ 3,621 | 10.6 % | ||||||

(1) Amounts adjusted for period over period foreign currency exchange rate and hedging differences

(2) The divestiture of UPS Freight was completed on April 30, 2021.

(3) Amounts adjusted for transformation & other

Reconciliation of Currency Adjusted Revenue, Revenue Per Piece,

and Adjusted Operating Profit

(in millions, except per piece amounts)

| Six Months Ended June 30, | ||||||||||||

| 2022As-Reported(GAAP) | 2021As-Reported(GAAP) | % Change(GAAP) | CurrencyImpact | 2022CurrencyNeutral(Non-GAAP)(1) | % Change(Non-GAAP) | |||||||

| Average Revenue Per Piece: | ||||||||||||

| International Package: | ||||||||||||

| Domestic | $ 7.48 | $ 7.38 | 1.4 % | $ 0.65 | $ 8.13 | 10.2 % | ||||||

| Export | 35.47 | 31.85 | 11.4 % | 1.14 | 36.61 | 14.9 % | ||||||

| Total International Package | $ 21.29 | $ 18.91 | 12.6 % | $ 0.89 | $ 22.18 | 17.3 % | ||||||

| Consolidated | $ 13.49 | $ 12.19 | 10.7 % | $ 0.13 | $ 13.62 | 11.7 % | ||||||

| Revenue: | ||||||||||||

| U.S. Domestic Package | $ 30,583 | $ 28,412 | 7.6 % | $ — | $ 30,583 | 7.6 % | ||||||

| International Package | 9,949 | 9,424 | 5.6 % | 404 | 10,353 | 9.9 % | ||||||

| Supply Chain Solutions(2) | 8,612 | 8,496 | 1.4 % | 99 | 8,711 | 2.5 % | ||||||

| Total revenue | $ 49,144 | $ 46,332 | 6.1 % | $ 503 | $ 49,647 | 7.2 % | ||||||

| 2022As-Adjusted(Non-GAAP) | 2021As-Adjusted(Non-GAAP) | % Change(Non-GAAP) | CurrencyImpact | 2022As-AdjustedCurrencyNeutral(Non-GAAP)(1) | % Change(Non-GAAP) | |||||||

| As-Adjusted Operating Profit(3): | ||||||||||||

| U.S. Domestic Package | $ 3,560 | $ 3,138 | 13.4 % | $ — | $ 3,560 | 13.4 % | ||||||

| International Package | 2,324 | 2,281 | 1.9 % | 88 | 2,412 | 5.7 % | ||||||

| Supply Chain Solutions(2) | 998 | 803 | 24.3 % | (18) | 980 | 22.0 % | ||||||

| Total operating profit | $ 6,882 | $ 6,222 | 10.6 % | $ 70 | $ 6,952 | 11.7 % | ||||||

(1) Amounts adjusted for period over period foreign currency exchange rate and hedging differences

(2) The divestiture of UPS Freight was completed on April 30, 2021.

(3) Amounts adjusted for transformation & other

Reconciliation of Free Cash Flow (Non-GAAP measure)

(in millions):

| Six Months Ended June 30, | ||

| 2022 | ||

| Cash flows from operating activities | $ 8,293 | |

| Capital expenditures | (1,388) | |

| Proceeds from disposals of property, plant and equipment | 9 | |

| Net change in finance receivables | 7 | |

| Other investing activities | (26) | |

| Free Cash Flow (Non-GAAP measure) | $ 6,895 | |

Reconciliation of Adjusted Debt to Adjusted EBITDA (Non-GAAP measure)

(in millions):

| TTM(1) | |||

| June 30, | |||

| 2022 | |||

| Net income | $ 10,933 | ||

| Add back: | |||

| Income tax expense | 3,111 | ||

| Interest expense | 695 | ||

| Depreciation & amortization | 3,018 | ||

| EBITDA | 17,757 | ||

| Add back (deduct): | |||

| Transformation and other | 231 | ||

| Defined benefit plan (gains) and losses | (15) | ||

| Investment income and other | (1,151) | ||

| Adjusted EBITDA | $ 16,822 | ||

| Debt and finance leases, including current maturities | $ 20,576 | ||

| Add back: | |||

| Non-current pension and postretirement benefit obligations | 8,343 | ||

| Adjusted total debt | $ 28,919 | ||

| Adjusted total debt/adjusted EBITDA | 1.72 | ||

(1) Trailing twelve months

Reconciliation of Return on Invested Capital (Non-GAAP measure)

(in millions):

| TTM(1) | ||

| June 30, | ||

| 2022 | ||

| Net income | $ 10,933 | |

| Add back (deduct): | ||

| Income tax expense | 3,111 | |

| Interest expense | 695 | |

| Other pension (income) expense | (1,181) | |

| Investment (income) expense and other | 15 | |

| Operating profit | 13,573 | |

| Transformation and other | 231 | |

| Adjusted operating profit | $ 13,804 | |

| Average debt and finance leases, including current maturities | 21,584 | |

| Average non-current pension and postretirement benefit obligations | 8,009 | |

| Average shareowners’ equity | 13,566 | |

| Average Invested Capital | $ 43,159 | |

| Net income to average invested capital | 25.3 % | |

| Adjusted Return on Invested Capital | 32.0 % |

(1) Trailing twelve months

Shenique Edwards , Kommunikationsansvarig, UPS Storbritannien, Irland och Norden.

e-post: sheniqueedwards@ups.com

Tel: +44 7816 646050

Om UPS

UPS (NYSE: UPS) är ett av världens största paketleveransföretag med en omsättning på 84,6 miljarder dollar (2020). UPS erbjuder ett brett utbud av integrerade logistiklösningar för kunder i mer än 220 länder och områden världen över. Företaget har över 540 000 anställda och mottot ”Moving our world forward by delivering what matters”, där vi alla arbetar efter strategin: Customer First. People Led. Innovation Driven. UPS har åtagit sig att minska sin miljöpåverkan och stödja de samhällen vi arbetar för runt om i världen. UPS arbetar även aktivt med mångfald, jämlikhet och inkludering. Företaget finns på ups.com, med mer information på about.ups.com och investors.ups.com/.

Taggar:

Marknadsnyheter

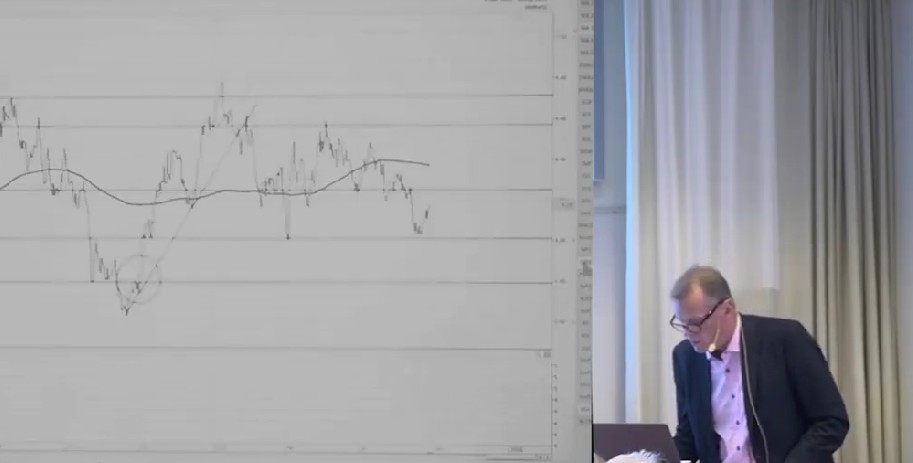

Teknisk analys på flera marknader med Anders Haglund

Anders Haglund går igenom den tekniska analysen på flera marknader samt även några olika enskilda aktier.

Marknadsnyheter

JRS chefsstrateg Torbjörn Söderberg om börsen framåt

JRS chefsstrateg Torbjörn Söderberg pratar med Jesper Norberg på EFN om börsens väg framåt. Man tar upp värderingar och makro, samt hur han själv väljer att agera.

Marknadsnyheter

Kreditkort skapar problem för USAs konsumenter – CNBC granskar

CNBC tittar närmare på hur kreditkort skapar problem för konsumenterna i USA som får betala räntor på upp till 36 %, och ovanpå det kommer nya avgifter. När det skapar så här stora problem blir det ett problem för ekonomin som helhet, det är inte bara ett individuellt problem.

CNBC granskar kreditkort och problemen de skapar

Vi skrev nyligen om rekordhög belåning hos investerare i USA. Det är samma sak här, när det är så många individer som är så hårt belånade blir det ett problem för hela aktiemarknaden.

-

Analys från DailyFX10 år ago

EUR/USD Flirts with Monthly Close Under 30 Year Trendline

-

Marknadsnyheter5 år ago

BrainCool AB (publ): erhåller bidrag (grant) om 0,9 MSEK från Vinnova för bolagets projekt inom behandling av covid-19 patienter med hög feber

-

Marknadsnyheter3 år ago

Marknadsnyheter3 år agoUpptäck de bästa verktygen för att analysera Bitcoin!

-

Analys från DailyFX12 år ago

Japanese Yen Breakout or Fakeout? ZAR/JPY May Provide the Answer

-

Marknadsnyheter2 år ago

Marknadsnyheter2 år agoDärför föredrar svenska spelare att spela via mobiltelefonen

-

Analys från DailyFX12 år ago

Price & Time: Key Levels to Watch in the Aftermath of NFP

-

Analys från DailyFX8 år ago

Gold Prices Falter at Resistance: Is the Bullish Run Finished?

-

Nyheter7 år ago

Nyheter7 år agoTeknisk analys med Martin Hallström och Nils Brobacke