Analys från DailyFX

US DOLLAR Technical Analysis: A Wild Open To June Is Set To Get Wilder

To See How FXCM’s Live Clients Are Positioned In FX Equities Click Here Now

Talking Points:

- US Dollar Technical Strategy: Are We About To Turn Higher?

- If We Hold 11,672, This May Be The Cheapest The US Dollar Will Be For A Long Time

- A Summer To Remember One Way Or Another!

News Flash, Hedge Funds apparently still hate the US Dollar. At least, as per the CFTC Commitment of Traders report that shows the percentage of bulls in lowest in the US Dollar in G10FX. Surprisingly, the institutional speculators would prefer to sell US Dollar than the British Pound ahead of the historic EU Referendum on June 23 that may result in a ‘Brexit.’

However, as a technical-based Trader, we have closed the window for the opening range of June, which I denote as the first 5-full trading days of a month, with a wide range and an equally wide range of possibilities from here. From a fundamental perspective, the optimism in the last half of May regarding an imminent Fed rate hike has all but dissipated after a pathetic Non-Farm Payroll on June 3.

The US Dollar has weakened for June’s open but, June isn’t over yet.

Compete to Win Cash Prizes With Your FXCM Mini Account, Click Here For More Info

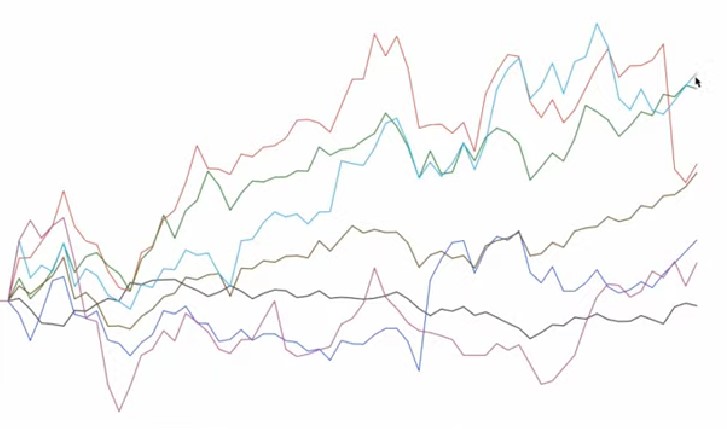

Multi-Year Weekly Chart on US Dollar

The chart above shows how aggressive the move higher has been since the 2011 low. The recent move down from the ~13-year high in January has brought us back to bullish price channel support. While it is difficult to make heads and tales of short-term price action on the chart above, the main takeaway is that a break higher, and specifically above 12,000 could show an aggressive resumption of the bullish trend.

Given the macro backdrop of decreasing expectations of a Federal Reserve Rate hike, a hold of the 12,000-price ceiling and break below the May low at 11,672 could be devastating for US Dollar Bulls. Such a development would validate the argument that the bull-run from July 2014 to January 2016 was built on false premises of multiple rate hikes that were never supported by economic data and we could be on our way to a larger correction.

While a lot of macro pivots will take place over the rest of 2016 such as the EU referendum, US presidential election, and further clarity of the Fed’s intended rate path, it seems fair to say that we could retrace anywhere from ~50-61.8% of the 2014-2016 price range. Such a move would take us down to 11,325-11,095 respectively.

What Will The June Opening Range Breakout Bring FX Traders?

The opening range of June was a wild one. We had a 200 point range with an ATR(5) hovering around 60 points at the beginning of the month. While the last few days have shown us retracting the bear move to open the move, there are a few key developments and levels to be on the watch out for the next few weeks as we endure the EU Referendum on the 23rd and the FOMC Rate announcement on June 15.

June Support Resitance Levels As of June 10

The opening range low is 11,798 while the opening range high is 11,998. These levels bracket sentiment perfectly as the key resistance we’ve been watching (highlighted on the chart above) is the 12,000 zone where we’ve seen many pivots since topping out in late January.

As dire as the fundamental picture has become for the greenback in terms of expected interest rate hikes (a fundamental driver of currency strength), a break above the 12,000 zone would turn all attention to further US Dollar upside.

In binary fashion, a break below the opening range low of 11,798 opens up the key 2016 low of 11,672. While this support range of 126 pips is large, a break below there could bring a move to the previously mentioned 11,325-11,095 zone.

There appears to be significance around the 11,800 zone, which is ~61.8% of the May range and also the previous resistance of the corrective price channel (red) shown in the chart above. Therefore, the hold of that zone was a short-term bullish development that has resulted in a push of ~11,900 where the Weekly Pivot resides. Further, a break below this level would be a blow to the US Dollar bulls that were just beginning to regain confidence.

Either way, given the event risk coming up, we can expect whichever opening range level breakout we receive will bring out an aggressive follow through.

Shorter-Term US Dollar Technical Levels for Friday, June 10, 2016

For those interested in shorter-term levels of focus than the ones above, these levels signal important potential pivot levels over the next 48-hours.

Interested In our Analyst’s Longer-Term Dollar Outlook? Please sign up for our free dollar guide here.

T.Y.

Analys från DailyFX

EURUSD Weekly Technical Analysis: New Month, More Weakness

What’s inside:

- EURUSD broke the ‘neckline’ of a bearish ‘head-and-shoulders’ pattern, April trend-line

- Resistance in vicinity of 11825/80 likely to keep a lid on further strength

- Targeting the low to mid-11600s with more selling

Confidence is essential to successful trading, see this new guide – ’Building Confidence in Trading’.

Coming into last week we pointed out the likelihood of finally seeing a resolution of the range EURUSD had been stuck in for the past few weeks, and one of the outcomes we made note of as a possibility was for the triggering of a ’head-and-shoulders’ pattern. Indeed, we saw a break of the ’neckline’ along with a drop below the April trend-line. This led to decent selling before a minor bounce took shape during the latter part of last week.

Looking ahead to next week the euro is set up for further losses as the path of least resistance has turned lower. Looking to a capper on any further strength there is resistance in the 11825-11880 area (old support becomes new resistance). As long as the euro stays below this area a downward bias will remain firmly intact.

Looking lower towards support eyes will be on the August low at 11662 and the 2016 high of 11616, of which the latter just happens to align almost precisely with the measured move target of the ‘head-and-shoulders’ pattern (determined by subtracting the height of the pattern from the neckline).

Bottom line: Shorts look set to have the upperhand as a fresh month gets underway as long as the euro remains capped by resistance. On weakness, we’ll be watching how the euro responds to a drop into support levels.

For a longer-term outlook on EURUSD, check out the just released Q4 Forecast.

EURUSD: Daily

—Written by Paul Robinson, Market Analyst

You can receive Paul’s analysis directly via email bysigning up here.

You can follow Paul on Twitter at@PaulRobinonFX.

Analys från DailyFX

Euro Bias Mixed Heading into October, Q4’17

Why and how do we use IG Client Sentiment in trading? See our guide and real-time data.

EURUSD: Retail trader data shows 37.3% of traders are net-long with the ratio of traders short to long at 1.68 to 1. In fact, traders have remained net-short since Apr 18 when EURUSD traded near 1.07831; price has moved 9.6% higher since then. The number of traders net-long is 15.4% lower than yesterday and 16.4% higher from last week, while the number of traders net-short is 0.4% higher than yesterday and 10.5% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURUSD prices may continue to rise. Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EURUSD trading bias.

— Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

Analys från DailyFX

British Pound Reversal Potential Persists Heading into New Quarter

Why and how do we use IG Client Sentiment in trading? See our guide and real-time data.

GBPUSD: Retail trader data shows 38.2% of traders are net-long with the ratio of traders short to long at 1.62 to 1. In fact, traders have remained net-short since Sep 05 when GBPUSD traded near 1.29615; price has moved 3.4% higher since then. The number of traders net-long is 0.1% higher than yesterday and 13.4% higher from last week, while the number of traders net-short is 10.6% lower than yesterday and 18.3% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBPUSD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current GBPUSD price trend may soon reverse lower despite the fact traders remain net-short.

— Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

-

Analys från DailyFX8 år ago

EUR/USD Flirts with Monthly Close Under 30 Year Trendline

-

Marknadsnyheter1 år ago

Marknadsnyheter1 år agoUpptäck de bästa verktygen för att analysera Bitcoin!

-

Marknadsnyheter4 år ago

BrainCool AB (publ): erhåller bidrag (grant) om 0,9 MSEK från Vinnova för bolagets projekt inom behandling av covid-19 patienter med hög feber

-

Analys från DailyFX11 år ago

Japanese Yen Breakout or Fakeout? ZAR/JPY May Provide the Answer

-

Analys från DailyFX11 år ago

Price & Time: Key Levels to Watch in the Aftermath of NFP

-

Analys från DailyFX7 år ago

Gold Prices Falter at Resistance: Is the Bullish Run Finished?

-

Nyheter5 år ago

Nyheter5 år agoTeknisk analys med Martin Hallström och Nils Brobacke

-

Marknadsnyheter6 år ago

Tudorza reduces exacerbations and demonstrates cardiovascular safety in COPD patients