Marknadsnyheter

eDreams ODIGEO achieves all-time record in bookings and revenues, greater profitability and strong subscriber growth

Outstanding performance reconfirms business on track to meet or exceed 2025 targets

Results for the 12 months ended 31st March 2023

Barcelona, 25 May 2023. – eDreams ODIGEO (hereinafter ‘eDO’ or ‘the Company’), one of the world’s largest online travel companies and one of the largest European e-commerce businesses, today released its results for the 12 months ended 31st March 2023.

The Company achieved a number of records in the period, including the highest-ever levels of bookings, mobile bookings, revenues and subscribers. The continued and rapid sales growth, coupled with sharply improved margins, resulted in accelerating profitability. The business achieved 16.2 million record bookings, a +29% increase over the previous 2022 high and 42% above pre-COVID levels, and continued to outperform the broader travel market. Although the European and global travel markets are still below pre-pandemic levels, eDreams ODIGEO has achieved above 2019 levels for 7 consecutive quarters, the only major travel company to achieve this, demonstrating the Company’s market-leading position and the strength of its customer proposition.

The key driver of the Company’s outperformance is ‘Prime’, the world’s first and largest travel subscription programme, which performed outstandingly with the addition of 1.7 million new subscribers, exceeding 4.3 million at the end of the fourth quarter, which represents 64% more than just one year ago.

eDreams ODIGEO’s continued progress and success enable it to reconfirm its guidance for the fiscal year 2025: greater than 7.25 million Prime members, around €80 ARPU (Average Revenue Per User) and Cash EBITDA in excess of €180 million.

RESULTS HIGHLIGHTS

- Record-breaking trading with strong improvement in profitability

- eDreams ODIGEO made further significant progress in the fiscal year 2023 with continued rapid revenue margin growth and sharply improved margins, resulting in rising profitability.

- Cash Revenue Margin surpassed the €600-million mark for the first time in the Company’s history, reaching €621 million and growing 47% in just one year. Revenue Margin increased 49% to €569.6 million.

- The business delivered strong growth in profitability as margins were sharply improved; + 8ppt since the start of the year. As guided, the maturity of Prime members is the most important driver for profitability. As more subscribers renew their memberships, profitability increases.

- Marginal Profit and Cash Marginal Profit stood at €113.2 million and €164.7 million, an increase of 71% and 53% the amount in fiscal year 2022, respectively.

- Cash Marginal Profit Margin increased 9ppt to 30% in the fourth quarter, from 21% in the first quarter. Cash EBITDA Margin in the fourth quarter also achieved very substantial improvements and stood at 16.7% vs. 8.8% in the first quarter of the fiscal year 2023.

- eDreams ODIGEO made further significant progress in the fiscal year 2023 with continued rapid revenue margin growth and sharply improved margins, resulting in rising profitability.

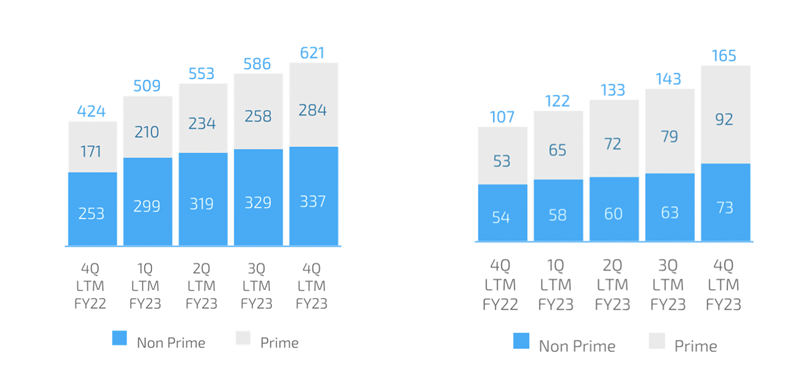

Evolution of Cash Revenue Margin Evolution of Cash Marginal Profit

(in million Euros)

-

- Cash EBITDA stood at €84.4 million in fiscal year 2023, up 91% year-on-year, with strong Cash EBITDA in the fourth quarter totalling 26.9 million and representing a 17% increase versus the third quarter and 93% increase compared to the first quarter.

- Bookings hit an all-time high of 16.2 million, representing 29% above the previous record achieved in fiscal year 2022 and 42% above pre-COVID-19, despite the macro and geopolitical context.

- As guided, the Company continues to progress with the strategic expansion of its global workforce, which will grow by 50% by 2025 to further fuel its long-term growth as a subscription business. The higher personnel costs associated with this recruitment drive, coupled with higher variable costs associated with larger trading volumes and higher acquisition costs due to the investment to acquire new Prime members, drove the bottom-line result.

- Excellent performance of the subscription model

- eDreams ODIGEO is the leader and inventor of the subscription model in travel. Prime continues to improve the quality of the business and grows strongly.

- Membership grew by 64% year-on-year (1.7 million new subscribers) to 4.3 million members.

- Throughout fiscal year 2023, the programme achieved average quarterly net adds of 421,000 new members.

- Rapid growth in subscribers has continued: 4.6m subscribers as of today[1], a further 300,000 since the year-end.

- Self-imposed targets will be met or even exceeded

- The Company is well on track to reach or even exceed its 2025 targets:

- Greater than 7.25 million Prime members.

- Prime ARPU (Average Revenue Per User) of €80, approximately

- Cash EBITDA in excess of €180 million.

Dana Dunne, CEO of eDreams ODIGEO commented: ”We are delighted to report outstanding results, with yet another year of successful strategic delivery. Even with the challenges posed by the market conditions, we continued to outperform the travel industry and significantly improved the profitability of our business, which was mostly driven by our unique subscription platform.

This year, we are proud to have achieved several historic milestones, including records in bookings, revenues, and mobile sales ever achieved in our 24-year history, all while successfully expanding our subscriber base at a robust pace. These remarkable accomplishments underscore the uniqueness of our offering and the strength of our winning proposition.

Our continued rapid growth is not only a testament to our successful strategy but also a source of long-term value for our shareholders, customers, partners, and team members. As we continue to lead in travel innovation with a forward-thinking, sustainable, and tech-driven business, we aim to push the boundaries of what is possible with technology and revolutionise the broader e-commerce industry, an ever-expanding multi-trillion euro segment with tremendous growth prospects.

Our excellent performance over the past twelve months would have not been possible without our outstanding people, our ‘eDOers’. Their impressive work and dedication have a material impact on the experiences of millions of travellers worldwide and we take pride in seeing how their contributions are shaping the future of travel. We will keep on cultivating the best talent as we continue growing as a subscription-led business.

We remain committed to driving innovation and delivering exceptional value to all our stakeholders. As we look ahead to our 2025 horizon, we do so with ever-increased confidence that we will deliver on our word and meet, or even exceed, our self-set targets and unlock a much greater potential that extends well beyond 2025. These are truly exciting times for eDreams ODIGEO.”

GENERAL OVERVIEW

eDreams ODIGEO made further significant progress in the fiscal year 2023, achieving record figures in several KPIs. The business delivered continued rapid revenue margin growth and sharply improved margins, resulting in rising profitability following the pivot to a subscription-based model. As guided, the maturity of Prime members is the most important driver for profitability. As more Prime members renew their memberships, profitability increases. In the fourth quarter, eDreams ODIGEO continued to see significant Cash Marginal Profit and Cash EBITDA margin improvements as the maturity of Prime members increased.

The Company’s trading demonstrated its recovery from COVID-19 with best-in-class performance outperforming the market (and its competitors) by a significant margin, which was driven by the increased quality of the business with the pivot to subscription and consumers’ desire to travel. eDreams ODIGEO, with its unique customer proposition and reaching 4.6 million Prime subscribers in May[2], is positioned to take advantage in a post COVID-19 era to attract more customers and capture further market share.

With Prime’s superior value proposition, eDO outperformed its industry peers. Throughout the pandemic, eDreams ODIGEO has consistently outperformed the airline industry, which highlights the strength and adaptability of its business model, with a business that has increased its quality with the pivot to subscription. The Company now continues to achieve strong growth in market share vs supplier direct bookings due to its better content quality, more comprehensive offer, flexibility and focus on leisure travel.

Despite the industry moving to more normalised seasonality patterns, the conflict in Ukraine, the global increase in inflation, and industry disruptions, in the fiscal year 2023 the Company achieved record bookings, reaching 16.2 million, and 29% above the fiscal year 2022 and 42% above pre COVID-19.

Additionally, mobile bookings also improved and accounted for 57% of total flight bookings, a record in the history of the Company.

Underpinning its proposition and growth, the business invested in technology and talent creating a tech lab in Milan to add to those already in Barcelona, Madrid, Porto, Palma de Mallorca and Alicante to harness and recruit best-in-class talent. Today, its AI models make on average up to 1.8 billion daily AI predictions and its platform is processing over 100 million daily user searches from our customers, and combining travel options from nearly 700 global airlines.

eDreams ODIGEO is a leading technology-based business in Europe and is at the forefront of technological change, including in the field of AI in which it has been investing over the past 10 years and has integrated advanced AI models across our platform such as deep learning and reinforcement learning algorithms similar to those being used in self-driving cars. These AI capabilities allow the Company to create superior and highly personalised products for its customers. Today, for example, already the majority of customers book the travel option that the AI engine recommended to them. As an industry innovator, the Company began investing in leveraging the power of generative AI, including Large Language Models (LLMs), before they became more popular over the last months.

FINANCIAL REVIEW

Revenue Margin and Cash Revenue Margin achieved record levels and increased 49% and 47%, respectively, vs the same period last year, following Bookings increasing 29% and the rise in Cash Revenue Margin/Booking of 14% driven by the increased quality of the business with the pivot to subscription.

Overall, the fourth quarter of the fiscal year 2023 has seen the improving trends seen in the two previous quarters, as well as significant improvements in profitability as more Prime members renewed their memberships. In fiscal year 2023, Marginal Profit and Cash Marginal Profit stood at €113.2 million and €164.7 million, an increase of 71% and 53% the amount in fiscal year 2022, respectively.

In the fourth quarter, Cash Marginal Profit Margin increased to 30% from 21% in the first quarter, a 9ppt improvement. Cash EBITDA also showed substantial improvements, which resulted in €84.4 million in the full-year period (€26.9 million in the fourth quarter alone), up 91% vs the same period last year. As the maturity of Prime members increases it is proven that margins improve. Cash EBITDA Margin in the fourth quarter stood at 16.7% vs 8.8% in the first quarter. As guided in the first quarter, strong growth in year 1 Prime members delayed profitability as profitability improves from year 2 onwards.

Net Income and Adjusted Net Income were a loss of €43.3 million and €34.7 million in the fiscal year (vs loss of €65.9 million and €52.3 million in fiscal year 2022), respectively. As guided, the Company continues to progress with the strategic expansion of its global workforce, which will grow by 50% by 2025 to further fuel its long-term growth as a subscription business. The higher personnel costs associated with this recruitment drive, coupled with higher variable costs associated with larger trading volumes and higher acquisition costs due to the investment to acquire new Prime members, drove the bottom-line result. The Company believes that Adjusted Net Income better reflects the real ongoing operational performance of the business.

In the fiscal year 2023, despite headwinds and normalisation in the market, the Company ended the fourth quarter with a positive Cash Flow from Operations of €102.5 million, following a working capital inflow of €69.4 million. The inflow in fiscal year 2023 reflected a strong growth in Prime members, better volumes in March 2023 compared to March 2022 as well as the fact that the average basket size increased as a result of airfare increases in fiscal year 2023 vs. 2022. Liquidity remained more than sufficient and stable throughout the pandemic, standing solid at €196 million in fiscal year 2023.

Leverage ratios have been temporarily impacted due to COVID-19. As announced on 19th January 2022, the Company successfully refinanced all its debt with better contractual terms for the debt, including most importantly the maintenance covenant. EBITDA of reference is now Cash EBITDA, covenant now springs at 40% vs 30% previously.

FINANCIAL INFORMATION SUMMARY

| (in € million) | FY23 | Var. FY23-FY22 | FY22 | Q4 FY23 | Var. Q4 FY23 – QFY22 | Q4 FY22 |

| Revenue Margin | 569.6 | 49% | 382.6 | 150.1 | 26% | 118.9 |

| Cash Revenue Margin | 621.0 | 47% | 423.8 | 161.3 | 27% | 126.8 |

| Cash Marginal Profit | 164.7 | 53% | 107.4 | 49.2 | 80% | 27.2 |

| Cash EBITDA | 84.4 | 91% | 44.2 | 26.9 | 148% | 10.8 |

| Adjusted EBITDA | 33.0 | 1015% | 3.0 | 15.7 | 439% | 2.9 |

| Net income | (43.3) | N.A | (65.9) | (9.2) | N.A | (10.9) |

| Adjusted net income | (34.7) | N.A | (52.3) | (8.9) | N.A | (9.8) |

| (in thousands) | ||||||

| Bookings | 16,152 | 29% | 12,531 | 4,067 | 13% | 3,602 |

PRIME REVIEW

Prime continued to outperform. Prime membership grew by 64% year-on-year to 4.3 million subscribers. Throughout the fiscal year 2023, the programme added an average of 421,000 new Prime members per quarter. Prime share of Cash Marginal Profit reached 56% in the year. The business is on track to exceed 7.25 million members by 2025.

(*) FY25 Prime membership figure is an estimate

In the fiscal year 2023, as expected, Prime members outgrew Prime Cash Revenues. This resulted in ARPU reduced in line with expectations to €75.1 per member. ARPU in any business is calculated by taking the revenue from the subscribers and dividing it by the average number of subscribers in the period. In eDO’s business, the subscription fees represent the majority of the Cash Revenue Margin, but they are paid by the end-of-period members as opposed to the average of period members. Mathematically, when the base of members grows and yearly increases of members are similar, the average and end-of-period members get closer to each other. This results in a decrease in the ARPU even if the revenues different from subscription fees stay similar on a per-subscriber basis. This is the effect eDreams ODIGEO is seeing on its reported ARPU.

LOOKING AHEAD

The desire to travel is undiminished. eDO has demonstrated that with Prime and its global leadership in flights -excluding China – it has a unique model which is delivering rapid sales growth together with improving margins and growing profitability and is enabling eDO to deliver outstanding performance and consistently outperform both the industry and its peers, trends which are expected to continue regardless of economic conditions.

Operating in the 2.1 trillion euros travel segment, one of the largest in the world, and with a model matching global structural drivers, eDO is in pole position and primed for further growth and success. eDO has a clear strategy focused on taking advantage of its global opportunity and has demonstrated its ability to capture new customers through the Prime programme with 67% of new Prime having never booked with eDO previously to 2019. The Company’s future growth will be driven by developing and growing its Prime membership base which has

continued to grow since the year-end by 300,000 further subscribers to 4.6 million[3], enhancing the breadth and depth of the offer to customers, further international expansion, continued enhancement of our e-commerce platform, increasing margins and delivering value.

Looking ahead, eDO is optimally positioned operationally, well-financed and is on track to meet its 2025 targets. Further strong growth is anticipated in sales and profitability and further progress will be made towards the FY25 targets, and beyond.

-ENDS-

About eDreams ODIGEO

eDreams ODIGEO is one of the world’s largest online travel companies and one of the largest e-commerce businesses in Europe. Under its four leading online travel agency brands – eDreams, GO Voyages, Opodo, Travellink, and the metasearch engine Liligo – it serves more than 17 million customers per year across 44 markets. Listed on the Spanish Stock Market, eDreams ODIGEO works with nearly 700 airlines. The business conceptualised Prime, the first subscription product in the travel sector which has topped 4.6 million members since launching in 2017. The brand offers the best quality products in regular flights, low-cost airlines, hotels, dynamic packages, cruises, car rental and travel insurance to make travel easier, more accessible, and better value for consumers across the globe.

(*) GLOSSARY OF TERMS

Reconcilable to GAAP measures

Adjusted EBITDA means operating profit / loss before depreciation and amortisation, impairment and profit / loss on disposals of non-current assets, as well as adjusted items corresponding to certain share-based compensation, restructuring expenses and other income and expense items which are considered by Management to not be reflective of the Group’s ongoing operations. Adjusted EBITDA provides to the reader a better view about the ongoing EBITDA generated by the Group.

Adjusted Net Income means the IFRS net income less certain share-based compensation, restructuring expenses and other income and expense items which are considered by Management to not be reflective of the Group’s ongoing operations. Adjusted Net Income provides to the reader a better view about the ongoing results generated by the Group.

Cash EBITDA means ”Adjusted EBITDA”, plus the variation of the Prime deferred revenue corresponding to the Prime fees that have been collected and that are pending to be accrued. The Prime fees pending to be accrued are non-refundable and will be booked as revenue based on usage, which refers to each instance the customer uses Prime to make a Booking with a discount, or when the Prime contracted period expires. Cash EBITDA provides to the reader a view of the sum of the ongoing EBITDA and the full Prime fees generated in the period.

Cash EBITDA Margin means Cash EBITDA divided by Cash Revenue Margin.

Cash Marginal Profit means ”Marginal Profit” plus the variation of the Prime deferred revenue corresponding to the Prime fees that have been collected and that are pending to be accrued. The Prime fees pending to be accrued are non-refundable and will be booked as revenue based on usage, which refers to each instance the customer uses Prime to make a Booking with a discount, or when the Prime contracted period expires. Cash Marginal Profit provides a measure of the sum of the Marginal Profit and the full Prime fees generated in the period.

Cash Marginal Profit Margin means Cash Marginal Profit divided by Cash Revenue Margin.

Cash Revenue Margin means ”Revenue Margin” plus the variation of the Prime deferred revenue corresponding to the Prime fees that have been collected and that are pending to be accrued. The Prime fees pending to be accrued are non-refundable and will be booked as revenue based on usage, which refers to each instance the customer uses Prime to make a Booking with a discount, or when the Prime contracted period expires. Cash Revenue Margin provides a measure of the sum of the Revenue Margin and the full Prime fees generated in the period.

Cash Revenue Margin per Booking means Cash Revenue Margin divided by the number of Bookings. Marginal Profit means “Revenue Margin” less “Variable Costs”. It is the measure of profit that Management uses to analyse the results by segments.

Prime ARPU means the Cash Revenue Margin generated from Prime users on a last twelve months basis. It is calculated considering all the Cash Revenue Margin elements linked to the bookings done by Prime members (such as but not limited to, the Prime fees collected, GDS incentives, commissions, ancillary services, etc.) divided by the average number of Prime members during the same period. Management considers this is a relevant measure to follow the Prime performance. As Prime is a yearly programme, this measure is calculated on a last twelve months basis.

Revenue Margin means the IFRS revenue less the cost of supplies. The Group’s Management uses Revenue Margin to provide a measure of its revenue after reflecting the deduction of amounts payable to suppliers in connection with the revenue recognition criteria used for products sold under the principal model (gross value basis). Accordingly, Revenue Margin provides a comparable revenue measure for products, whether sold under the agency or principal model.

Variable Costs includes all expenses which depend on the number of transactions processed. These include acquisition costs, merchant costs and other costs of a variable nature, as well as personnel costs related to call centers as well as corporate sales personnel. The Group’s Management believes the presentation of Variable Costs may be useful to readers to help understand its cost structure and the magnitude of certain costs. The Group has the ability to reduce certain costs in response to changes affecting the number of transactions processed.

Other Defined Terms

Bookings refers to the number of transactions under the agency model and the principal model as well as transactions made under white label arrangements. One Booking can encompass one or more products and one or more passengers.

Prime members means the total number of customers that have a Prime subscription in a given period.

Prime / Non Prime. The Group presents certain profit and loss measures split by Prime and Non Prime. In this context, Prime means the profit and loss measure generated from Prime users. Non-Prime means the profit and loss measure generated from non-Prime users. For instance, in the case of Prime Cash Revenue Margin, it includes elements such as, but not limited to, the Prime fees collected, GDS incentives, commissions, ancillary services, etc. As Prime is a yearly program, Prime / Non Prime profit and loss measures are presented on a last twelve months basis.

[1] As of 15th May 2023

[2] As of 15th May 2023

[3] As of 15 May 2023

Marknadsnyheter

Regeringen föreslår lättnader i byggkraven för studentbostäder

Regeringen har beslutat om en lagrådsremiss med förslag till lättnader i byggkraven för studentbostäder. Syftet är att öka möjligheterna till flexibilitet vid byggandet.

– På många studieorter är det svårt för studenter att hitta boende. Därför behöver byggregelverket förenklas. Syftet är att möjliggöra för fler studentbostäder genom sänkta byggkostnader och ökad flexibilitet, säger infrastruktur- och bostadsminister Andreas Carlson.

Förslaget innebär att det blir möjligt att göra undantag från kraven på tillgänglighet och användbarhet i en byggnad som innehåller studentbostäder. Undantagen ska kunna tillämpas vid både nyproduktion och vid ändring av en byggnad.

Det ska vara möjligt att göra undantag för högst 80 procent av studentbostäderna i ett byggprojekt. Minst 20 procent av studentbostäderna ska fortfarande uppfylla gällande krav på tillgänglighet och användbarhet för personer med nedsatt rörelse- eller orienteringsförmåga.

Lagändringen ger större flexibilitet vid byggande av studentbostäder och skapar fler tänkbara sätt att utforma planlösningar. Till exempel kan bostadsytan minskas och fler bostäder rymmas inom en given yta.

De föreslagna undantagen ska inte hindra personer med funktionsnedsättning att vara delaktiga i sociala sammanhang. En studentbostad som omfattas av undantagen ska kunna besökas av en person med nedsatt rörelse- eller orienteringsförmåga.

Regeringen breddar också definitionen av studentbostäder till att inkludera all vuxenutbildning för att göra det möjligt för fler kommuner att erbjuda studentbostäder.

Förslagen föreslås träda i kraft den 1 juli 2025.

Lagrådsremissen: Lättnader i byggkraven för studentbostäder – Regeringen.se

Presskontakt

Ebba Gustavsson

Pressekreterare hos infrastruktur- och bostadsminister Andreas Carlson

Telefon (växel) 08-405 10 00

Mobil 076-12 70 488

ebba.gustavsson@regeringskansliet.se

Marknadsnyheter

“Vi behöver tillsammans enas om vettiga avtal, som sätter standard för branschen”

Sveriges Radios Kulturnytt gör just nu en mycket välkommen granskning av villkoren i musikbranschen. Igår lyftes artisten Siw Malmkvists situation med ett avtal som inte förnyats på över 60 år. Hennes situation är tyvärr långt ifrån unik. Musikerförbundet har länge uppmärksammat att majorbolagen fortsätter att betala extremt låga royaltynivåer till artister vars kontrakt skrevs på 1960-talet – en tid då digital streaming inte existerade.

– Jag kan intyga att artisterna som talar ut i P1 är långt ifrån ensamma om sin situation och vi uppmanar deras artistkollegor att gå ut med sitt tydliga stöd till de som vågar bryta tystnaden om oskäliga ersättningar, säger Musikerförbundets ordförande Karin Inde.

Musiker och artister skapar det värde som skivbolagen tjänar pengar på, men ändå ser vi gång på gång hur bolagen behåller stora delar av intäkterna. Att en av Sveriges mest folkkära artister, med en karriär som sträcker sig över decennier, fortfarande har en oskälig royalty är ett tydligt bevis på branschens obalans.

– Tystnadskulturen kring prissättning är enbart bra för bolagen. Både artister och musiker skulle verkligen tjäna på att dela med sig till varandra om hur betalningar och dealar verkligen ser ut. Förstås i trygga, egna rum. Det är bara bolagen som tjänar på att vi inte pratar med varandra om pengar, säger Karin Inde.

Stort tack till de modiga artister som ser till att lyfta problematiken! För att vi ska få till en i grunden mer rättvis musikbransch behöver de stora parterna i sammanhanget – skivbolagen, musikerna och artisterna – göra som de flesta andra svenska branscher lyckas med:

– Vi behöver tillsammans enas om vettiga och balanserade avtal, som sätter standard för branschen. Musikerförbundet är redo att göra vår del i arbetet för bättre villkor i musikbranschen, frågan är om skivbolagen är redo, säger Karin Inde.

Karin Inde

Förbundsordförande

karin.inde@musikerforbundet.se

+46 (0)704447228

Musikerförbundet är fackförbundet för professionella musiker och artister. Vi arbetar för förbättrade upphovsrättsliga och arbetsrättsliga villkor och för att våra medlemmar ska få en rättvis del av de värden de skapar i samhället.

Marknadsnyheter

Bönor från egen kaffeskog, sump till jord – Viking Lines nya kaffe gör gott på många olika sätt

Viking Lines resenärer dricker varje år 8,5 miljoner koppar kaffe. Nu satsar rederiet på ett helt nytt kaffe som ger minskade klimatutsläpp och bättre levnadsvillkor för odlarna. Kaffet från Slow Forest odlas på rederiets egen odling i Laos utan kemiska gödningsmedel, handplockas och rostas därefter i Danmark.

Allt kaffe som serveras på Viking Lines fartyg är nu hållbart producerat Slow Forest-kaffe, odlat på rederiets 75 hektar stora odling på högplatåerna i Laos och rostat i Danmark. Kaffeplantorna odlas bland träd på återbeskogad mark, i stället för på traditionellt skövlade plantager. Viking Lines odling ligger i en kolsänka där målsättningen är att plantera 30 000 träd, vilket innebär nästan 400 träd per hektar. Kaffeskogen förbättrar också den lokala biologiska mångfalden i området.

Odlingen, bearbetningen och rostningen av kaffet hanteras av Slow Forest Coffee. För företaget är det viktigt att produktionskedjan är rättvis och transparent. Utöver miljöfördelarna erbjuder Slow Forest bättre lönevillkor och sjukersättning för byns odlare.

”Den traditionella kaffetillverkningens koldioxidavtryck är stort och merparten av intäkterna går till Europa i stället för produktionsländerna. Vi ville göra annorlunda. Våra kunder vill göra hållbara val, och nu kan de njuta av sitt kaffe med bättre samvete än någonsin tidigare,” berättar Viking Lines restaurangchef Janne Lindholm.

Bönorna till Slow Forest-kaffet får sakta mogna i skuggan av träden, utan kemiska gödningsmedel. De plockas också för hand, vilket avsevärt förbättrar kaffets kvalitet och smak. Viking Lines nya kaffe består till 100 procent av Arabica-bönor, med en balanserad syrlighet samt smak av nötter och choklad. Rostningsprofilen har skapats av den världsberömda danska rostningsmästaren Michael de Renouard.

”Vi valde en mörkrost till fartygets kaffe, vilket passar både finländarnas och svenskarnas nuvarande smakpreferenser gällande rostning. Finländarnas smak gällande kaffe har under de senaste åren utvecklats mot en mörkare rostning. Innan vi gjorde vårt slutgiltiga val testades det nya kaffet i Viking Cinderellas bufférestaurang och personalmässen – och båda testgrupperna gav toppbetyg. Då 8,5 miljoner koppar kaffe bryggs varje år kan inget lämnas åt slumpen!” säger Janne Lindholm.

Viking Lines hållbarhetsmål stannar inte vid produktionskedjan. Kaffesump från fartygen återvinns nämligen som råmaterial för trädgårdsjord. Detta minskar avsevärt användningen av jungfrulig torv vid tillverkningen av mylla.

”Vi har som mål att allt som tagits ombord på fartygen som är möjligt att återvinna ska återanvändas eller återvinnas. Det gäller inte bara kaffet utan även matavfall och till exempel textilier som tas ur bruk. Ett bra exempel på vårt livscykeltänkande är att frityrolja från fartygets restauranger blir till biobränsle för den finska sjöfartsindustrin,” säger Viking Lines hållbarhetschef Dani Lindberg.

Slow Forest Coffee – 5 fakta:

- Slow Forest Coffee är ett kaffeföretag som verkar i Laos, Vietnam och Indonesien i samarbete med över 500 lokala kaffeodlare.

- Företaget grundades år 2019 av Pinja Puustjärvi, driven av en vilja att skydda skogarna i Laos och stötta lokala odlare. Puustjärvi bodde som barn i Laos på grund av sin fars arbete.

- Kaffet odlas i restaurerade kaffeskogar, som binder stora mängder kol och ökar den biologiska mångfalden.

- Det är viktigt för företaget att produktionskedjan är ansvarsfull och transparent, samt att verksamheten gynnar både miljön och de lokala samhällena.

- Slow Forest Coffee betalar odlarna bättre ersättning än genomsnittet i Laos och erbjuder förmåner som underlättar deras liv: förskottsbetalningar, utbildning och möjligheten att låna pengar från en krisfond.

Mera infomation om Slow Forest Coffee här

Tilläggsinformation:

Janne Lindholm, restaurangchef

janne.lindholm@vikingline.com, tel. +358 400 744 806

Dani Lindberg, hållbarhetschef

dani.lindberg@vikingline.com, tel. +358 18 27 000

Johanna Boijer-Svahnström, informationsdirektör

johanna.boijer@vikingline.com, tel. +358 18 270 00

Christa Grönlund, informationschef

christa.gronlund@vikingline.com, tel. +358 9 123 51

-

Analys från DailyFX10 år ago

EUR/USD Flirts with Monthly Close Under 30 Year Trendline

-

Marknadsnyheter5 år ago

BrainCool AB (publ): erhåller bidrag (grant) om 0,9 MSEK från Vinnova för bolagets projekt inom behandling av covid-19 patienter med hög feber

-

Marknadsnyheter2 år ago

Marknadsnyheter2 år agoUpptäck de bästa verktygen för att analysera Bitcoin!

-

Analys från DailyFX12 år ago

Japanese Yen Breakout or Fakeout? ZAR/JPY May Provide the Answer

-

Marknadsnyheter2 år ago

Marknadsnyheter2 år agoDärför föredrar svenska spelare att spela via mobiltelefonen

-

Analys från DailyFX12 år ago

Price & Time: Key Levels to Watch in the Aftermath of NFP

-

Analys från DailyFX8 år ago

Gold Prices Falter at Resistance: Is the Bullish Run Finished?

-

Nyheter7 år ago

Nyheter7 år agoTeknisk analys med Martin Hallström och Nils Brobacke