Marknadsnyheter

eDreams ODIGEO continues to outperform the market and delivers strong growth in subscribers, bookings, revenues and profits

Barcelona, 15 November 2022. – eDreams ODIGEO (hereinafter ‘eDO’ or ‘the Company’), Europe’s largest online travel company, the largest globally in terms of flights outside of China and one of the largest European e-commerce businesses, today reports its results for the first half of its fiscal year 2023 ended 30 September 2022.

With 247 websites and apps in 44 countries, 21 languages and 37 different currencies on one central platform, eDreams ODIGEO now covers 80% of the global travel market.

eDO continues to outperform the industry and its peers, as it has consistently done for the last two years. Since launching its subscription programme, Prime, eDO has become a higher quality business with a loyal customer base and a recurring revenue stream that delivers predictable and sustainable customer relationships, together with the associated ensuring financial benefits. Despite the macroeconomic context, the travel market, particularly leisure travel, will still grow. The Company continues to outperform the market, with its booking levels standing at plus 48% vs 2019 pre-COVID, and almost 1 million new subscribers added in the last 6 months alone. The continued strong performance of the business allows it to reconfirm its March 2025 guidance of over 7.25 million subscribers, ARPU of €80 and cash EBITDA of €180 million.

RESULTS HIGHLIGHTS

- eDreams ODIGEO continues to deliver strong Bookings growth

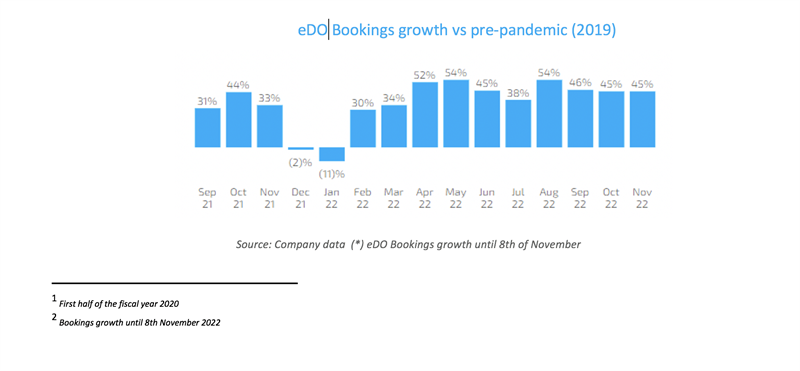

- In the first half of the fiscal year 2023, eDO achieved strong Bookings, reaching 8.6 million, which represents 50% above the same period last year and +48% above pre-COVID-191.

- In October and November2 despite macro-economic headwinds, Bookings were up 45% above pre-COVID-191

- eDO Bookings performance is materially better than the market, with a business that has increased its quality with the pivot to subscription.

- The world’s first travel subscription programme, eDreams Prime, continues to outperform

-

- The Company reached 3.6 million subscribers, which is the result of a 479,000 run rate per quarter during the first half of the fiscal year 2023. This represents growth of +8% and +47% vs fiscal years 2022 and 2021 quarterly run rates, respectively.

- Despite Omicron, Ukraine War, high inflation and a market still below Pre-COVID levels, Prime’s Net Adds run rate is ahead of expectations, and churn rates have slightly improved.

- Solid financial performance with strong growth in Cash Revenue Margin and meaningful Cash EBITDA Margin improvement

- In the first half of the fiscal year, Revenue Margin and Cash Revenue Margin continued above pre-COVID levels, by 3% and 12% respectively.

- The Company delivered strong growth in Cash Revenue Margin, up 69% year-on-year to €316.5 million, despite travel options constrained by COVID-19 travel restriction uncertainty. Revenue Margin increased by 72%, to €289.0 million, due to the 50% increase in Bookings and 15% increase in Revenue Margin per Booking.

- Cash Marginal Profit increased to €74.4 million in the period; up +51% from the first half of the fiscal year 2022.

- As expected, the business delivered strong Cash EBITDA in the second quarter, which resulted in €34.5 million in the first half of the year (€20.5 million in the second quarter of the fiscal year 2023 standalone), up 78% vs the same period last year. As guided in the first quarter of the fiscal year, strong growth in the first year of Prime members delays profitability as it jumps in their second year.

- The Company is progressing at a brisk pace with the strategic expansion of its global workforce, which will grow by 50% to further fuel its long-term growth as a subscription business. The higher investments in personnel and the effects of foreign currency exchange resulted in higher fixed costs. This, coupled with higher variable costs associated with the notable increase in trading, drove the bottom-line result.

- Looking ahead

- These results demonstrate the Company is well on track to meet its self-imposed targets by the fiscal year 2025:

- Cash EBITDA in excess of €180 million

- Greater than 7.25 million Prime members

- Average Revenue per User (ARPU) of €80, approximately.

- These results demonstrate the Company is well on track to meet its self-imposed targets by the fiscal year 2025:

Dana Dunne, CEO of eDreams ODIGEO commented: “We are delighted to deliver another solid set of results, which continue to demonstrate that our subscription model is breaking the mold and revolutionising the way people book travel. Our successful transition from a transaction-led business to one primarily based on subscriptions is once again reflected in the continued and strong growth of our subscriber base, which has now3 topped 3.8 million members.

Exactly one year ago, we set ambitious goals for ourselves: exceeding 7.25 million Prime members and €180 million in Cash EBITDA by 2025. Throughout the last 12 months, we have made excellent progress towards these and our performance in the first half of the fiscal year shows that we are well on track to deliver on our 3-year guidance, as we have consistently done. Everyone at eDO is looking forward to delivering further growth and superior returns for our shareholders and great service and an unrivalled proposition for our customers.

Looking at the wider industry, travel has shown strong growth for decades, except during the global shutdown of COVID. Through economic downturns, conflict or even natural disasters, the leisure traveller has demonstrated their desire to keep travelling. Now is no different and we expect the resurgence to continue. eDreams ODIGEO is trading 48% above pre-COVID levels and is therefore undeniably better positioned than anybody else to take advantage of this next phase with its focus on leisure travel and a proposition which delivers unbeatable choice and value to its customers.”

BUSINESS REVIEW

Throughout the first quarter, the travel market continued to improve and recover significantly, with eDreams ODIGEO’s trading demonstrating its recovery from COVID-19 with best-in-class performance and outperforming the market (and its competitors) by a significant margin, which was driven by the increased quality of its business with the pivot to subscription and consumers’ desire to travel.

eDreams ODIGEO, with its unique customer proposition and reaching 3.8 million Prime subscribers in November4, is positioned to take advantage in a post-COVID19 era to attract more customers and capture further market share.

Throughout the pandemic, eDreams ODIGEO has consistently outperformed the Global OTAs and the airline industries, which highlights the strength and adaptability of its business model. eDreams ODIGEO’s superior value proposition is leading to outperforming the industry. In the second quarter of the fiscal year 2023, the Company outperformed the regular airlines by 64 percentage points and the Low-Cost carriers by 40 percentage points. Despite eDO’s superior value proposition leading to outperforming the industry peers, the gap is expected to close as corporate travel returns.

[3] As of 8th of November 2022

[4] As of 8th November2022.

IMPROVEMENTS IN YEAR-ON-YEAR TRADING AHEAD OF AIRLINE INDUSTRY

| REGION | 2Q FY22 | 3Q FY22 | 4Q FY22 | 1Q FY23 | 2Q FY23 |

| eDO Total | 22% | 26% | 20% | 50% | 46% |

| IATA Europe | (52)% | (41)% | (40)% | (21)% | (18)% |

| Low Cost Airlines | (36)% | (26)% | (43)% | 1% | 6% |

| eDO vs IATA | 74ppt | 67ppt | 60ppt | 71ppt | 64ppt |

| eDO vs Low Cost | 58ppt | 52ppt | 63ppt | 49ppt | 40ppt |

Source: IATA Economics, Corporate Low Cost Airlines Websites & Company Data.

Despite the conflict in Ukraine, the global increase in inflation, and recent industry disruptions, in the first quarter of the fiscal year 2023, eDO achieved strong Bookings, reaching 8.6 million Bookings, which represents +50% above the same period last year and +48% above pre-COVID. Additionally, mobile bookings remained stable and accounted for 54% of the total flight bookings made in the second quarter.

FINANCIAL REVIEW

Revenue Margin and Cash Revenue Margin continue above pre-COVID levels by 3% and 12%, respectively. Cash Revenue Margin in the first half of the fiscal year 2023 increased by +69% compared to the same period last year, due to Bookings being up +50% and the increase in Revenue Margin per Booking of +15% driven by the increased quality of our business with the pivot to subscription.

Overall, in the first half of the fiscal year, eDO has seen the improving trends it saw in the fiscal year 2022 and a return to profitability. Cash Marginal Profit stood at €74.4 million, an increase of +51% compared to the previous year, when it reached €49.2 million. As expected, strong Cash EBITDA in the second quarter of the fiscal year 2023, which resulted in €34.5 million in the aggregated of the half year (€20.5 million in the second quarter alone), up 78% vs the same period last year. As guided in the first quarter, strong growth in Prime members in their first year delays growth in profitability but jumps in the second year. In addition, if instead of reaching 3.6 million members in the second quarter of the fiscal year 2023, the Company had reached 3.5 million members (110,000 less net adds, with 290,000 new members instead of 400,000), eDO would have achieved an 18% Cash EBITDA margin instead of 13%, which would have represented 5 points higher Cash EBITDA Margin.

Revenue diversification initiatives continue to develop. The Revenue Diversification Ratio continues to grow and has increased to 73% in the last twelve months to the second quarter of 2023, up from +54% in the same period of the fiscal year 2021, rising 17 percentage points in two years.

Adjusted Net Income was a loss of €19.0 million in the first half of the fiscal year 2023, compared to a loss of €27.7 million in the same period last year. The Company believes that Adjusted Net Income better reflects the real ongoing operational performance of the business.

The bottom-line result is mainly driven by the planned strategic expansion of the Company’s global workforce. As announced last year, eDO plans to add 500 new employees by March 2025 and it has already increased its workforce by 201 employees year-on-year, with 170 new employees hired between March and September 2022 alone, representing 34% of the target headcount achieved in less than 15% of the time. The higher investments in personnel and the effects of foreign currency exchange resulted in higher fixed costs. This, coupled with higher variable costs associated with the notable increase in trading, contributed to the bottom-line result.

In the first half of the fiscal year 2023, despite Ukraine war, recent air industry disruptions, which affected good portions of the first quarter, and macro headwinds, the Company ended the quarter with a positive Cash Flow from Operations of €33.1 million, mainly due to a working capital inflow of €19.5 million

The inflow during the first half of the fiscal year 2023 is smaller than in the first half of the fiscal year 2022 due to the higher recovery of volumes, especially in the second quarter of fiscal year 2022, with the massive vaccination and release of travel restrictions while in the first half of the fiscal year 2023 the volumes have been more stable.

Unsurprisingly, leverage ratios have been temporarily impacted. As announced on the 19th of January, the Company successfully refinanced all its debt with better contractual terms for the debt, including most importantly the maintenance covenant. EBITDA of reference is now Cash EBITDA, covenant now springs at 40% vs 30% previously, and from September 2022 and December 2022 the Cash EBITDA of reference is the higher of last quarter annualised or LTM.

SUMMARY INCOME STATEMENT

| (in € million) | 2Q FY23 | Var. FY23 vs. FY22 | 2Q FY22 | 1H FY23 | Var. FY22 vs. FY21 | 1H FY22 |

| Revenue Margin | 143.3 | 43% | 99.9 | 289.0 | 72% | 168.4 |

| Cash Revenue Margin | 157.3 | 39% | 113.5 | 316.5 | 69% | 187.0 |

| Cash EBITDA | 20.5 | 26% | 16.2 | 34.5 | 78% | 19.4 |

| Adjusted EBITDA (*) | 6.4 | 138%. | 2.7 | 7.0 | 837% | 0.7 |

| Net income | (10.1) | N.A. | (13.6) | (24.0) | N.A. | (37.5) |

| Adjusted net income (*) | (7.5) | N.A. | (12.2) | (19.0) | N.A. | (27.7) |

| (in thousands) | ||||||

| Bookings | 4,181 | 19% | 3,513 | 8,583 | 50% | 5,740 |

PRIME REVIEW

eDreams ODIGEO is the leader and inventor of a subscription-based model in travel. Prime continues to improve the quality of the business and grows strongly. Prime membership grew by 109% year-on-year to 3.6 million subscribers, which is the result of a 479,000 run rate per quarter during the first half of the fiscal year 2023 (+8% and +47% vs quarterly run rates of fiscal years 2022 and 2021, respectively). Over the past 5 years, eDreams ODIGEO has successfully developed and tested its unique subscription offering and has a bright future ahead. During the pandemic, the Company continued to invest and innovate its subscription offering and has seen remarkable results.

One year after the start of super high growth in Prime Net Adds, Gross Adds will be partially offset by churn applying to a higher Prime member base. The average revenue per user (ARPU)3 of Prime is converging with the guidance of €80 per member and stood at €80.4 per member. Prime Cash Marginal Profit in the last 12 months to the second quarter of the fiscal year 2023 reached 54%.

Looking ahead

These results demonstrate that the Company is well on track to meet its self-imposed targets by the fiscal year 2025:

-

-

- Cash EBITDA in excess of €180 million

- Greater than 7.25 million Prime members

- Average Revenue per User (ARPU) of €80, approximately.

-

-ENDS-

About eDreams ODIGEO

eDreams ODIGEO is one of the world’s largest online travel companies and one of the largest e-commerce businesses in Europe. The business is the largest player worldwide in flight revenues, excluding China, and the largest in Europe. Under its four leading online travel agency brands – eDreams, GO Voyages, Opodo, Travellink, and the metasearch engine Liligo – it serves more than 17 million customers per year across 44 markets. Listed on the Spanish Stock Market, eDreams ODIGEO works with over 690 airlines and +2.1 million hotels. The business conceptualised Prime, the first subscription product in the travel sector which has attracted 3.8 million members since launching in 2017. The brand offers the best quality products and the widest choice of regular flights, low-cost airlines, hotels, dynamic packages, cruises, car rental services and travel insurance products to make travel easier, more accessible, and better value for consumers across the globe.

GLOSSARY OF TERMS

Cash EBITDA means ”Adjusted EBITDA”, plus the variation of the Prime deferred revenue corresponding to the Prime fees that have been collected and that are pending to be accrued. The Prime fees pending to be accrued are non-refundable and will be booked as revenue based on usage, which refers to each instance the customer uses Prime to make a Booking with a discount, or when the Prime contracted period expires. Cash EBITDA provides to the reader a view of the sum of the ongoing EBITDA and the full Prime fees generated in the period.

Cash Marginal Profit means ”Marginal Profit” plus the variation of the Prime deferred revenue corresponding to the Prime fees that have been collected and that are pending to be accrued. The Prime fees pending to be accrued are non-refundable and will be booked as revenue based on usage, which refers to each instance the customer uses Prime to make a Booking with a discount, or when the Prime contracted period expires. Cash Marginal Profit provides a measure of the sum of the Marginal Profit and the full Prime fees generated in the period.

Cash Revenue Margin means ”Revenue Margin” plus the variation of the Prime deferred revenue corresponding to the Prime fees that have been collected and that are pending to be accrued. The Prime fees pending to be accrued are non-refundable and will be booked as revenue based on usage, which refers to each instance the customer uses Prime to make a Booking with a discount, or when the Prime contracted period expires. Cash Revenue Margin provides a measure of the sum of the Revenue Margin and the full Prime fees generated in the period.

Marknadsnyheter

Studie: Eksem kopplat till ätstörningar

En ny studie från Yale visar att personer med eksem löper ökad risk för ätstörningar

som anorexi, bulimi och hetsätning. Forskarna analyserade över 250 000

patientjournaler och fann att eksempatienter är tre gånger mer benägna att utveckla

hetsätning och dubbelt så benägna att drabbas av anorexi eller bulimi. Det föreslås

att ätstörningar kan vara ett sätt att hantera depression och ångest relaterat till

eksem. Tidig upptäckt är viktig för att kunna ge rätt stöd och vård till dessa individer.

Marknadsnyheter

Kandy´z är Årets Franchisekedja 2024

Kandy´z har tilldelats utmärkelsen ”Årets Franchisekedja” vid Svenska Franchisegalan som varje år genomförs på Grand Hôtel i Stockholm. Förutom ”Årets Franchisekedja” delades priser ut i kategorierna ”Årets Franchisetagare”, Årets CFO”, ”Framtidens Franchise”, ”Årets Marknadsförare” och ”Årets Franchisebragd”. – Samtliga finalister och vinnare är tydliga exempel på den mångfald av branscher som franchise representerar och har samtliga bidragit på ett positivt sätt till att utveckla företagsformen. Det är väldigt glädjande att ett relativt nystartat franchiseföretag vinner utmärkelsen Årets Franchisekedja i år, säger Jan Fraggstedt, vd Svenska Franchise Föreningen.

Kandy´z får utmärkelsen ”Årets Franchisekedja” 2024 med motiveringen:

”Vinnaren av Årets Franchisekedja 2024 stöttar sina franchisetagare och hjälper dem att nå framgång. Med en god lönsamhet hos sina franchisetagare och med människan i fokus utvecklar vinnaren ständigt sitt koncept med olika verktyg och

förgyller vardagen och skapar välbefinnande både på jobbet och privat.”

”Årets Marknadsförare” (delas ut i samarbete med SpiderAds) – Pressbyrån

”Årets marknadsförare vinner för sin banbrytande marknadsföring där de kombinerar kreativitet med samhällsengagemang för att skapa starka kampanjer som inte bara stärker varumärket utan också genererade försäljningsökningar och ökad medvetenhet. Kampanjerna för Pressfrihetens Dag, Lusseballen och Årets Lussekatt är bara några av aktiviteterna som fått enorm uppmärksamhet.”

”Årets CFO” (delas ut i samarbete med Azets) – Marie-Louise Lindström, HusmanHagberg

”Detta är en CFO med stenkoll! Hen har lång erfarenhet av att arbeta i franchisevärlden och kan alla delar från kontoren upp till givaren. Denna CFO är mycket engagerad och pedagogisk och har franchisetagarnas fulla förtroende. Med god dialog och professionellt stöd är hen högst delaktig i

hela kedjans utveckling.”

”Årets Franchisetagare” (delas ut i samarbete med Marginalen Bank) – Erik Stridsberg, Pinchos Uddevalla

”Vinnaren har under 2023 kraftigt ökat såväl försäljningen som antalet kunder och snittköp. Därtill ligger man i toppen inom kedjan avseende kundnöjdhet. Vinnaren och hens nyckelpersoner har inte bara fokuserat på siffror, utan

har även visat en stark förmåga att utveckla och stödja sina medarbetare. Genom att skapa en positiv arbetsmiljö har franchisetagaren inspirerat teamet att sträva efter en bra upplevelse för kunden och bidra till den

övergripande framgången för verksamheten.”

”Framtidens Franchise” (delas ut i samarbete med BDO) – Fantastic Frank

”Att bygga och utveckla Framtidens Franchise kräver nytänkande, kreativitet, målmedvetenhet och mod. Genom sitt nytänkande har årets vinnare skapat ett marknadsföringskoncept i världsklass. Detta i kombination med en unik IT-plattform som ligger i absolut framkant och en stor portion mod har man på ett målmedvetet sätt lyckats ta sitt koncept långt utanför Sveriges gränser.

Förutom ett antal etableringar i Europa så finns man nu även representerade i USA och Asien.

Årets vinnare har blivit en av de mest omskrivna aktörerna i sin bransch och en stor erkänd internationell branschtidning har utsett grundarna till ”de entreprenörer som inspirerat och utvecklat sin bransch mest.” Med ett nuläge där man har potentiella franchisetagare från olika länder som står i kö för att få kliva ombord, så känns det som att resan bara har börjat för denna framåtlutade kedja.”

”Årets Franchisebragd” (delas ut i samarbete med FranchiseArkitekt) – Paul Lederhausen, grundare av McDonald´s i Sverige

”Detta pris går till en sann entreprenör och företagsledare. Hans far gav aldrig veckopeng utan sade: ”Jag säger som Sandrew sa, det finns tioöringar att plocka upp på gatan, bara du orkar böja dig ner. ”Det finns inte ord som nog kan beskriva vad vinnaren har haft för betydelseför franchise i Sverige, då denna person även i allra högsta grad var

involverad i bildandet av den Svenska Franchise Föreningen för över 50 år sen. Det är egentligen fel att säga att denna utmärkelse i år heter Årets Franchisebragd utan bör i detta fall benämnas som halvseklets Franchisebragd.

Vinnaren av detta pris startade upp den första McDonald’s-restaurangen i Sverige 1973 på Kungsgatan i Stockholm och har under alla dessa år bidragit till att hundratusentals personer har jobbat i kedjan och utbildat fler än 30 000 ledare. En sann franchisebragd som ingen annan har gjort i Sverige, inte bara förra året utan även halvseklet.”

För mer information:

Jan Fraggstedt, vd Svenska Franchise Föreningen. Tel: 0703-54 87 20. E-post: jan@svenskfranchise.se

Svenska Franchise Föreningen har som ändamål att sprida kunskap om franchising och att verka för att utveckla, stärka och skydda affärsmodellen. Visionen är att franchising ska uppfattas som en allmänt accepterad och uppskattad företagsform i Sverige. Svenska Franchise Föreningen står även i kontakt med en fristående etisk nämnd som erbjuder tolkning och tillämpning av etiska frågor inom franchising.

Marknadsnyheter

mySafety Group: Intäkterna och resultatet för helåret 2023 justeras

26 april 2024

mySafety Group AB (”mySafety Group” eller ”Bolaget”) offentliggjorde den 14 februari 2024 att det förelåg ett behov att genomföra en ej kassaflödespåverkande justering av koncernens immateriella anläggningstillgångar. Efter dialog med Bolagets revisor och redovisningsexperter har styrelsen i Bolaget idag, den 26 april 2024, beslutat att göra ytterligare justeringar i koncernens immateriella anläggningstillgångar. I tillägg ska en justering av framtida skatteskulder påföras värdet av de immateriella anläggningstillgångarna. Vidare har styrelsen idag, till följd av att det inom ramen för Bolagets ordinarie genomgång inför årsredovisningen och revisionen framkommit att en del av intäkterna från ett av mySafety Groups partnersamarbeten under en period redovisats i både gammal och ny process, beslutat att justera koncernens intäkter och resultat. Till följd av ovanstående justeringar kommer intäkterna för koncernen under 2023 att uppgå till 377,1 miljoner kronor (jämfört med 477,9 miljoner kronor i bokslutskommunikén för 2023) och resultatet för koncernen under 2023 kommer att uppgå till 33,2 miljoner kronor (jämfört med 122,3 miljoner kronor i bokslutskommunikén för 2023). Justeringarna påverkar inte koncernens kassaflöde.

Justeringarna i koncernens immateriella tillgångar beror på en mer konservativ värdering av de immateriella anläggningstillgångarna efter dialog med revisorn och redovisningsexperter, vilket påverkar koncernens intäkter och resultat. Intäkterna och resultatet justeras även med anledning av det fel som uppstått i redovisningen av intäkterna från partnersamarbetet.

mySafety Groups årsredovisning kommer att offentliggöras den 30 april 2024.

mySafety Group AB

För mer information vänligen kontakta:

Marcus Pettersson, verkställande direktör, +46(0)730 29 99 01, marcus.pettersson@mysafety.se.

Denna information är sådan information som mySafety Group AB är skyldigt att offentliggöra enligt EU:s marknadsmissbruksförordning. Informationen lämnades, genom ovanstående kontaktpersons försorg, för offentliggörande kl. 19.15 den 26 april 2024.

Om mySafety Group AB

mySafety Group AB är en koncern som investerar i verksamhet med huvudinriktning på digital transformation inom såväl B2B som B2C. mySafety Groups B-aktie är sedan 1998 noterad på Nasdaq Stockholm, Small Cap (tidigare under namnet Empir Group AB). För mer information – investor.mysafety.se.

-

Analys från DailyFX8 år ago

EUR/USD Flirts with Monthly Close Under 30 Year Trendline

-

Marknadsnyheter1 år ago

Marknadsnyheter1 år agoUpptäck de bästa verktygen för att analysera Bitcoin!

-

Marknadsnyheter4 år ago

BrainCool AB (publ): erhåller bidrag (grant) om 0,9 MSEK från Vinnova för bolagets projekt inom behandling av covid-19 patienter med hög feber

-

Analys från DailyFX11 år ago

Japanese Yen Breakout or Fakeout? ZAR/JPY May Provide the Answer

-

Analys från DailyFX11 år ago

Price & Time: Key Levels to Watch in the Aftermath of NFP

-

Analys från DailyFX7 år ago

Gold Prices Falter at Resistance: Is the Bullish Run Finished?

-

Nyheter5 år ago

Nyheter5 år agoTeknisk analys med Martin Hallström och Nils Brobacke

-

Marknadsnyheter6 år ago

Tudorza reduces exacerbations and demonstrates cardiovascular safety in COPD patients